SBF Proposes Community Standards, Ethereum’s Supply Growth Becomes Deflationary, and More!

.webp)

This Week in Crypto

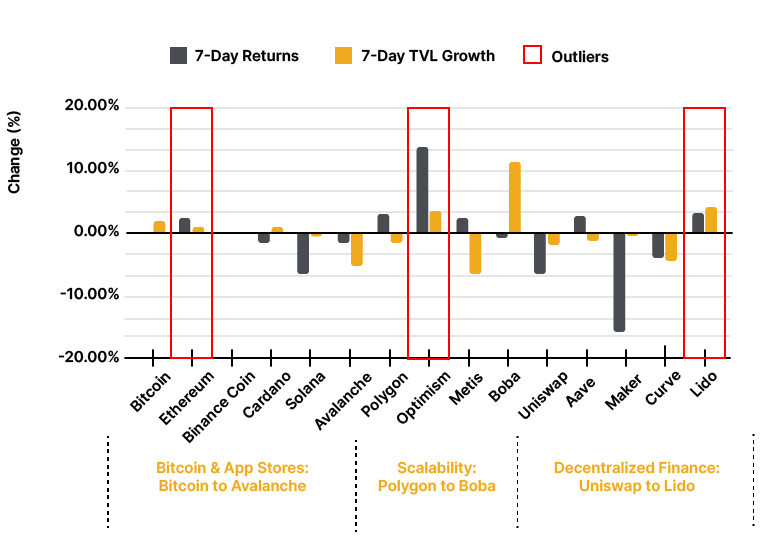

The crypto market entered another week maintaining a high resistance level, with Bitcoin’s price bearly moving as shown in the figure below and Ethereum’s returns rising by almost 2.4%. This week’s biggest winners are Optimism increasing in price by almost 14%, Lido by 3%, and Algorand’s total value locked (TVL) increased by 11% on the back of a $25M injection in the Layer 1’s DeFi protocols which we’ll delve deeper into later in this report.

Figure 1: Weekly TVL and Price Performance of Major Crypto Categories

Source: 21Shares, Coingecko, DeFi Llama*

Key takeaways:

- Tesla’s $218M of Bitcoin holdings in Q3 remain unchanged from Q2

- Ethereum’s supply growth has become deflationary over the past two weeks

- MakerDAO to invest $1.2BB into Coinbase custody for to earn $15M in annual revenue

