Could Uniswap’s fee switch be DeFi’s defining signal?

Key takeaways:

- Decentralized finance (DeFi) is shifting from speculative token models to cash-flow-driven economics.

- Leading protocols now return revenue directly to token holders.

- Buyback-based tokenomics are spreading across the ecosystem.

- Uniswap is creating the strongest economic link between activity and token value.

- The shift signals DeFi’s maturation and raises the bar for token value capture.

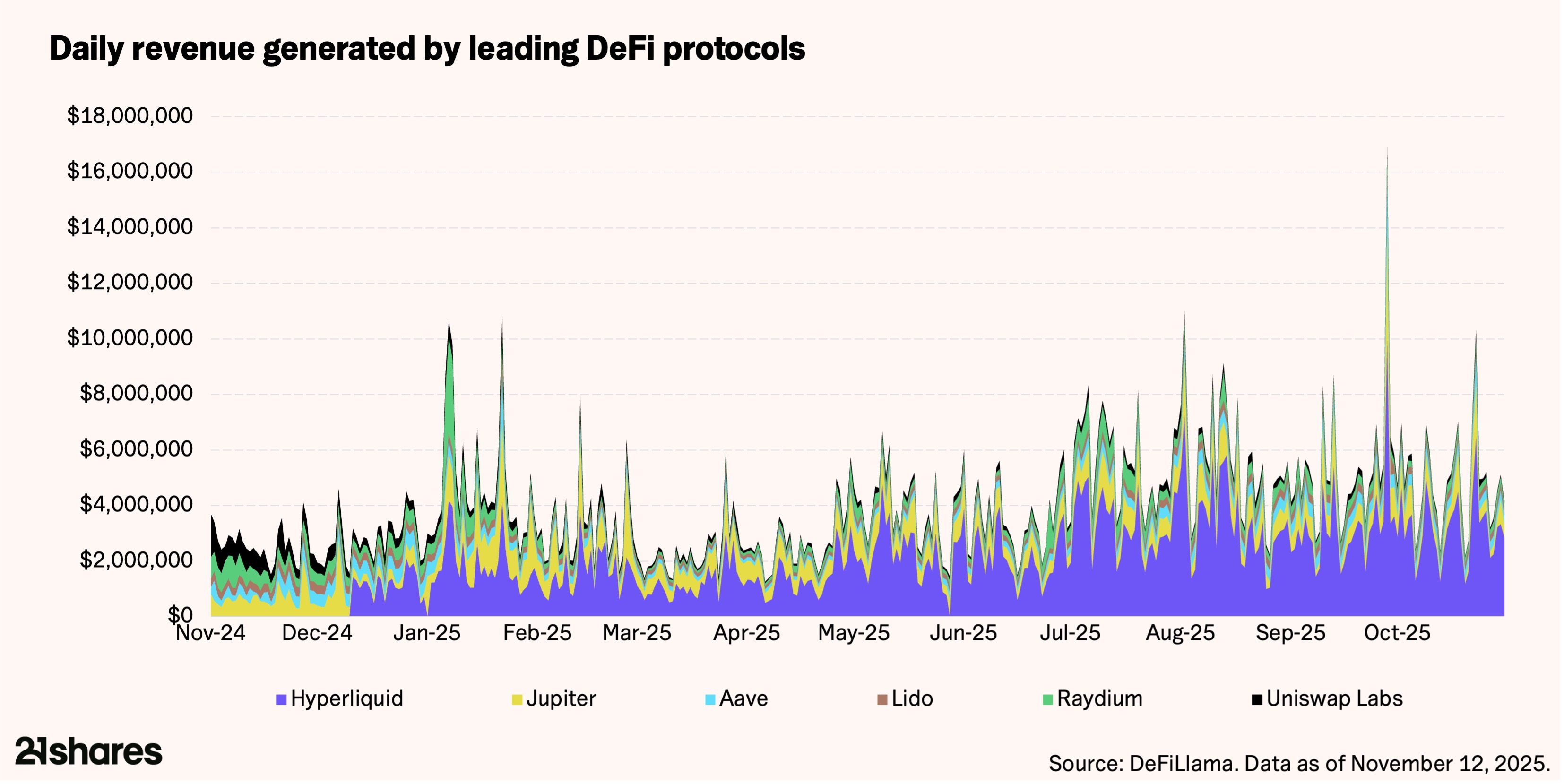

Decentralized finance is entering a new stage in its development. As predicted in our market outlook earlier this year, leading financial applications are beginning to operate less like experimental token networks and more like mature, revenue-producing businesses. Instead of depending on inflationary token emissions, vague governance promises, or speculative narratives, the new generation of DeFi tokenomics is anchored in something far more durable: cash flow.

