Inside TOKEN2049 Dubai: What it means for crypto exchange-traded products

TOKEN2049 Dubai gathered the sharpest minds in crypto, from builders and founders to big-money investors and asset managers. Beyond the buzz, the conference spotlighted a clear trend: crypto exchange-traded products (ETPs) are quickly becoming the go-to entry point for both institutions and everyday investors.

Macro sentiment and Bitcoin’s role as a strategic reserve asset

A major theme at TOKEN2049 was the rising belief that crypto, especially Bitcoin, is beginning to break away from traditional markets. In today’s volatile macro environment, Bitcoin is increasingly seen as the most resilient asset, not just in crypto but across all asset classes. The long-term vision of separating money from the state, echoing the shift from gold to fiat, was a recurring narrative throughout the event.

Another hot topic: a potential global race for Bitcoin. Pantera Capital’s Dan Morehead pointed to countries like China, Russia, the UAE, and India as likely purchasers in response to a potential US Strategic Bitcoin Reserve. If that happens, demand could skyrocket as nations compete for a share of Bitcoin’s limited supply.

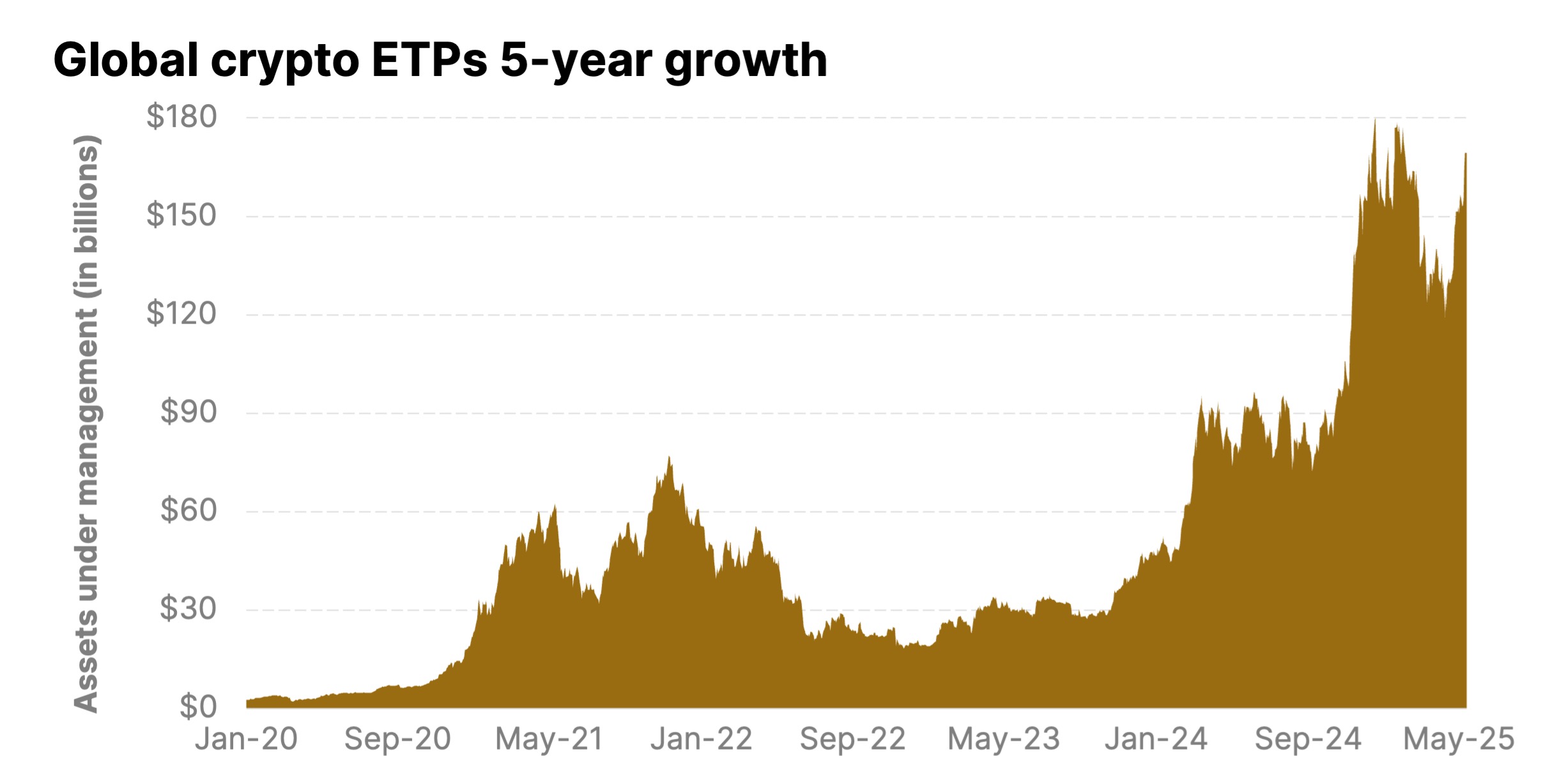

Exchange-traded products gaining institutional momentum

Over $150 billion is now invested in crypto ETPs and ETFs globally, nearing record highs. What’s more, the full spectrum of institutional investors is getting in, from family offices to pension funds. Issuers are bullish that this momentum will build, thanks to the appeal of registered, liquid, and accessible products. As the US signals a more crypto-friendly political shift, talk at TOKEN2049 turned to the possibility of additional ETF approvals in the US, highlighting the growing demand for more secure, diversified crypto exposure as the market matures.

Bitcoin’s DeFi and staking boom

Once met with skepticism, Bitcoin-based DeFi (Decentralized Finance) and staking applications have emerged as key topics this year. The Bitcoin ecosystem is thriving with scalability solutions, as investors rush to tap into its full potential as a yield-bearing asset. This shift strengthens Bitcoin’s investment case, with its growing, multifaceted ecosystem making it an increasingly attractive investment opportunity.

Spotlight is on Solana

Solana commanded significant attention at the conference, trailing only Bitcoin in visibility. As the leading Ethereum competitor, Solana is drawing increasing interest from developers, users, and investors alike. This trend shows no signs of slowing, with numerous projects migrating to or building on Solana. Other projects generating major buzz included Sui, MegaETH, Hyperliquid, and Berachain, highlighting the next wave of innovation and where investor focus is shifting.