- A South Carolina house has been sold as an NFT on OpenSea

Spot and Derivatives Markets

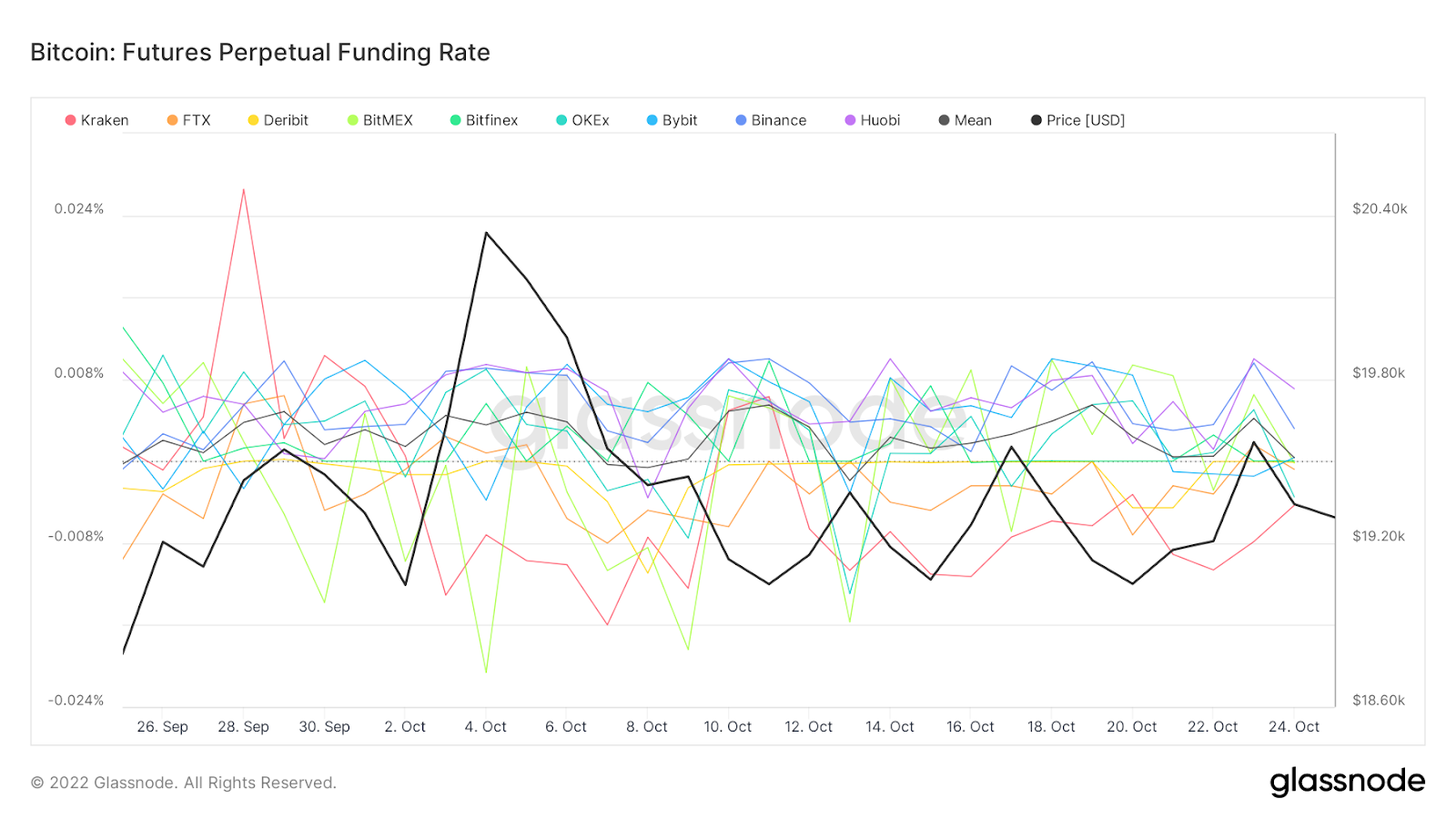

Figure 2:

Source: Glassnode

The chart above plots the average funding rate (in %) set by exchanges for perpetual futures contracts. A negative funding rate, as seen in Figure 2, means that short positions have to pay long positions periodically and usually indicates a bearish sentiment since more short traders are dominant.

