Bitcoin Shakes off FUD While Solana Gets Help: What Happened This Week in Crypto?

This Week in Crypto

- Bitcoin Reclaims $72K After a Weekend of FUD

- Help Is on the Way for Solana’s Technical Hurdles

- The Domino Effect of Uniswap’s Fee-Switch Proposal

Bitcoin Reclaims $72K After a Weekend of FUD

The last mile in the fight against inflation is said to be the longest one. According to the latest monthly publication from the Institute for Supply Management (ISM), consumption remained strong in the U.S. as manufacturing activity showed expansion for the first time since 2022, dimming hopes for a rate cut in June. The news created some pull-back in the market, especially for tech stocks like Nasdaq, S&P500, and Invesco, which dipped by 1-2% over the following two days. The U.S. jobs market also ended the week on a high note – not reassuring for rate cuts. Nonfarm Payrolls came in on Friday, indicating that the labor market is stronger than ever, as it increased by 303K compared to the expected 200K. Since March’s results indicate a resilient economy thus far, the Fed will likely delay cutting rates to keep their ammunition for when it’s needed. Now, all eyes are on the CPI print coming out on Wednesday.

The bearish sentiment surrounding last week’s macroeconomic indicators spread fear, uncertainty, and doubt (FUD) in the market, mixed with a pinch of profit-taking, starting April with almost a billion dollars in ETF outflows in one day, as shown in Figure 1. On April 2, a day after the ISM publication, on-chain data revealed that the U.S. government moved 30K BTC to an address identified as Coinbase Prime Deposit and another tied to the government. It was the remaining batch of the ~50K BTC that the Department of Justice confiscated from the Silk Road fraud case in November 2021, when Bitcoin traded at above $60K. Last year, the government sold ~20K BTC in two batches. The original plan was for the government to sell the remaining 30K throughout 2023 when Bitcoin was trading way below $40K. While the reason for the hold-up is speculative, the facts are the U.S. government made at least 6% gains on their sale, unlike the losses they accrued when they sold at a discounted price in March and June 2023.

Figure 1 – Bitcoin Spot ETF Flows

Source: Glassnode

Finally, while Bitcoin fell by 6%, from $69.7K to $65K on April 2, the cryptoasset climbed back above $70K levels on April 8. The reason for Bitcoin’s surge to a four-week high could be influenced by short-term holders continuing to accumulate more than 80K BTC since the beginning of April, ahead of the halving event expected in roughly 10 days.

Figure 2 – BTC Supply Held By Long-Term Holders vs. Short-Term Holders (Since October Rally)

Source: Glassnode

Help Is on the Way for Solana’s Technical Hurdles

As Solana emerges as the favored platform for the recent surge in “meme coins,” the increased demand has strained the network's capacity, leading to difficulties in processing nearly 75% of non-consensus transactions, i.e., transactions that include activities such as swapping, staking, and lending. However, it’s worth highlighting that Solana currently has more than 1.1M new users joining the network daily. This is an increase of more than 1000% from November of last year, which shows the unprecedented growth the network has experienced over Q1 of 2024.

