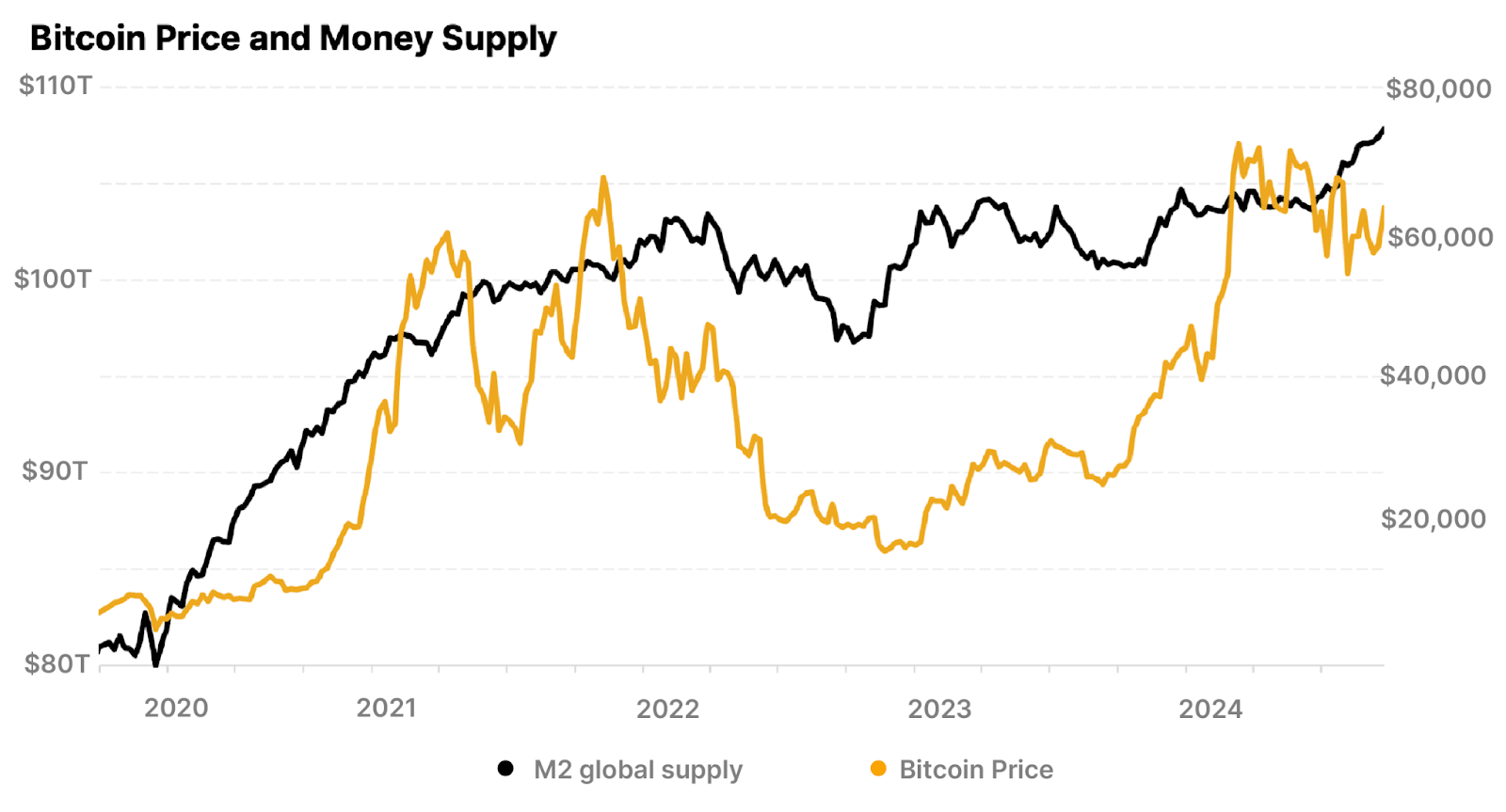

Will liquidity continue driving Bitcoin’s price?

Historically, Bitcoin’s price has exhibited a strong correlation with global liquidity, particularly the M2 money supply. Data from May 2013 to July 2024 indicates a correlation of 0.94 between Bitcoin’s price and M2, underscoring this relationship.

Currently, we are witnessing an expansion in the M2 money supply, which traditionally bodes well for Bitcoin. Where M2 goes next is not clear. Inflation concerns persist, with the Federal Reserve’s preferred inflation gauge, the Personal Consumption Expenditures (PCE) index, rising by 0.3% in February, with annual inflation at 2.9%. However, the unemployment rate rose to 4.1% in February (above expectations at 4%), and job growth was weaker than expected as the Trump administration began to slash the federal workforce. While these mixed signals paint a cloudy path for rate cuts in the coming year, some clarity is anticipated during the FOMC press conference on March 19.

On top of this, consumer confidence in the U.S. has dropped to an eight-month low, driven by concerns over tariffs and global geopolitical uncertainties. Historically, tariffs have driven up prices, triggering interest rate hikes to curb inflation, which in turn tends to reduce available liquidity in financial systems. This dynamic could influence Bitcoin’s price trajectory.

The question persists: Will Bitcoin continue to track global liquidity, or will increasing global adoption lead to a decoupling?

Reasons for Continued Correlation:

- Bitcoin’s Perception: During periods of uncertainty, investors tend to pull capital from risk-on assets. Since many still view Bitcoin in this category, its price remains highly sensitive to global liquidity fluctuations.

- Adoption Levels: Despite growth, Bitcoin’s adoption may not yet be sufficient to insulate it from broader liquidity trends.

Reasons for Potential Decoupling:

- Geographical Distribution: Bitcoin’s widespread global ownership could mitigate the impact of localized liquidity shifts.

- Strategic Reserves: Increased demand could counteract liquidity-driven selling pressures if institutions and nations begin holding Bitcoin as a reserve asset. Here’s what you need to know about the strategic crypto reserve in the U.S..

In conclusion, while Bitcoin’s price has historically tracked global liquidity, evolving perceptions of Bitcoin as an emerging store of value, as well as its widespread global ownership, could influence its future correlation with money supply trends.

.jpg)