The rise of Hyperliquid: DeFi’s record-breaking powerhouse

.jpeg)

Last week, we explored perpetual futures and how decentralized exchanges (DEX) are powering their explosive rise. Among them, a leading DEX, Hyperliquid, is breaking records, leading volumes, and sending its token to new all-time highs.

Before diving into the numbers and what’s driving them, a quick refresher: Hyperliquid runs on its own blockchain, setting it apart from typical trading platforms. Sitting at the intersection of three unstoppable forces: soaring derivatives demand, the shift to decentralized infrastructure, and the rise of next-gen financial architecture, it’s quickly establishing itself as one of DeFi’s most formidable players.

Revenue reaches unprecedented heights

Hyperliquid blew past the $100 million mark in monthly revenue during August, reaching approximately $110 million, a 21% increase from July's $86.6 million. Notably, the platform processed around $357 billion in perpetuals trading volume for the month, a 12% month-over-month rise.

The surge was fueled by heightened market volatility, which drove trading across major assets, and Hyperliquid’s high-performance infrastructure, attracting professional traders seeking centralized exchange-like execution in a decentralized environment. At the same time, structural shifts in the DeFi perpetuals landscape, including declining activity on competing platforms, have concentrated liquidity on Hyperliquid, enabling it to capture the lion’s share of onchain perpetuals trading.