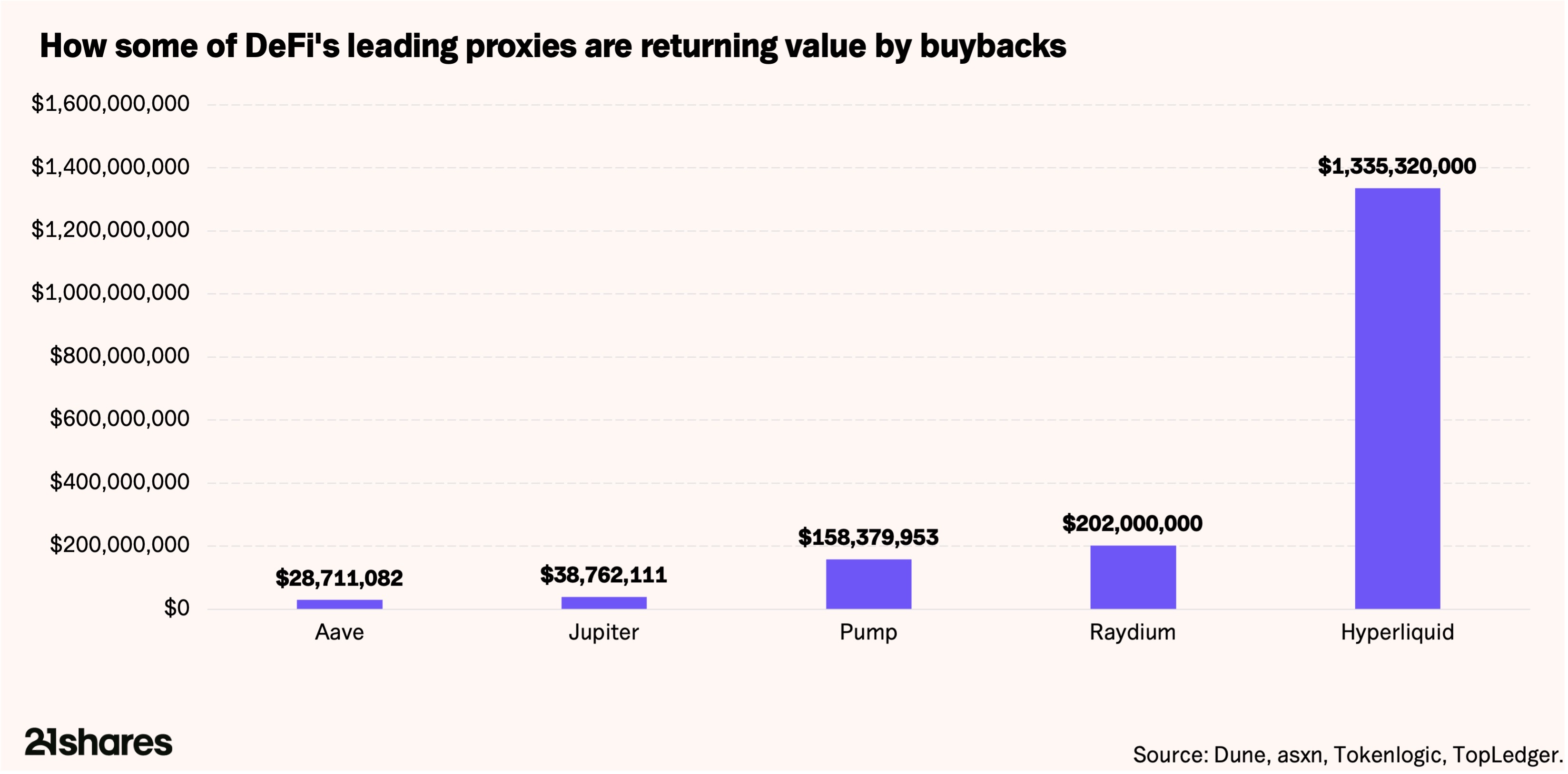

Across the ecosystem, major protocols are redirecting income back to token holders through buybacks, burns, and revenue-sharing mechanisms. This marks a structural shift toward long-term value creation and away from the short-term extraction models that dominated earlier cycles.

The new economic model: DeFi as a cash-flow engine

Historically, most DeFi governance tokens offered participation rights but little direct economic value. While protocols generated millions in trading fees, interest, or staking spreads, that revenue often stayed within treasuries or funded more ecosystem incentives. Liquidity mining accelerated adoption but diluted tokenholders relentlessly.

That paradigm is now breaking down. Today’s leading protocols are adopting economic designs that resemble corporate finance, with a focus on earnings, margins, sustainability, and capital allocation. Three mechanisms define this shift:

- Buybacks: using protocol income to purchase tokens on the open market, creating sustained demand.