Stablecoins lead the charge in crypto adoption

A final theme to highlight from the conference was that stablecoins have achieved the first clear product-market fit in crypto. While several new stablecoin projects were discussed, seasoned builders identified only a few with true potential. Nonetheless, stablecoins' role in driving crypto adoption remains undeniable, powering decentralized finance and generating significant fees for major blockchains like Ethereum and Solana.

This report has been prepared and issued by 21Shares AG for publication globally. All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however, we do not guarantee the accuracy or completeness of this report. Crypto asset trading involves a high degree of risk. The crypto asset market is new to many and unproven and may have the potential not to grow as expected.Currently, there is relatively small use of crypto assets in the retail and commercial marketplace in comparison to relatively large use by speculators, thus contributing to price volatility that could adversely affect an investment in crypto assets. In order to participate in the trading of crypto assets, you should be capable of evaluating the merits and risks of the investment and be able to bear the economic risk of losing your entire investment.Nothing herein does or should be considered as an offer to buy or sell or solicitation to buy or invest in crypto assets or derivatives. This report is provided for information and research purposes only and should not be construed or presented as an offer or solicitation for any investment. The information provided does not constitute a prospectus or any offering and does not contain or constitute an offer to sell or solicit an offer to invest in any jurisdiction. The crypto assets or derivatives and/or any services contained or referred to herein may not be suitable for you and it is recommended that you consult an independent advisor. Nothing herein constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal recommendation. Neither 21Shares AG nor any of its affiliates accept liability for loss arising from the use of the material presented or discussed herein.Readers are cautioned that any forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors.This report may contain or refer to material that is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would subject 21Shares AG or any of its affiliates to any registration, affiliation, approval or licensing requirement within such jurisdiction.