Crypto Market's Wild Q2: Boom, Crash, and Recovery

.jpg)

Market Outlook

The second quarter of this year is already upon us. It was impacted by a rollercoaster of emotions from a market sentiment standpoint as Q2 contained a series of unforeseeable and paradigm-shifting events.

On April 14th, Bitcoin nearly crossed the $65K mark at the peak of the speculative mania mainly driven by spot and leveraged trading emanating from experienced investors, financial institutions, and newcomers in the retail cohort. The open interest of Bitcoin futures is a quintessential indicator to gauge the demand for leveraged trading as the futures market dominates the spot market in trading volume. In that respect, both markets processed astronomical dollar amounts by recording all-time highs this past quarter. By the end of May, futures exchanges had a 31% month-over-month (MoM) growth rate settling $2.56 trillion in volume, while spot crypto exchanges handled $2.31 trillion and experienced MoM growth of 39% in the same month.

Spot buying soared at a phenomenal pace ~156% YTD by the end of May. Conversely, last year, from January to May 2020, the rate was only ~ 54 %. but this year the crypto boom was caused by four phenomena:

- The continued institutional adoption of bitcoin, for example, Tesla bought $1.5 billion worth of bitcoin, and JP Morgan launched an actively managed product for their clients

- The long-awaited public listing of Coinbase, the leading US crypto exchange in April, undoubtedly created a new wealth for investors and employees that could potentially have flowed back into the crypto market

- The rise of meme cryptoassets such as Dogecoin (1-year return of 5,361.6%) principally fueled by Elon Musk

- The growing recognition of decentralization due to the GameStop saga. Ethereum (166.87% YTD return) and the long tail of DeFi projects and NFTs noticeably benefited from this movement.

As covered in our previous investor letters, the crackdown on bitcoin and trading in China drove the most significant market crash in Bitcoin’s history leading speculation to wane across the board and Chinese miners to go offline to move out. The daily futures open interest has declined by more than 55%, and since the May sell-off has remained bound between $10.7 billion and $13.0 billion. The price of Bitcoin wasn’t spared and has plummeted by more than 40% from its all-time high. The cryptoasset finished Q2 with the worst quarterly performance of -38.8% amongst the top 5 cryptoassets by market capitalization.

On the more positive side and in alignment with our thesis, we believe that fundamentals are improving since late May. Capital International, one of the world's oldest investment firms with +$2trillion in AUM, purchased over a 10% stake in MicroStrategy. The latter is the largest corporate bitcoin holder, which earlier this year announced that its boards of directors will be paid in Bitcoin instead of cash for their service — becoming the first publicly traded company to do so.

Despite the fact that the Bitcoin market will likely remain quiet in the foreseeable future, miners are starting to get back online as the hash rate has started to pick up again from its dip. At 21Shares, we are closely monitoring how the future will pan out with data-driven analysis using fundamental metrics like hash rate that are indispensable tools to witness the evolution of the crypto market especially in bear markets.

