Bitcoin below $100K: temporary dip or official bear market?

Bitcoin’s drop back below $100,00, after setting a new all-time high earlier this year, has sparked fears of an approaching bear market. We believe a recent decline reflects a temporary bout of weakness, not the start of a deep or prolonged downturn

What’s behind the recent weakness?

Bitcoin’s pullback is the result of three overlapping forces: forced liquidations, large-holder selling combined with ETF outflows, and a sharp liquidity swueeze driven by macro events.

Liquidation overhang

The decline below $100,000 has been heavily influenced by forced selling. The process began with a $19 billion deleveraging wave in October, followed by an additional $13 billion in liquidations, $3 billion of which occurred in the past week alone. With market depth unusually thin, these automated sell-offs triggered outsized price drops as buyers failed to absorb the supply.

Selling by large Bitcoin investors and ETF outflows

After almost six months above $100,000, many long-term investors began taking profit. Investors with $100 million and $1 billion in Bitcoin have sold roughly $12 billion since October. Spot Bitcoin ETFs mirrored this behavior, with $866 million in outflows on Thursday, the second-largest single-day withdrawal on record. While profit-taking is normal, it added meaningful supply into an already fragile market.

A liquidity drain amid macro uncertainty

A major problem has been a simple cash shortage. Because of the recent government shutdown in the US, the Treasury continued withdrawing cash from the financial system while being unable to spend, effectively removing about $150 billion from circulation. This tightening hurt all risk assets, but the impact on crypto, where liquidity is thinner, was particularly acute.

Silver linings: current weakness is not a Bitcoin-specific issue

Despite these pressures, several underlying trends indicate that Bitcoin’s correction is more likely a reset than the beginning of a deep bear market.