- Burns: permanently removing repurchased tokens from circulation to reduce supply.

- Revenue sharing: distributing protocol earnings to stakers or lockers, giving tokens tangible yield.

This emerging framework mirrors public markets, where quantifiable cash flows form the foundation of valuation.

How protocols are implementing the shift

Over the past year, numerous projects have introduced revenue-based tokenomics:

- Aave is implementing a recurring buyback program expected to reach up to $50 million annually.1

- Lido is preparing automated LDO buybacks and a fee-based revenue share for stakers.2

- Hyperliquid directs most trading fees toward HYPE buybacks, creating one of the strongest capital-return pipelines in DeFi.3

- Maple Finance allocates 25% of loan revenue to SYRUP buybacks, replacing inflationary incentives.4

- Jupiter dedicates half of all protocol income into a trust dedicated to purchasing JUP.5

- Raydium channels 12% of fees into RAY repurchases.6

- EtherFi approved a $50 million revenue-funded buyback that activates when the token trades below a set threshold.7

While their mechanics vary, the strategic intent is consistent: generate revenue, return it to long-term holders, and align token value with protocol performance.

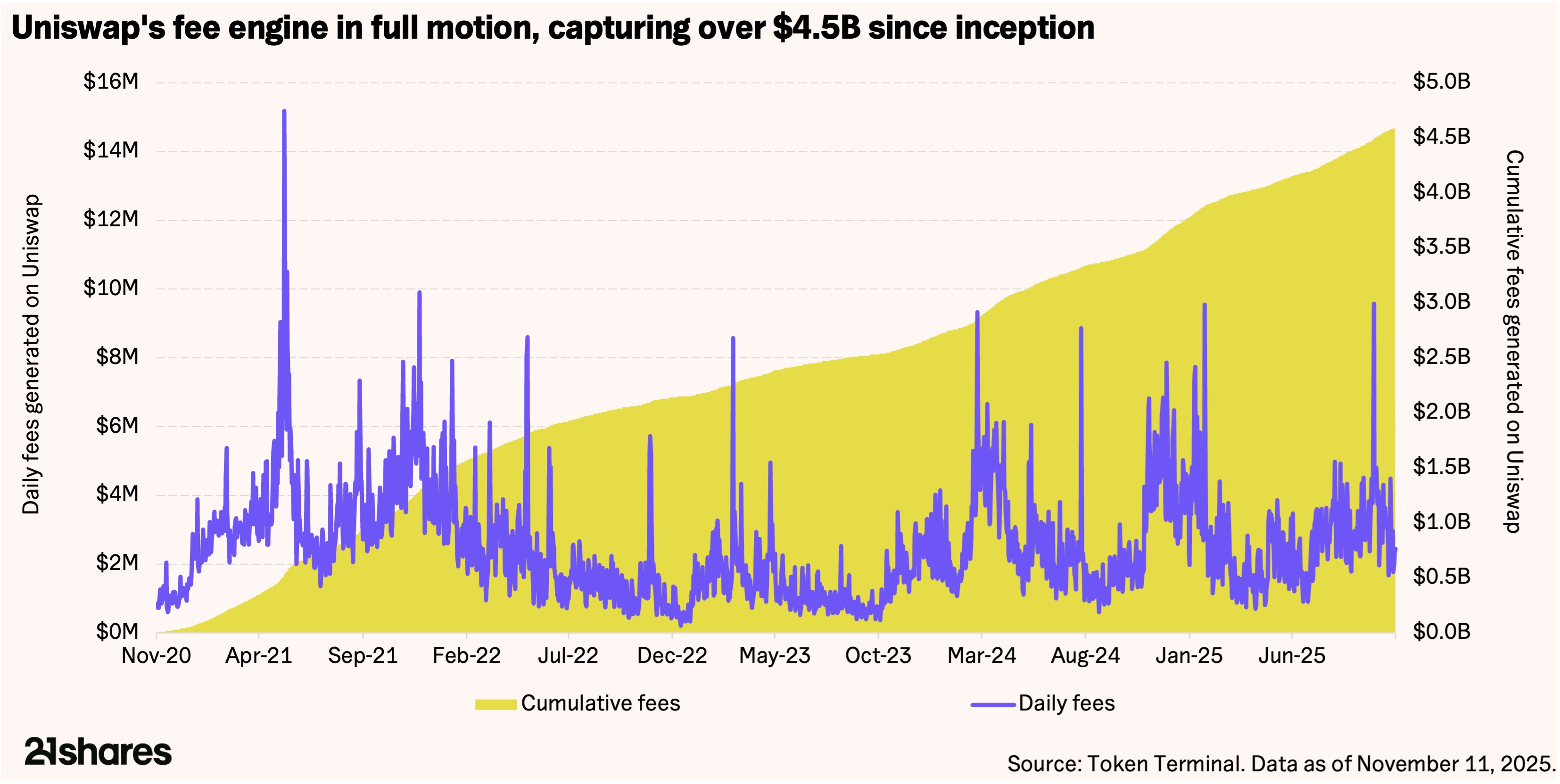

Uniswap as the core case study

No project illustrates this shift toward revenue-based tokenomics more clearly than Uniswap. For years, the UNI token was widely criticized for having no direct link to the protocol’s enormous trading volume. Uniswap generated billions in annual fees, yet UNI holders received none of it.

