China's Crypto Crackdown Sparks 18% Market Plunge

Market Outlook

The entire crypto market dropped by more than 18% in the past 3 days on the back of increased crackdown on crypto services in China. The regulatory treatment of cryptoassets has become a lot more specific and precise than before. Last Friday, the government of the People's Bank of China (PBoC) issued a circular stating that cryptocurrency-related transactions and venues are deemed illegal activities in mainland China while overseas crypto services are prohibited from serving China-based users.

Major exchange tokens such as OKB and Huobi Token dropped by more than 10% upon the announcement. In the same vein, a handful of crypto exchanges and other services took drastic measures in response to this news item in the past three days.

- Mining pool service, StarkPool will shut down its operations

- Crypto exchanges, Binance and Huobi will prohibit access to Chinese users

- E-commerce giant, Alibaba, will ban the sale of crypto mining machines on its site.

At 21Shares, we are expecting significantly more crypto services to forbid access to Chinese users. Such services, mainly crypto exchanges, will undoubtedly add China amongst their prohibited locations to their terms of service. This list of blacklisted locations is usually composed of North Korea, Iran, and surprisingly some exchanges also include the United States — as discovered in this study conducted by our research team last year.

In addition, last Friday, our Research Lead, Eliézer Ndinga, told our team that we also should anticipate a firewall on overseas crypto services in China. As a matter of fact, as of today, TheBlock reported that crypto price-tracking websites, CoinMarketCap and Coingecko are blocked by China’s internet firewall. Nonetheless, our research team detected that this is not the first time crypto services such as Coinbase got blacklisted in China. Coinbase’s firewall occurred several times starting back in October 2014 and yesterday as well. This shouldn’t come out as a surprise as these measures coincided with one of the many reiterated China crackdowns on crypto venues.