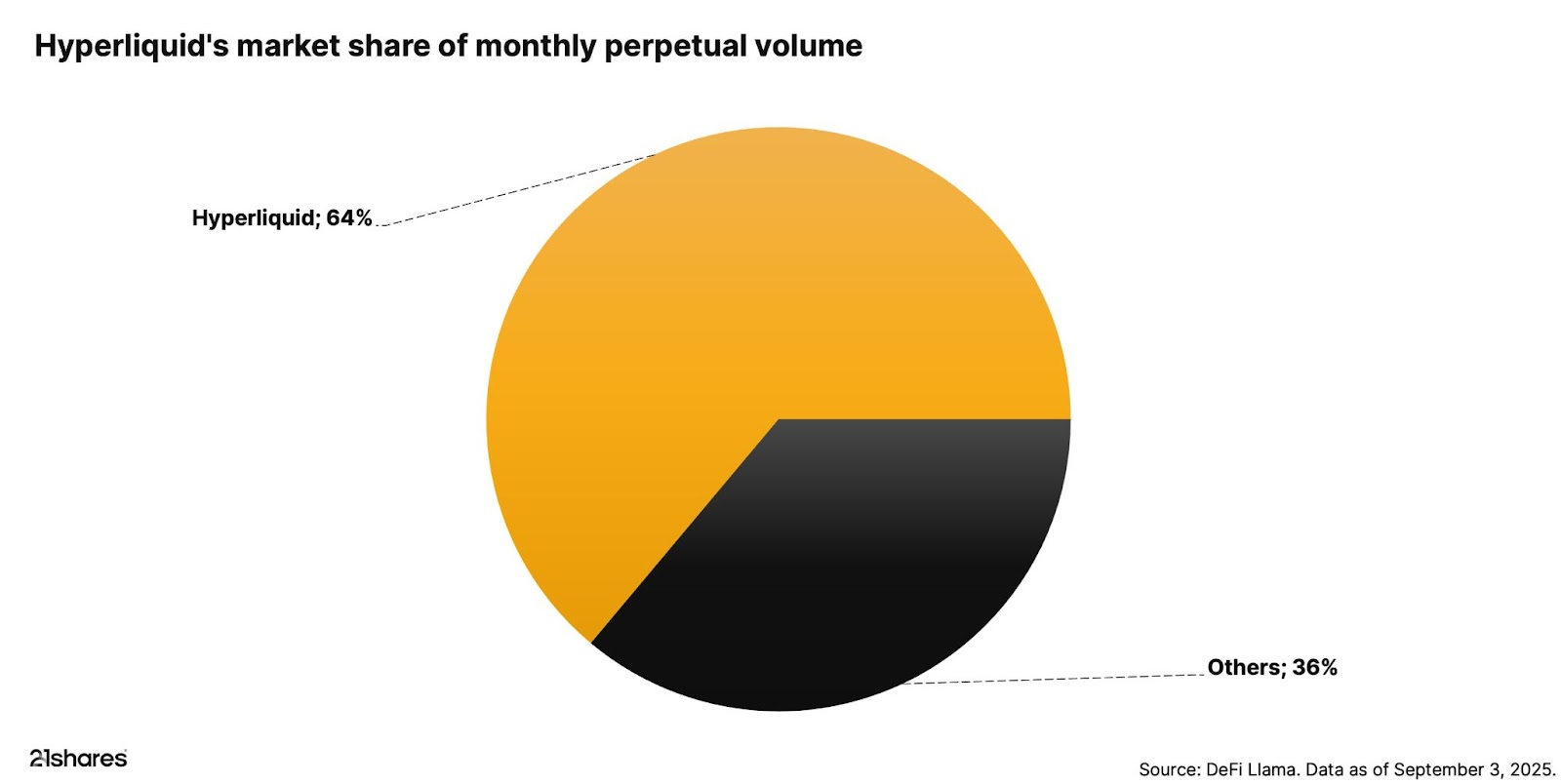

Dominating the DeFi perpetuals market

Over the past month, Hyperliquid has dominated decentralized perpetuals, commanding 64% market share. This dominance is a result of its fast on-chain infrastructure, which supports sub-second execution and up to 200,000 orders per second, features that attract both retail and institutional traders.