On-chain Indicators

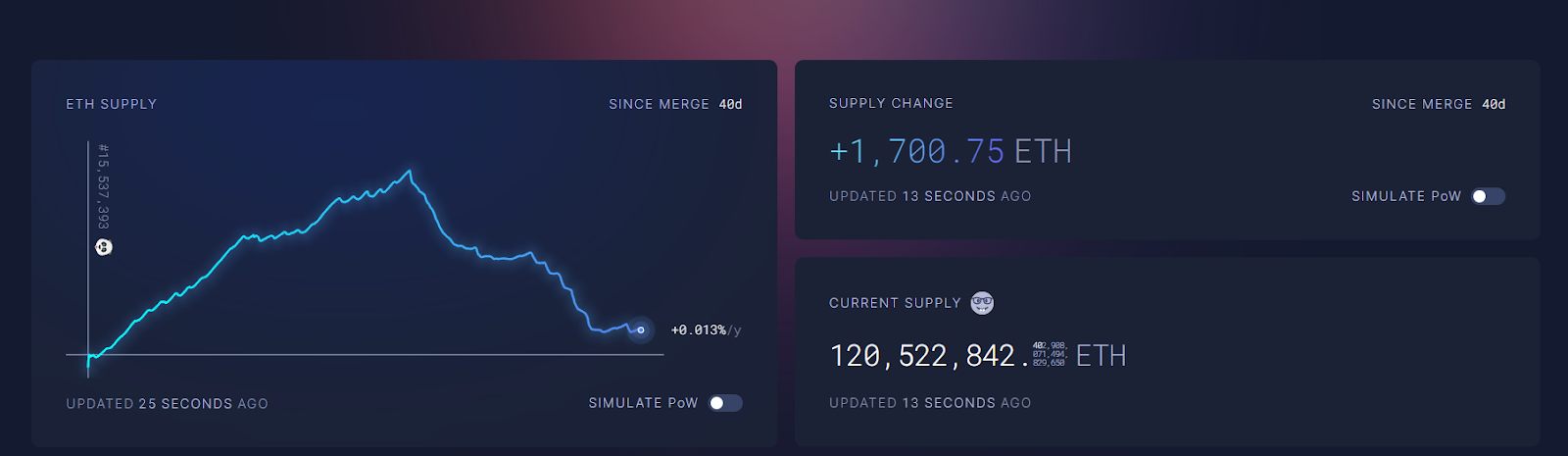

Figure 3:

Source: Ultrasound.money

Ethereum’s supply growth has become deflationary over the past two weeks as the network prepares itself to convert ETH into a deflationary asset in the long run, in the case that Ethereum maintains its adoption, and in turn, becomes a more valuable asset. In Figure 3 we can see that issuance of ETH has dropped after the Merge, which promises to decrease Ethereum’s inflation rate by 90%. We delve deeper into the implications of that further in this report.

Macro and Regulations

Europe’s leaders met on October 20 and 21 at a summit in Brussels where they discussed the war in Ukraine and its implications on the energy market ahead of an unusually cold winter. They agreed on the need to accelerate and intensify efforts to reduce energy demand, avoid rationing, secure supply and lower prices. On that note, energy consumed by Bitcoin miners jumped by 41% over the past 12 months. In its Q3 earnings report, Tesla is revealed to be holding $218M worth of Bitcoin. Tesla’s holdings from Q2 to Q3 remain unchanged, and this shows that institutional money still finds safety in this asset class during times of an almost-recession.

On October 19, the CEO of crypto exchange FTX Sam Bankman-Fried (also known as SBF) shared his “ideal” crypto standards; these are the key takeaways:

- Blacklists, rather than allowlists, as the suggested approach to sanctions compliance on blockchain environments.

- A 5-5 community standard when dealing with hackers snatching a number higher than the protocol’s reserves.

- Knowledge-based quizzes to determine product suitability for consumer protection

- DeFi needs to remain free and permissionless; no developer needs a license to code a smart contract.

SBF’s proposal was met with a backlash from the community, arguing that complying with OFAC’s sanctioned list would mean ending transactions with entire populations rather than specific addresses convicted as bad actors. It’s also important to bear in mind that as big as FTX is in the industry, as a centralized exchange its views and thought process aren’t representative. In principle, at 21Shares, we believe SBF’s proposal is a good step to spur conversation within the community to help cultivate healthier regulations that would protect consumers and protocols alike without hindering the benefit of either.

In terms of law enforcement, a new Interpol unit is allegedly being dedicated to crypto crimes to cater to the fact that little training or resources are allocated to generic law enforcement teams which often impedes the process. Interpol is indeed not the only law enforcement agency pained by lack of resources; a US Judge leading the Celsius case aims to look to use a UK consultation paper due to the absence of a US equivalent. It is only natural that crypto regulatory infrastructures are still brewing, given the nascency of the industry. We believe that the efforts of cross-border regulations can be very vital for the space and could speed up the process of having a global judicial system that can comprehend the nitty-gritty of the industry and therefore champion both justice and innovation.