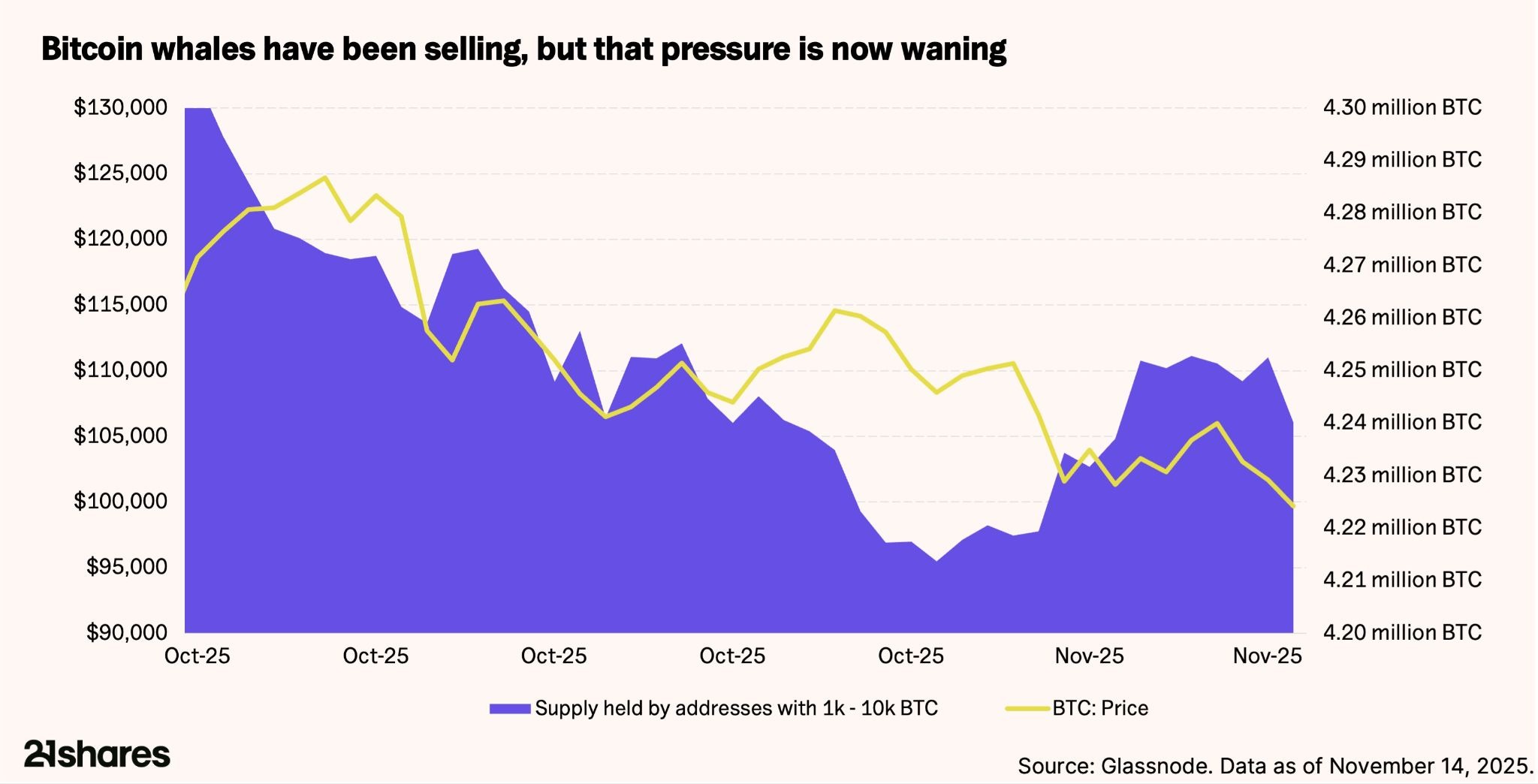

Long-term selling pressure is already slowing

The heaviest selling, mostly from investors who have held for a long time, appears to be finished. Even the biggest "whale" investors are selling less. Assets are shifting into the hands of new, likely stickier holders. Historically, this transition marks the late stages of a sell-off.

Liquidity conditions are poised to improve

The liquidity squeeze that weighed on Bitcoin is beginning to ease. Quantitative tightening is scheduled to end in December, and with the government shutdown resolved, spending can flow back into the economy instead of being trapped in Treasury accounts.

Importantly, global money supply has continued to expand, a backdrop that historically supports Bitcoin once liquidity returns. So far, Bitcoin has lagged that expansion, but if liquidity continues to improve, history suggests it could begin to catch up.

Structural demand drivers remain intact

The macro forces behind this cycle are strengthening. A key driver is the return of the “debasement trade,” where investors seek protection against the weakening of fiat currencies, like the US dollar. With deficits widening, tariffs rising, and debt levels climbing, this trend is accelerating. Investors are responding accordingly: gold is up more than 50% this year, with over $50 billion in inflows, more than the previous two decades combined! Bitcoin plays a similar role to gold in this environment. Historically, whenever conditions push investors toward stores of value, Bitcoin benefits. At the same time, Bitcoin also captures upside during broad growth and liquidity cycles. While it underperformed major tech stocks this year, past cycles suggest that Bitcoin often outperforms following these periods of lag.

Why this is a market reset and not the start of a deep bear market

Having fallen more than 20% from its all-time high, Bitcoin meets the technical definition of a short-term bear market. However, this decline looks far more like a valuation reset than the deep bear markets of the past, which lasted multiple years and wiped out more than 80% of Bitcoin’s price. Crucially, none of the classic bear-market catalysts are present today: there has been no security failure, no systemic fraud, no regulatory shock, and no macro tightening cycle. Historically, pullbacks of this magnitude have resolved within one to three months and often marked the consolidation phase before the next leg higher.

In our view, Bitcoin is not entering a deep bear market. While volatility and consolidation may persist into year-end, the fundamental drivers behind this cycle remain intact, supporting a constructive long-term outlook.

This report has been prepared and issued by 21Shares AG for publication globally. All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however, we do not guarantee the accuracy or completeness of this report. Crypto asset trading involves a high degree of risk. The crypto asset market is new to many and unproven and may have the potential not to grow as expected.Currently, there is relatively small use of crypto assets in the retail and commercial marketplace in comparison to relatively large use by speculators, thus contributing to price volatility that could adversely affect an investment in crypto assets. In order to participate in the trading of crypto assets, you should be capable of evaluating the merits and risks of the investment and be able to bear the economic risk of losing your entire investment.Nothing herein does or should be considered as an offer to buy or sell or solicitation to buy or invest in crypto assets or derivatives. This report is provided for information and research purposes only and should not be construed or presented as an offer or solicitation for any investment. The information provided does not constitute a prospectus or any offering and does not contain or constitute an offer to sell or solicit an offer to invest in any jurisdiction. The crypto assets or derivatives and/or any services contained or referred to herein may not be suitable for you and it is recommended that you consult an independent advisor. Nothing herein constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal recommendation. Neither 21Shares AG nor any of its affiliates accept liability for loss arising from the use of the material presented or discussed herein.Readers are cautioned that any forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors.This report may contain or refer to material that is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would subject 21Shares AG or any of its affiliates to any registration, affiliation, approval or licensing requirement within such jurisdiction.

_logo.svg)

.svg.png)