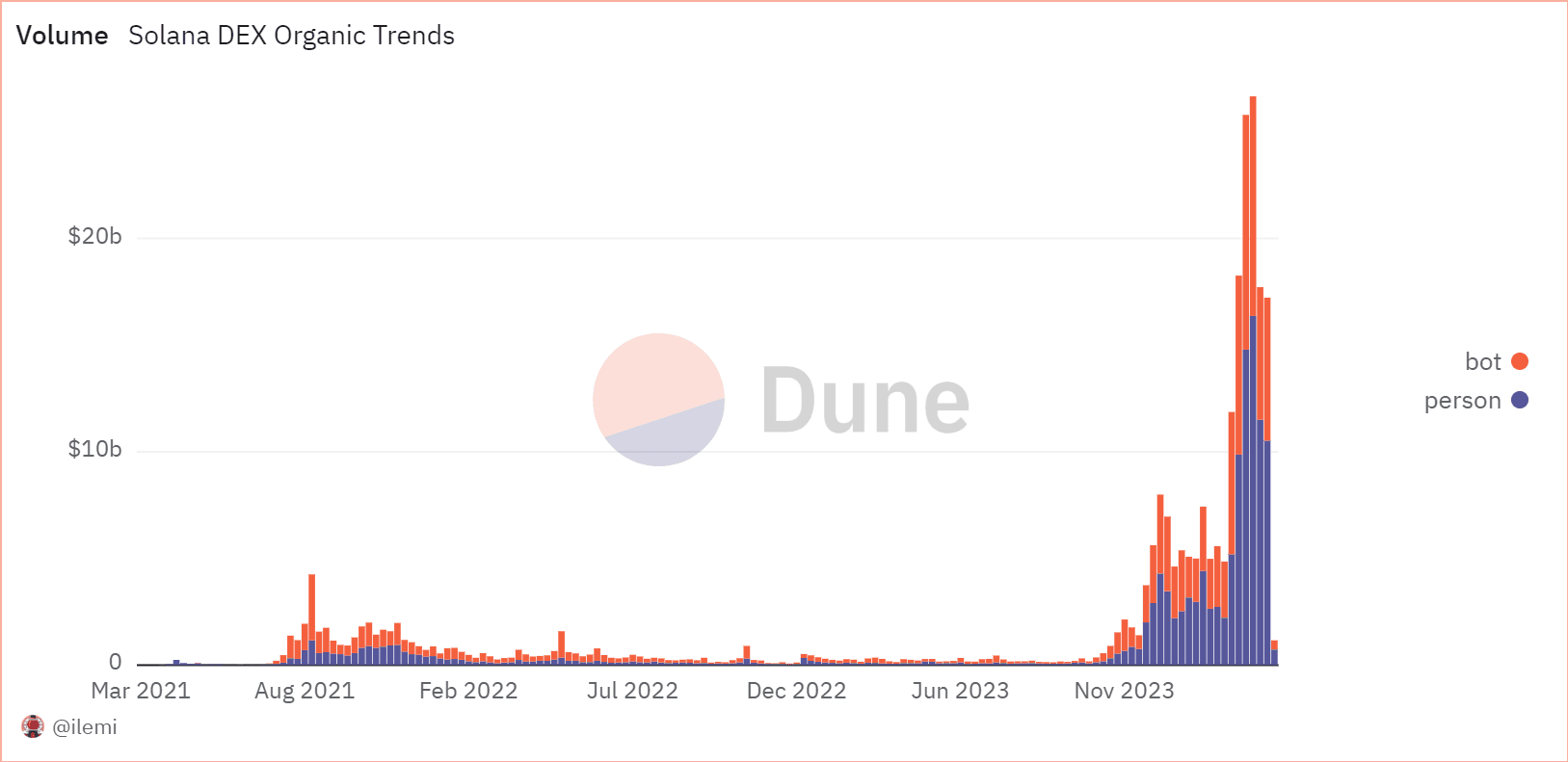

That said, the congestion appears primarily triggered by a surge in bot-driven spam transactions, exacerbated by the growing speculation surrounding meme coins, as bots usually aim to exploit arbitrage opportunities in a thriving ecosystem. In fact, bots have been playing a sizable role in catalyzing network activity, accounting for approximately 55% at the peak over the last few weeks. Notably, on March 18, during Solana's period of record-breaking decentralized exchange (DEX) trading volume of $26.7B, bot activity attributed to $10.3B of that volume, as illustrated in Figure 3.

Figure 3 – Solana’s Volume Classified into Bot vs Organic Activity

Source: Illemi on Dune

In line with this, several strategies are underway to address the networks’ current limitations. Anza, the team behind Solana's Agava client, is on the verge of releasing an update aimed at alleviating network bottlenecks and optimizing client software to handle numerous requests more efficiently. Additionally, Solana is gearing up to launch a v0.18 update, which promises enhanced transaction processing capabilities through a new feature called a "Transaction Scheduler." A module that prioritizes transactions based on factors like computational requirements, ensuring efficient execution. Finally, the adoption of Solana's priority fees, enabling users to offer additional fees for higher transaction priority, is poised to expand across various applications in the coming weeks, which could serve as an interim solution adjacent to the network’s engineering enhancements expected to roll out over the coming two weeks.

The Domino Effect of Uniswap’s Fee-Switch Proposal

Several DeFi protocols are restructuring their economic models to enhance the utility of their native tokens. For instance, Aave, the largest money market protocol with nearly $12B in assets under management (AUM), is poised to unveil a “fee-switch” proposal. Marc Zeller, the protocol’s founder, disclosed that a preliminary assessment will be released next week to gauge the community’s response to the new mechanism. If adopted, we could anticipate Aave beginning to distribute revenue to both token holders and stakers. This move would be particularly logical considering the protocol's current annualized profits of approximately $60M, as depicted in Figure 4, juxtaposed with yearly expenses of approximately $12-15M.

