FUD vs. Fundamentals: What Happened This Week in Crypto?

.webp)

This Week in Crypto

- Ethereum: FUD vs. Fundamentals

- Arbitrum Doubles Down on Dencun’s Cost-Efficiency

- Optimism Strides Towards Full Decentralization

- Can This Major Upgrade Help Fantom Level Up With Solana?

Ethereum: FUD vs. Fundamentals

Fear, uncertainty, and doubt (FUD) have clouded Ethereum's business prospects after CoinDesk reported on March 20 that Ethereum’s Github repository seemed to confirm rumors about ongoing investigations by the Securities and Exchange Commission (SEC). If true, this could be business as usual for the regulator as it nears its deadline for a decision on ETH spot ETFs on May 23. Nevertheless, statements about the investigations are vague and ambiguous, whether they're focused on the Ethereum Foundation or the companies dealing with it, making it a curious case to monitor closely.

How did the market react? Nothing dramatic. In the past week, despite Ethereum experiencing a 10% drop on the day of Coindesk's report, it quickly recovered the following day with a 10% rebound and shrugging off the uncertainty, ultimately closing the week with a modest 1.78% gain. The below on-chain metrics are also worth noting:

- ETH deposits on centralized exchanges increased by ~3%, well within the 3-5% average increases seen in May 2021, 2022, and 2023, which is understandable as investors capitalize on reaching the $4K milestone.

- The market-value-to-realized-value (MVRV) is one of crypto’s leading on-chain indicators comparing Ethereum’s current market price to its historical average transaction price, to estimate its valuation based on past trends.. As shown in Figure 1, the MVRV went from 2.23 on March 13 to 1.65 on March 24, indicating that the network continues to be undervalued when compared to previous bull runs. For example, in May 2021, the MVRV Z-score was at 5.57 when Ethereum traded at around $3.9K.

Figure 1: Ethereum’s MVRV Z-Score (7D Moving Average)