That may change under the proposed late-2025 UNIfication package8. Unlike earlier fee-switch attempts, this initiative comes directly from the founder, reflecting increased regulatory confidence.

UNIfication activates a long-debated fee switch, routing a portion of trading fees into buy-and-burn activity, effectively tying token value to protocol usage. The package also includes a one-time burn of 100 million UNI, a consolidation of the Uniswap Foundation and Labs, and a budget model funded by protocol revenue.

Given that Uniswap processes over $100 billion in monthly volume, even a small fee allocation could generate substantial long-term value for tokenholders. The proposal signals an important milestone for the sector: the largest decentralized exchange is embracing revenue-driven tokenomics.

Implications for tokens and protocols

This evolution reshapes how DeFi tokens are valued and understood:

- Tokens gain intrinsic yield, reducing reliance on speculation.

- Protocols are incentivized to improve revenue efficiency and capital allocation.

- Long-term holders benefit more directly than short-term liquidity farmers.

- Sustainable treasury management becomes essential.

Projects that fail to establish strong value capture risk losing liquidity, users, and governance relevance.

A sign of market maturity

The rise of cash-flow-oriented tokenomics marks a turning point for DeFi. The sector is becoming more disciplined, grounded in real economic activity, and better aligned with regulatory clarity. It also positions DeFi to appeal to institutional investors who prioritize measurable returns. Uniswap’s transition stands as a defining milestone, and a signal that many emerging protocols are likely to follow.

______

Footnotes:

- Aave Governance Forum, “ARFC: Aave Buybacks Program — An Update.”

https://governance.aave.com/t/arfc-aave-buybacks-program-an-update/23290 - Lido Finance, X (formerly Twitter), Official Announcement.

https://x.com/LidoFinance/status/1988210133130969447 - Artemis Analytics, “Hyperliquid: A Valuation Model and Bull Case.”

https://www.artemisanalytics.com/resources/hyperliquid-a-valuation-model-and-bull-case - Maple Finance Community, “MIP-019: Activate the SSF and Sunset Staking.”

https://community.maple.finance/t/mip-019-activate-the-ssf-and-sunset-staking/1042 - Boligbaronen, X (formerly Twitter), Buybacks Commentary.

https://x.com/boligbaronen/status/1883490750895423668 - Raydium Documentation, “RAY Buybacks.”

https://docs.raydium.io/raydium/protocol/the-ray-token/ray-buybacks - Ether.fi Governance, “ETHFI Buyback Program – Treasury Deployment Proposal.”

https://governance.ether.fi/t/ether-fi-dao-proposal-treasury-deployment-for-ethfi-buy-back-program/3178

- Uniswap Labs Blog, “Unification.”

https://blog.uniswap.org/unification

This report has been prepared and issued by 21Shares AG for publication globally. All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however, we do not guarantee the accuracy or completeness of this report. Crypto asset trading involves a high degree of risk. The crypto asset market is new to many and unproven and may have the potential not to grow as expected.Currently, there is relatively small use of crypto assets in the retail and commercial marketplace in comparison to relatively large use by speculators, thus contributing to price volatility that could adversely affect an investment in crypto assets. In order to participate in the trading of crypto assets, you should be capable of evaluating the merits and risks of the investment and be able to bear the economic risk of losing your entire investment.Nothing herein does or should be considered as an offer to buy or sell or solicitation to buy or invest in crypto assets or derivatives. This report is provided for information and research purposes only and should not be construed or presented as an offer or solicitation for any investment. The information provided does not constitute a prospectus or any offering and does not contain or constitute an offer to sell or solicit an offer to invest in any jurisdiction. The crypto assets or derivatives and/or any services contained or referred to herein may not be suitable for you and it is recommended that you consult an independent advisor. Nothing herein constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal recommendation. Neither 21Shares AG nor any of its affiliates accept liability for loss arising from the use of the material presented or discussed herein.Readers are cautioned that any forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors.This report may contain or refer to material that is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would subject 21Shares AG or any of its affiliates to any registration, affiliation, approval or licensing requirement within such jurisdiction.