Crypto is growing up: 3 things to learn from a recent conference

.jpg)

Crypto’s path to mainstream adoption is gaining momentum, and the latest Permissionless conference in New York made that clear. At 21Shares, we see these developments as more than passing trends. Here are three key insights from the conference that embody our investor-first perspective and forward-looking approach.

1. The rise of real-world assets and stablecoins

Real-world assets (RWAs) are traditional financial or physical assets, like real estate, that are turned into digital tokens and moved onto blockchain networks. The event featured discussions on topics like tokenized credit markets, demonstrating how investing is becoming more accessible to investors.

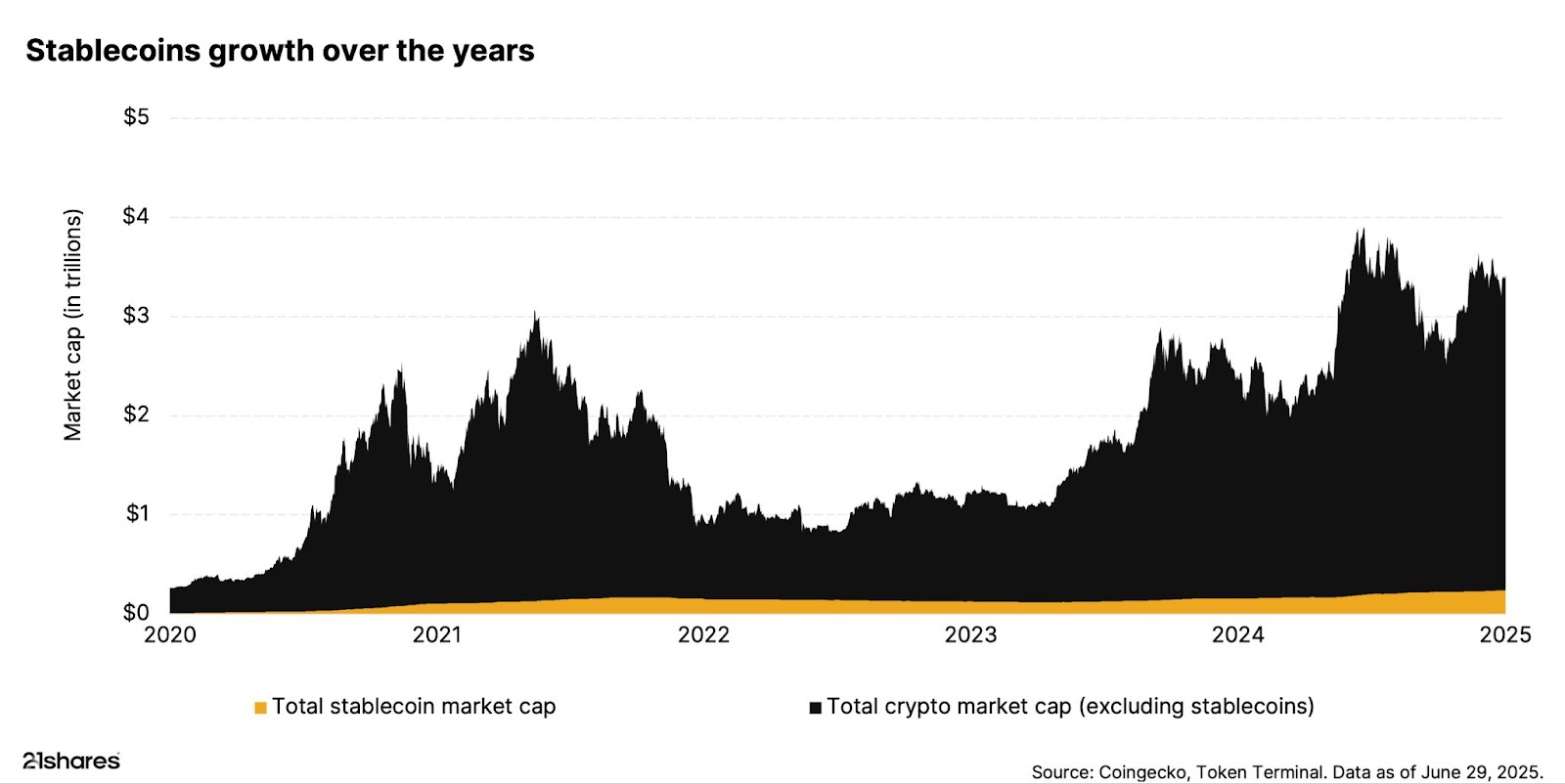

Stablecoins, the cryptocurrencies designed to maintain a stable value by being pegged to assets like fiat currencies or gold, were also a primary focus of the event. Their market has seen significant growth in recent years, with Citigroup projecting it could reach $3.7 trillion by 2030.

This expansion is driven by practical uses such as cross-border payments. A clear sign of this momentum was Mastercard’s announcement at the conference of a partnership with Chainlink to enable card-based transactions on the blockchain.

The growth of RWAs and stablecoins is driving demand for the blockchains they depend on, especially Ethereum. Stablecoin issuers need to hold and use the native tokens of these blockchains (like Ether) to issue, transact, and settle on-chain. As more economic activity shifts to tokenized assets, these blockchains benefit from greater usage, increased fee revenue, and long-term value growth. This strengthens the investment case for Ethereum and similar platforms as essential infrastructure assets, making them increasingly attractive for inclusion in diversified portfolios through regulated exchange-traded products (ETPs).

2. Keep crypto simple and user-friendly

A recurring theme across the panels was the industry’s push to simplify crypto by masking the technical complexities of blockchain, making applications feel more familiar. Developers highlighted mobile-first designs featuring built-in fiat on-ramps, invisible wallets, and AI-powered onboarding.

Just as people use the Internet daily without understanding protocols like TCP/IP or DNS, 21Shares anticipates that the next wave of crypto users will adopt the technology once it becomes invisible, and when interacting with blockchain-based apps feels seamless and effortless, without users even realizing they’re on-chain.

3. Bitcoin and Ethereum: The foundation of crypto finance

At the conference, Bitcoin and Ethereum took center stage in nearly every discussion. Ethereum co-founder Joe Lubin referred to them as “the highest-power money,” capturing a sentiment widely shared across panels focused on institutional adoption, scalability, and the expanding role of decentralized finance.