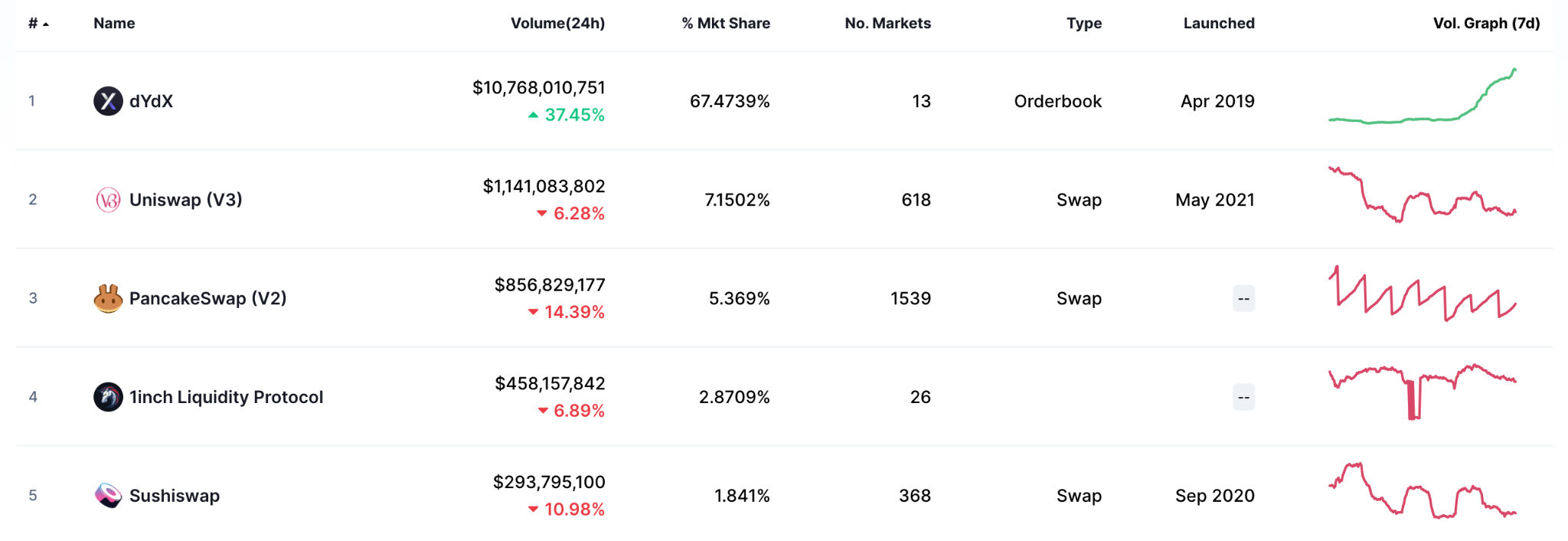

For us, at 21Shares, this crackdown on crypto venues represents the most important promotion for decentralized financial services (DeFi). In other words, financial services built on a blockchain, mainly Ethereum, accessible to anyone in the world with an Internet connection. China is now the biggest user base of DeFi. We are already seeing capital inflows to DeFi applications, some of them reaching all-time high daily trading volume such as dYdX — a derivatives platform focused on futures contracts without an expiration date, called perpetual swaps, pioneered by BitMEX. dYdX processed more than $10 billion in trading volume in the past 24 hours, this is at least 10 times more than other leading decentralized exchanges built on Ethereum such as Uniswap and Sushiswap — and noticeably more than Coinbase and BitMEX respective daily volume.

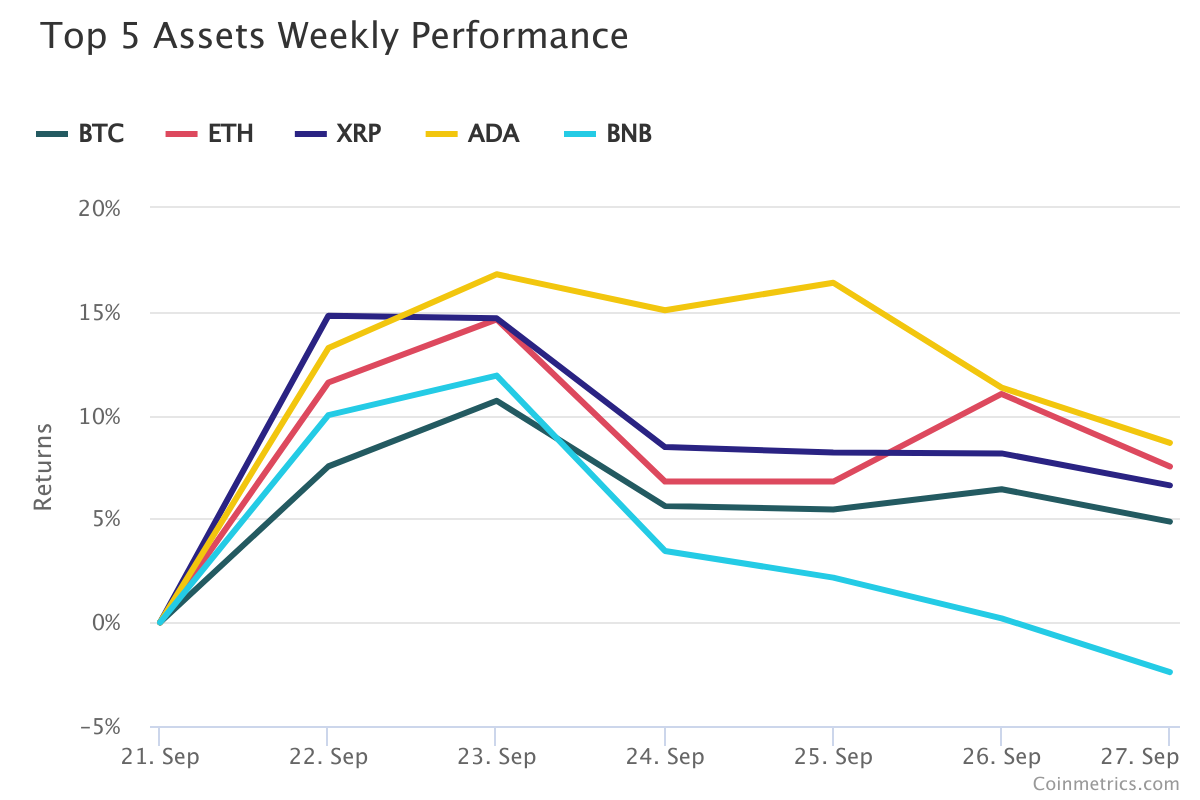

Weekly Returns

The returns of the top five crypto assets over the last week were as follows — BTC (4.68%), ETH (7.52%), BNB (-2.3%), XRP (6.61%), and ADA (8.66%).