Crypto Infrastructure

L1 updates: Ethereum is fulfilling one of the key pledges of the Merge as it continues to maintain its deflationary status. Following last week’s heightened activity pertaining to the XEN token, ETH carried on with its impressive burn rate this week owing to the increased speculative trading activity triggered by Vitalik’s light-hearted commentary that someone should create a token called “THE” as a joke. The mem-asset surged by 1000% over the following days, spawning other playful meme tokens such as DIE, which also rose by roughly 5500% and expectedly crashed afterwards. What’s worth pointing out here is the economic ramifications of the switch to POS, as ETH now doesn’t demand a lot of network activity to turn deflationary since the daily issuance significantly decreased. Ethereum burnt 10K of its unit over the past month and is now en route to reaching pre-merge supply levels.

In other news, ETH’s alarm clock smart contract - a feature enabling users to send future transactions by identifying the receiver address, the amount to be sent and the time for executing the transaction - was exploited. The minor bug allowed the hacker to exploit the scheduler process and funnel 260K worth of ETH on the back of reverting transactions with inflated gas fees, which would ultimately pay back the attacker a larger portion of the refunded tx fees than deserved.

Aptos, the new L1 advertised as a Solana killer due to its novel consensus mechanism and superior transactional capabilities reaching a theoretical upper bound of 100K, unveiled its mainnet last Wednesday. However, the launch was riddled with controversies on the back of the questionable tokenomics, mediocre throughput leaving it to process 4 Txs initially and increasing to 14 as of today’s writing, and poor communication from the foundation’s discord. In other news, Avalanche unveiled an all-encompassing command center that abstracts the complexity of performing on-chain actions. Dubbed Core-web, the command center will provide users with a portfolio tracker to check their token holding values, view NFTs, and perform numerous on-chain activities like bridging and swapping. This is excellent as it removes the complexity of dealing with web3 ecosystems, which is the biggest obstacle for onboarding new users. Avalanche also released elastic validation - a feature equipping validators with more customizable power over subnets and allowing them to stake their native token. The new mechanism is rolled out as part of the Banff upgrade.

Scalability: Optimism revealed their latest offering in tackling the issue of standardizing blockchain development via announcing OpStack. The architectural blueprint is a collection of modular components that break down traditional blockchains' monolithic structure and split them into consensus, governance, and execution layers - refining their performance and circumvents congestion in the process. Actualizing the vision could be vital for crypto's growth as it advances interoperability via shared message-passing while enhancing decentralization via introducing shared sequencers. The latter can also present atomic cross-chain composability, which hadn't been possible under the current monolithic regime. The reason is that the same consensus layer can now underpin a disparate set of blockchains with different architectural designs. In similar news, Arbitrum reached a new ATH in daily transactions, an impressive milestone as the network managed to secure the current sticky user base without predatory incentivization programs. Finally, zkSync mainnet will be deployed on the 28th of October, intensifying the competition as Polygon and BNB have already released the testnets of their zk rollups networks.