Bitcoin and Ethereum form the foundation of any crypto exchange-traded fund (ETF) portfolio. Their strong liquidity, growing regulatory clarity, and increasing real-world utility position them as essential long-term holdings for both seasoned investors and those just entering the space.

Conclusion

Crypto is entering a transformative new phase defined by real-world utility, mainstream accessibility, and infrastructure-driven value. These developments underscore the growing importance of crypto exchange-traded products (ETPs) as regulated, trusted bridges connecting traditional finance with digital asset innovation. As blockchain technology becomes ever more seamless, 21Shares believes this evolution will unlock significant long-term value.

This report has been prepared and issued by 21Shares AG for publication globally. All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however, we do not guarantee the accuracy or completeness of this report. Crypto asset trading involves a high degree of risk. The crypto asset market is new to many and unproven and may have the potential not to grow as expected.Currently, there is relatively small use of crypto assets in the retail and commercial marketplace in comparison to relatively large use by speculators, thus contributing to price volatility that could adversely affect an investment in crypto assets. In order to participate in the trading of crypto assets, you should be capable of evaluating the merits and risks of the investment and be able to bear the economic risk of losing your entire investment.Nothing herein does or should be considered as an offer to buy or sell or solicitation to buy or invest in crypto assets or derivatives. This report is provided for information and research purposes only and should not be construed or presented as an offer or solicitation for any investment. The information provided does not constitute a prospectus or any offering and does not contain or constitute an offer to sell or solicit an offer to invest in any jurisdiction. The crypto assets or derivatives and/or any services contained or referred to herein may not be suitable for you and it is recommended that you consult an independent advisor. Nothing herein constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal recommendation. Neither 21Shares AG nor any of its affiliates accept liability for loss arising from the use of the material presented or discussed herein.Readers are cautioned that any forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors.This report may contain or refer to material that is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would subject 21Shares AG or any of its affiliates to any registration, affiliation, approval or licensing requirement within such jurisdiction.