Net Inflows per 21Shares ETP

The net inflows of our ETPs combining $23.01 million in the past week, were as follows: AADA (+$ 3,487,392.71), ABNB(-$ 850,422.90), ABTC (+$ 6,475,886.07), ADOT (+$ 3,441,097.56), AETH (+$ 1,367,616.96), ASOL (+$ 3,658,168.56), AXTZ (-$ 865,925.03), MOON (+$ 6,301,081.08).

Media Coverage

We are so excited to reveal our two new products, the 21Shares Crypto Basket Equal Weight ETP (Ticker: HODLV) and 21Shares Crypto Basket 10 ETP (Ticker: HODLX). HODLV seeks to track the investment results of an equally-weighted index composed of the top 5 largest crypto assets based on market capitalization. Meanwhile, HODLX seeks to track the investment results of an index composed of the top 10 largest crypto assets based on market capitalization.

Last week we pushed six additional crypto ETPs on the German stock exchange, which total up to 10 products on Deutsche Boerse XETRA. The new crypto ETPs include Solana ETP (Ticker: 21XL GY), Polkadot ETP (Ticker: PDOT GY), Cardano ETP (Ticker: DADA GY), Stellar Lumens ETP (Ticker: XLME GY), Tezos (Ticker: 21XZ GY), and the Crypto Basket Index ETP (Ticker:21XH GY).

“We are pleased to expand crypto investment opportunities in Germany, as one of our key markets, where we are the first and only firm providing such a comprehensive product suite. This development underscores our commitment to helping investors safely access crypto assets, now and in the future,” ETF Express quoted Hany Rashwan, CEO and co-founder of 21Shares.

In other news, UK-based OPTO picked up our feature on Wall Street Journal earlier this month in this report that explores whether the US will ease up on crypto restrictions as crypto ETF’s popularity hit the roof. “When 21Shares launched the ABNB crypto ETF in October 2019, it held around 1.1 million coins worth about $20.7m, or $18.52 each – each coin is now worth more than $400, giving it total assets under management of more than $451.5m,” wrote OPTO, quoting the Journal.

Have you checked out our latest State of Crypto? Click on the cover below and download your issue!

Once you click on the cover page: For web users, click on ‘print’ at the bottom right-hand side of the page. For mobile users, click on ‘continue to website’, then click at the top right-hand side on the three dots, then click ‘direct download’.

News

In Historic First, Twitter Allows Bitcoin Tipping for Its Users, Plans a Feature for NFTs

What happened?