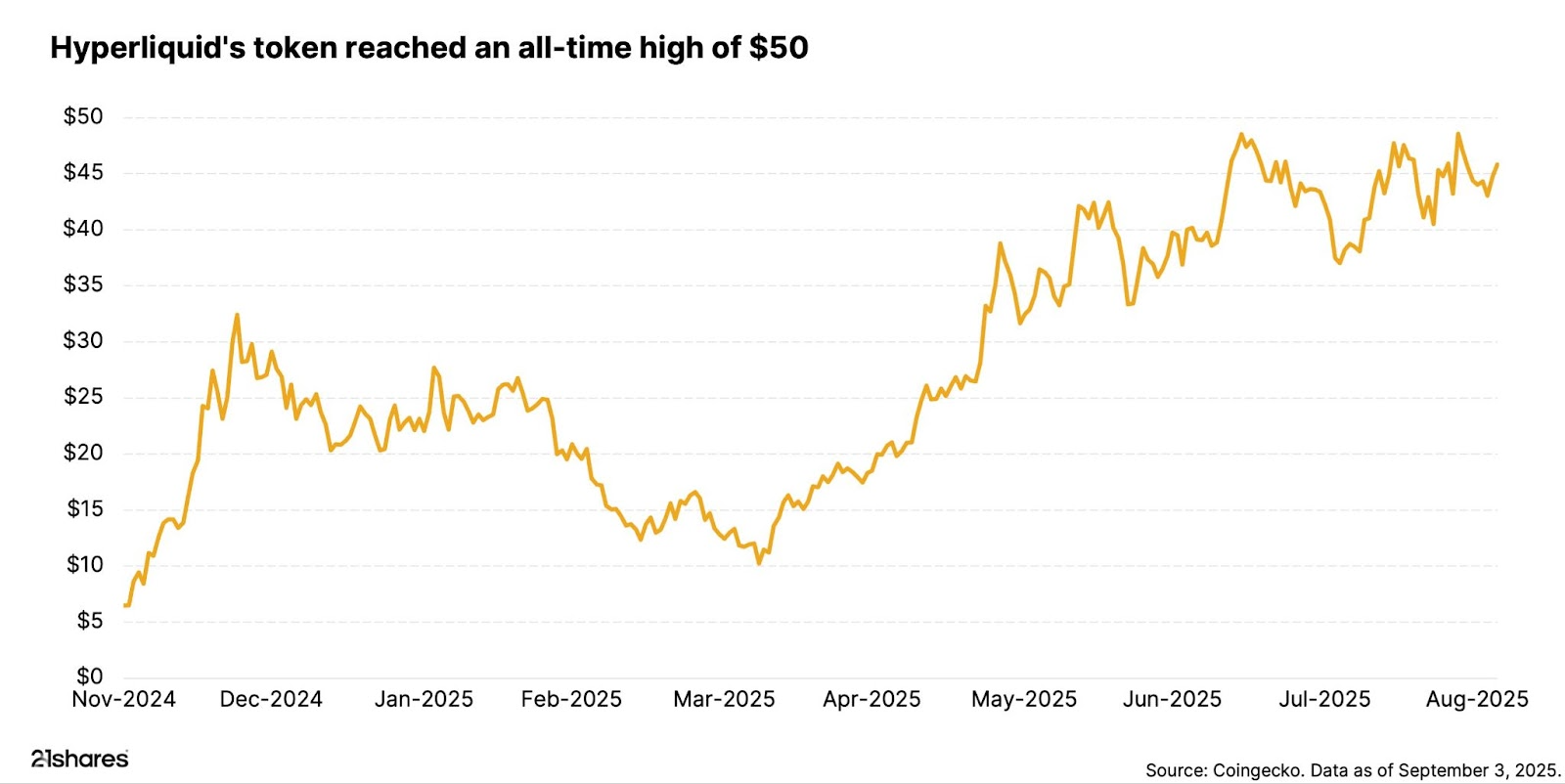

Token price rockets to an all-time high

The native token, HYPE, reached a peak of $50.99 in late August. Analysts attribute this increase to record trading activity and the protocol’s automated token buyback mechanism, which directs a significant portion of fees into market purchases, which helps reduce the circulating supply.

What’s driving the momentum?

- Sustained volume surge: With August’s $357 billion in volume, Hyperliquid has emerged as the largest onchain venue for crypto derivatives.

- Innovative infrastructure: The Hyperliquid blockchain provides high throughput and near-instant finality, rivaling centralized exchanges while maintaining decentralization.

- Tokenomics that favor holders: Most revenue flows into token buybacks via the “Assistance Fund,” tightening supply and supporting long-term price discovery.

What's next for Hyperliquid?

Hyperliquid’s rapid ascent shows little sign of slowing. Its planned expansion into new markets, such as spot trading and the tokenization of real-world assets, has the potential to attract fresh user groups and drive even greater volumes.

The launch of its custom operating system, HyperEVM, in early 2025, has transformed Hyperliquid from a derivatives powerhouse into a full-fledged Layer 1 ecosystem, giving developers the tools to build innovative DeFi applications directly on its infrastructure.

For institutions, the appeal is clear: high throughput, transparent settlement, and composable liquidity, all within a blockchain-native environment. Together, these developments could cement Hyperliquid’s place as one of the most influential players in the next phase of decentralized finance.

This report has been prepared and issued by 21Shares AG for publication globally. All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however, we do not guarantee the accuracy or completeness of this report. Crypto asset trading involves a high degree of risk. The crypto asset market is new to many and unproven and may have the potential not to grow as expected.Currently, there is relatively small use of crypto assets in the retail and commercial marketplace in comparison to relatively large use by speculators, thus contributing to price volatility that could adversely affect an investment in crypto assets. In order to participate in the trading of crypto assets, you should be capable of evaluating the merits and risks of the investment and be able to bear the economic risk of losing your entire investment.Nothing herein does or should be considered as an offer to buy or sell or solicitation to buy or invest in crypto assets or derivatives. This report is provided for information and research purposes only and should not be construed or presented as an offer or solicitation for any investment. The information provided does not constitute a prospectus or any offering and does not contain or constitute an offer to sell or solicit an offer to invest in any jurisdiction. The crypto assets or derivatives and/or any services contained or referred to herein may not be suitable for you and it is recommended that you consult an independent advisor. Nothing herein constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal recommendation. Neither 21Shares AG nor any of its affiliates accept liability for loss arising from the use of the material presented or discussed herein.Readers are cautioned that any forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors.This report may contain or refer to material that is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would subject 21Shares AG or any of its affiliates to any registration, affiliation, approval or licensing requirement within such jurisdiction.