Decentralized Finance

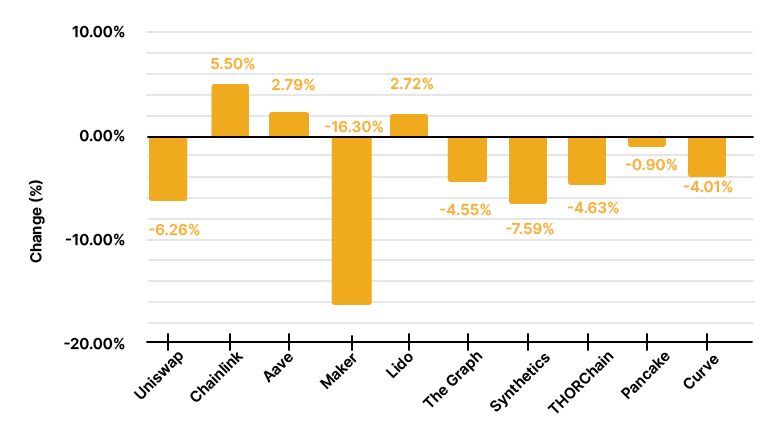

Figure 4: Top 10 DeFi Assets Weekly Performance

Source: 21Shares, Coingecko

ETH ecosystem: Frax Finance, the protocol behind the semi-collateralized and algorithmic stablecoin FXS, announced their venture into the liquid staking business. As a recap, liquid-staking refers to delegating your POS assets to a third party to earn yield, all without locking funds. That said, Frax will meet fierce competition as it introduces frxETH to the ETH derivative vertical currently saturated with other players like Rocketpool and Ankr, Coinbase and Lido. The latter is the most dominant, with Coinbase coming in second. Frax's decision is an excellent move for ETH's decentralization for the following reason: as Lido's ascendancy over ETH2 deposits - driven by the product's attractiveness and being the first to the market - made them responsible for a huge portion of its block production, and raised concerns of centralization on the consensus layer. Thus, having a more inclusive validator set should help promote censorship resistance at the protocol level. In other news, MakerDAO's new governance vote proposing to invest $1.1B USDC into Coinbase Custody passed with 75% approval. The deal should see Maker earn a 1.5% yield on its deposit, amounting to roughly $15M in annual revenue. This is healthy for MakerDAO as it continues diversifying its balance sheet, and earning further yield that ensures the protocol's survivability.

Flourishing L1: Although Aptos sustained a messy launch last week, the emerging L1 still managed to catch the industry’s attention. Pancake Swap, the biggest DEX on the BNB chain by volume, pushed a new governance proposal to expand to the Aptos ecosystem. The exchange - which went live on the network after a 97% approval - is now also available in Ethereum and BNB. Moving on, Algorand’s TVL experienced a major boost on the back of several developments. Crypto-native VC firm Hivemind deployed $200M worth of capital into multiple DeFi protocols projects. FTX also recently announced their support for native USDC on Algorand, while Fifa announced its Fifa+ collect program where Algorand will build out their marketplace for iconic historical moments in the form of digital collectibles (NFTs).

NFTs and Metaverse

Figure 5:

Source: 21Shares, Dune Analytics

As trading volume continues to dwindle given the macroeconomic factors, development in the space has been moving in the opposite direction. Reddit now has more NFT wallets than Opensea, grossing more than $350M in earnings, thanks to Polygon integration. Blur, a real-time updated NFT marketplace backed by Paradigm, went live on Ethereum as a beta version, offering zero trading fees along with a future airdrop of its BLUR token to anyone who has traded Ethereum-based NFTs in the last six months. Rarible transformed its marketplace into an NFT aggregator showing listings across marketplaces like Opensea, LooksRare, X2Y2, and Sudoswap with prices.

Real estate has also appeared on NFT news this past week. Roofstock, a real estate platform South Carolina house got sold on OpenSea for $175K. While being sold on a decentralized ledger brings about the perks of lower transactional costs and more, tokenization of real estate is being battle-tested, arguably at the best time for battle tests, under many horizons such as demand and regulatory approval.

*In Figure 1, returns are collected on Monday close while TVLs are collected on Tuesday close

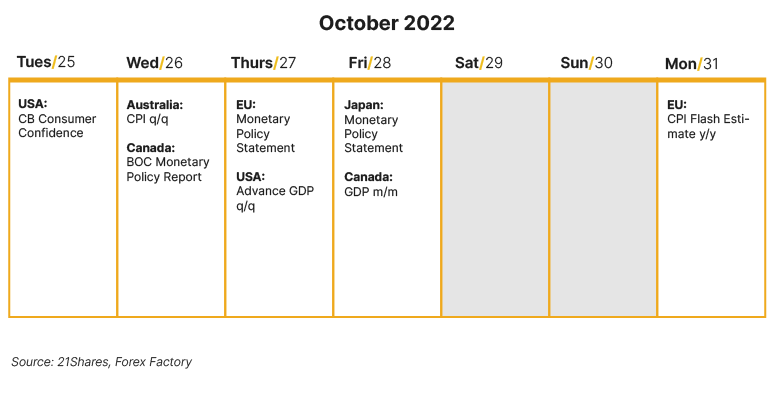

Next Week's Calendar

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

_logo.svg)

.svg.png)