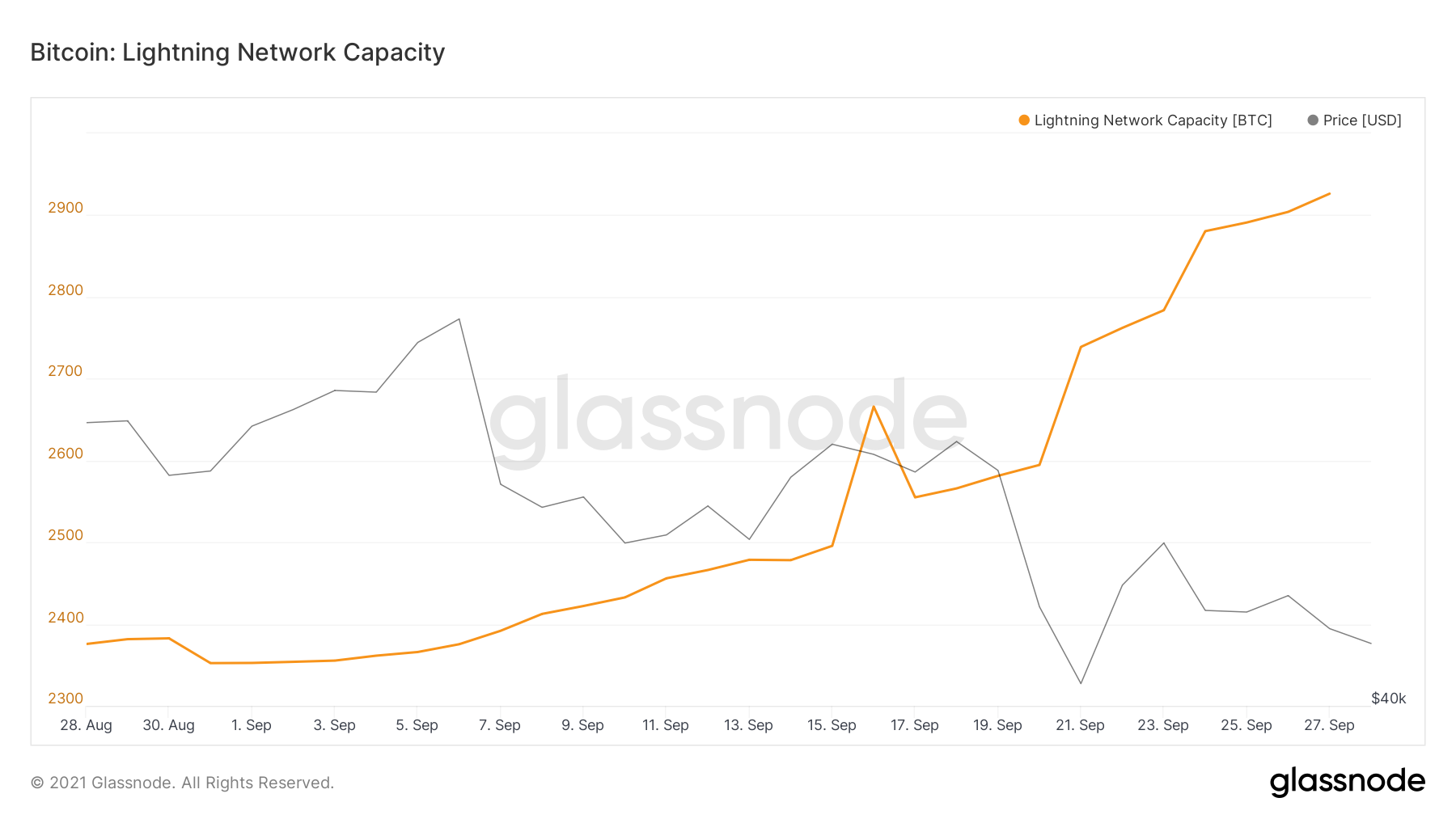

After months of experimentation since last May, Twitter users will very soon be able to pay other users using the social network’s new ‘Tip’ feature, as a way to incentivize content creation on Twitter. The company announced it will roll out the Tip feature globally for its iOS users this week, however Android users will have to wait some more time. Back in the beta days, Tip used to function with merely fiat currencies through e-payment services such as Square’s Cash app and PayPal’s Venmo. Now for Bitcoins, Twitter will integrate the Strike bitcoin lighting wallet service, allowing people to send and receive Bitcoin, offering instant and free payments globally. So far, Strike is only available for users in El Salvador and the US, unless they’re based in Hawaii or New York. To send and receive these crypto tips, Twitter will allow users to add their Bitcoin address. No fees will be charged by Twitter in these transactions.

Without elaborating, the company also announced it’s working on yet another blockchain-powered project. As a way to support digital art, this unnamed feature would allegedly allow users to authenticate and show off their NFT collections.

Why does it matter?

In a time of increasing regulatory clampdowns, be it from China or the US Securities and Exchange Committee, initiatives like the ones Twitter is taking highlight the fact that innovation will not cease to exist. Workers in the DeFi and crypto space are proving, day after day, the immense support these decentralized tech solutions can bring for long undervalued individuals working in industries like journalism and digital art.

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

_logo.svg)

.svg.png)