Figure 4 – Aave V2 Monthly Revenue across Ethereum, Polygon and Avalanche

Source: @xmc2 on Dune

As a result, this strategy could prove to be a compelling business approach to incentivize users to support the protocol while reshaping the function of governance tokens. Aave isn’t the only established DeFi protocol pursuing this path either, as Frax Finance, another blue-chip DeFi protocol, activated the “fee-switch” just last week. The newly implemented mechanism has resulted in distributing approximately $400,000 to token stakers, with projected annualized revenue sharing of around $20.8M. Overall, as we emphasized earlier in February, Uniswap’s initiative will likely serve as a pivotal catalyst inspiring numerous existing DeFi protocols to reconsider their approaches to the role of their tokens. Nevertheless, the regulatory implications of these protocols are yet to be fully understood as they could potentially appear to function in a manner akin to securities.

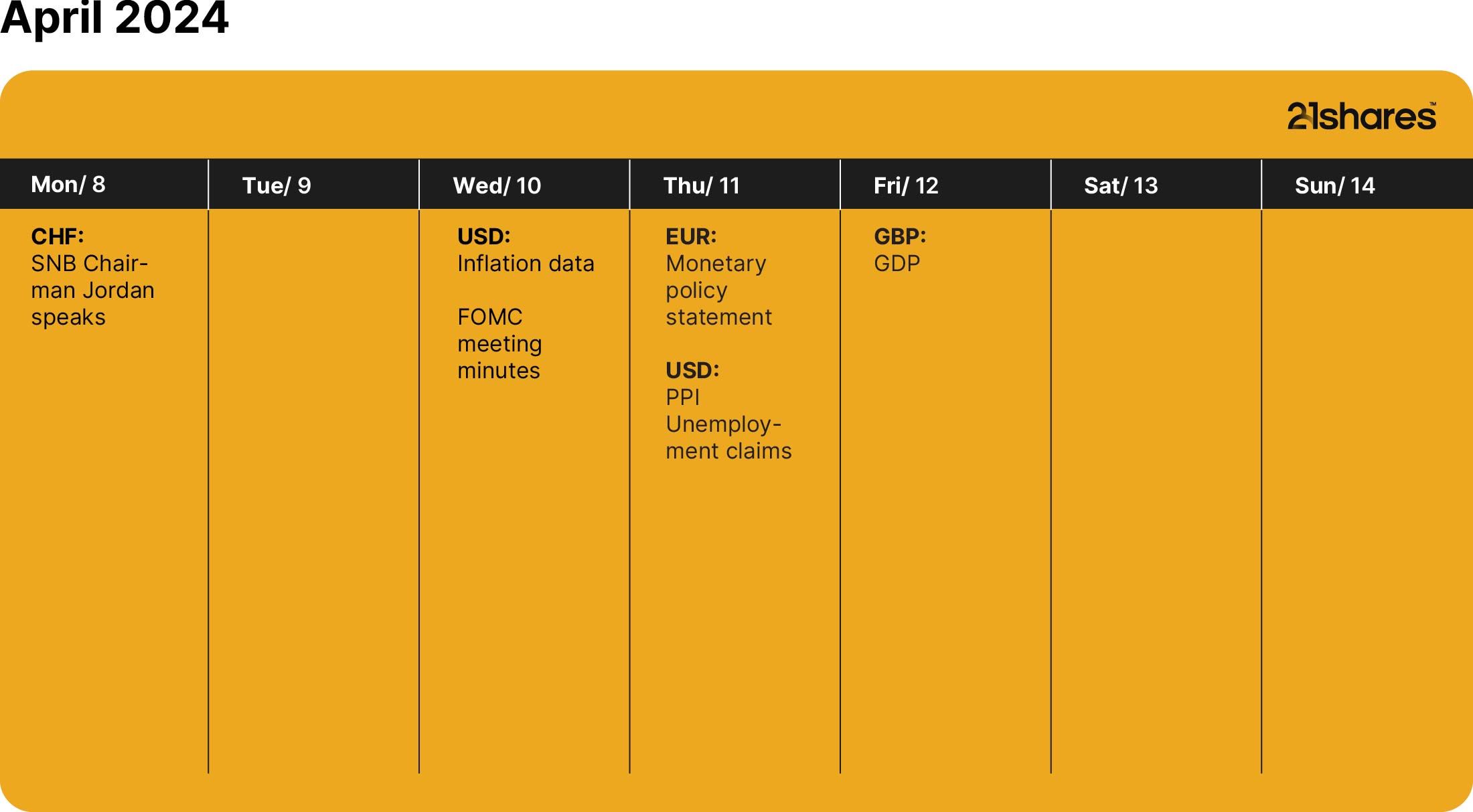

This Week’s Calendar

_logo.svg)

.svg.png)