Source: Glassnode

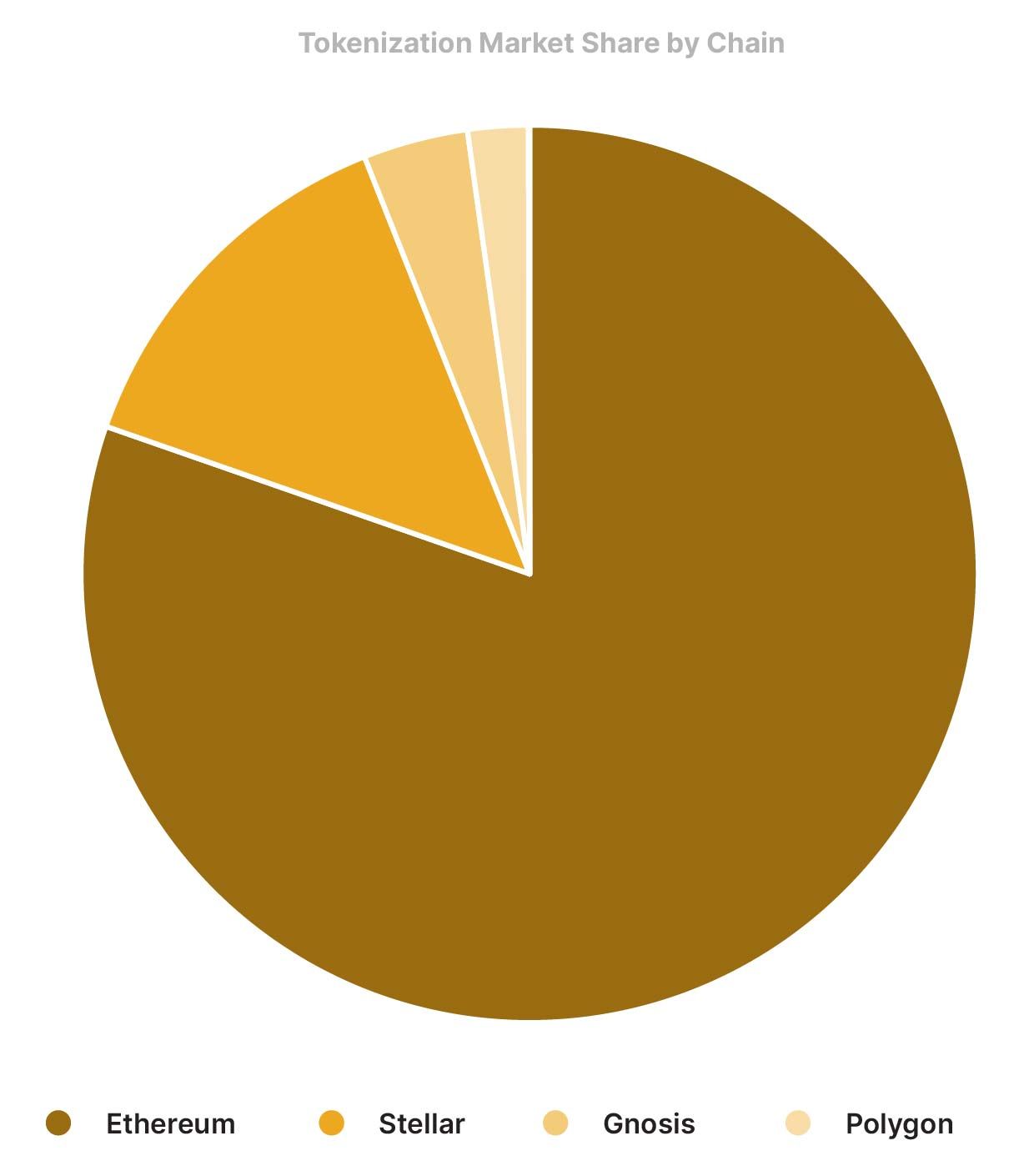

On a more positive note, the biggest news for Ethereum was arguably BlackRock’s announcement of tokenizing treasury bonds and repo agreements. The asset manager has partnered with Securitize as a transfer agent and tokenization platform to launch their yield-bearing fund, BUIDL, on top of Ethereum. As shown in Figure 2, Ethereum accounts for 80.33% of tokenized assets, if we exclude fiat-collateralized stablecoins. BlackRock has joined the likes of Franklin Templeton and Citigroup, among others, in tokenizing real-world assets. The deployment on Ethereum reiterates our thesis that the network will continue playing a vital role across the tokenization realm. So far, there has been a total of over $2 billion worth of commodities and government securities, among other traditional assets tokenized on several networks. Thanks to blockchain technology, these tokenized assets boast several advantages over their traditional form due to their transparency, around-the-clock trading, and faster settlement.

Figure 2: Tokenization Market Share by Chain

Source: 21.co on Dune Analytics

On the fundamental side, Ethereum’s core developers have launched an initiative called “pump the gas” to raise the gas block limit from 30 to 40 million (and even more), decreasing gas fees on Ethereum’s mainnet by as much as 33%. The gas block limit is the maximum amount of gas that all transactions combined can consume within a single block. The discussion of expanding the gas block limit has been up for debate since Vitalik brought it up in January 2024. However, some are not in favor of the initiative, arguing that EIP-4844 has already increased the block size and that it could lead to potential risks of network spam and attacks.

Arbitrum Doubles Down on Dencun’s Cost-Efficiency

With Optimism, Base, and Arbitrum all witnessing transaction fees drop by over 90% post-Dencun's activation, the total number of transacting addresses across their networks has almost doubled since then, as seen below in Figure 3. However, Arbitrum has taken a step further by introducing the ATLAS upgrade, aiming to drive fees down even more. Specifically, ATLAS decreased what’s known as the “L1 surplus fees” from 32 gwei to zero while lowering the L2 base fees from 0.1 to 0.01 gwei, helping the network achieve a median transaction fee of ~$0.002, the lowest since October 2022. Applications built on Arbitrum can reap the benefit of the upgrade right away without any modifications from their end, while L3 networks built on top of Arbitrum, using its Orbit framework, need to implement the upgrade to capitalize on the blob posting mechanism to experience lower fees.

Figure 3: Number of Transacting Addresses across Base vs. Optimism vs, Arbitrum

Source: msibl7 on Dune

Optimism Strides Towards Full Decentralization

On the other hand, Optimism is progressing towards its vision of full decentralization. For context, the network currently relies on a single sequencer, a validator that posts transaction data from Optimism on Ethereum, run by the Optimism Foundation itself. This sequencer is overseen by an elected security council, which acts as a custodian managing the protocol upgrades and the security of the network by ensuring that the sequencer is acting honestly, amongst other security-related tasks. This means that only a handful of eight elected individuals can contest the validity of transactions if they suspect any malicious behavior. Nevertheless, this was a temporary setup until Optimism released its “Fault Proof” system, which determines the validity of transactions before they’re posted on Ethereum’s mainnet. This enables a proactive rather than a reactive approach to maintaining transaction integrity. In line with this, Optimism rolled out the second iteration of the system on Sepolia testnet after releasing the first in October of last year, with the full launch expected later this year, where anyone can submit a fault-proof and dispute the validity of transactions.

Can This Major Upgrade Help Fantom Level Up With Solana?

The Ethereum alternative blockchain is set to implement its upcoming Sonic upgrade in the spring of 2024. Although the date isn’t determined yet, the next network iteration will position Fantom as one of the most scalable networks within the Ethereum Virtual Machine (EVM) ecosystem, capable of rivaling Solana’s efficiency. Namely, Sonic introduces the Fantom Virtual Machine (FVM), a new operating system facilitating close to 2000 transactions per second (TPS) based on the latest testnet results while adopting parallelization to enhance transaction throughput. Further, Sonic achieves transaction finality in under a second, with transaction fees costing less than a cent while introducing Carmen, a new database model that reduces the storage costs for validators by close to 90%. This enables them to participate in the network’s security validation in a cost-effective manner while expediting the time required for the foundation to spin up a new archival validator node from several weeks to 36 hours.

All in all, the excitement in anticipation of the upgrade can be seen with Fantom’s price growing by 200% over the last 30 days, while its DEX trading volume has surged by close to 12-fold, growing from $5M and peaking at $60M last week. Fantom’s stablecoin assets under management has also increased by about 150% over the same period since the lows of October 2023, implying that new users are increasingly depositing capital into the network to experiment with its ecosystem, akin to what was seen during the run-up of the ETF-led rally last October. Nevertheless, Fantom shows promising growth prospects as its P/E ratio continues to decrease despite its recent price gains, as shown below in Figure 4. This indicates that transaction volume and network utilization are outpacing its market capitalization growth, potentially implying that Fantom remains relatively undervalued.

Figure 4: NVT: The P/E-Equivalent of Blockchain Networks

Source: Glassnode

This Week’s Calendar

Source: Forex Factory, 21Shares

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

_logo.svg)

.svg.png)