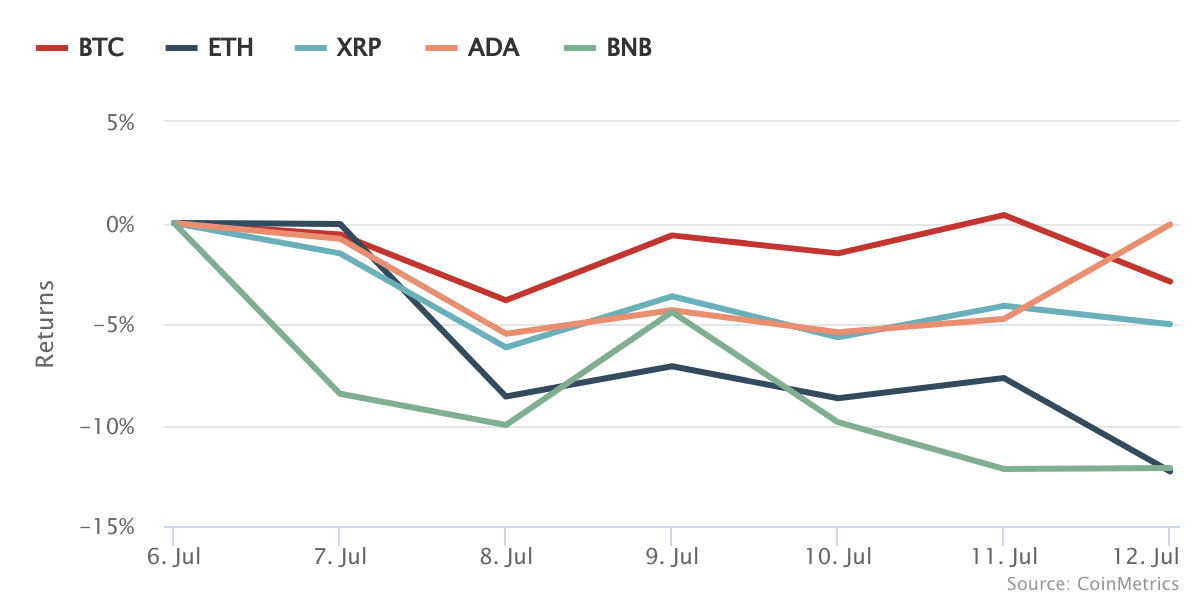

Weekly Returns

The returns of the top six crypto assets over the last week were as follows — BTC (-2.98%), ETH (12.29%), BNB (-12.12%), XRP (-5.01%), and ADA (-7.07%).

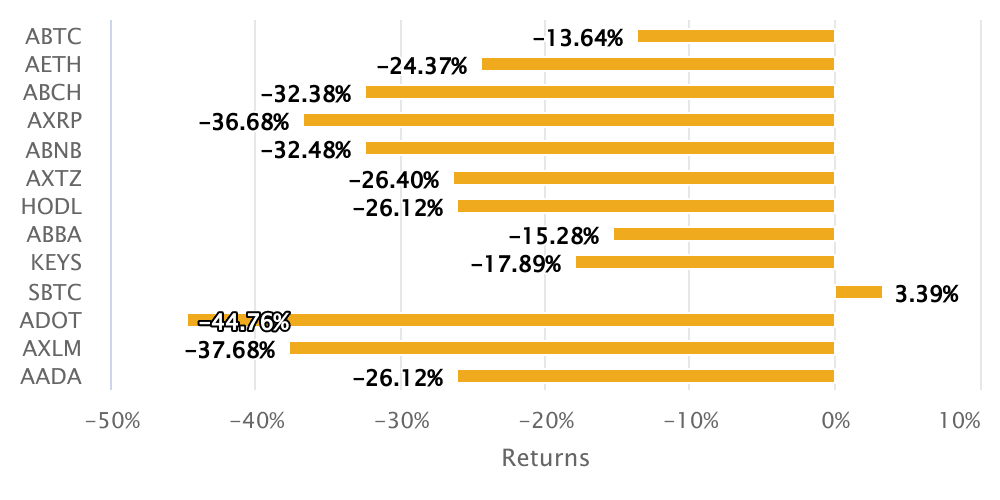

Monthly ETP Returns

The performance of our line of ETPs over the last 30 days is as follows: ABTC (-13.64%), AETH (-24.37%), ABCH (-32.38%), AXRP (-36.68%), ABNB (-32.48%), AXTZ (-26.40%), HODL (-26.12%), ABBA (-15.28%), KEYS (-17.89%), SBTC (3.39%), ADOT (-44.76%), AXLM (-37.68%), AADA (-26.12%).

Media Coverage

Trackinsight published their newest article "Is Bitcoin an ESG investment?" wherein featured the views of our Managing Director, Laurent Kssis, and our Research Lead, Eliézer Ndinga. Give it a read here.

“The recent restrictions of mining activities in China have accelerated the paradigm shift of bitcoin mining to North America and to a lesser extent to Western Europe going forward as we predicted a year ago. For example, the American company Square has pledged to support this type of initiative starting with $10 million. In the same vein, Elon Musk and Michael Saylor of MicroStrategy, held a private meeting with miners based in North America to form a council to disclose energy usage in a standardized manner and promote the use of renewable energy in the world. As anticipated 21Shares in our 2021 predictions, we also expect more initiatives to employ Bitcoin mining using renewable energy sources.” — Eliézer Ndinga

“*Bitcoin provides an option [to the unbanked] because it provides an alternative financial asset and monetary system accessible to anyone with an Internet connection. Hence the Bitcoin network doesn’t impose any kind of discrimination.*” — Laurent Kssis

The leading crypto-related journal, CoinDesk mentioned our previous investor letter from last week in their Market Wrap titled "Ether Outperforms Bitcoin as Crypto Sentiment Improves". Read the full article here.

Our Head of Southern Europe, Massimo Siano appeared in ETF World to present our new members in the Italian team — Chiara El Rikabi and Alessandro Mondio. Give it a read here.

ExtraETF published "Investing in Bitcoin is easy with 21Shares". Read the full article here.

Our CEO, Hany Rashwan, was invited to the Bank On It podcast hosted by John Siracusa. This episode is available here.

News - Binance: Watchdog Clamps Down on Cryptocurrency Exchange

What happened?

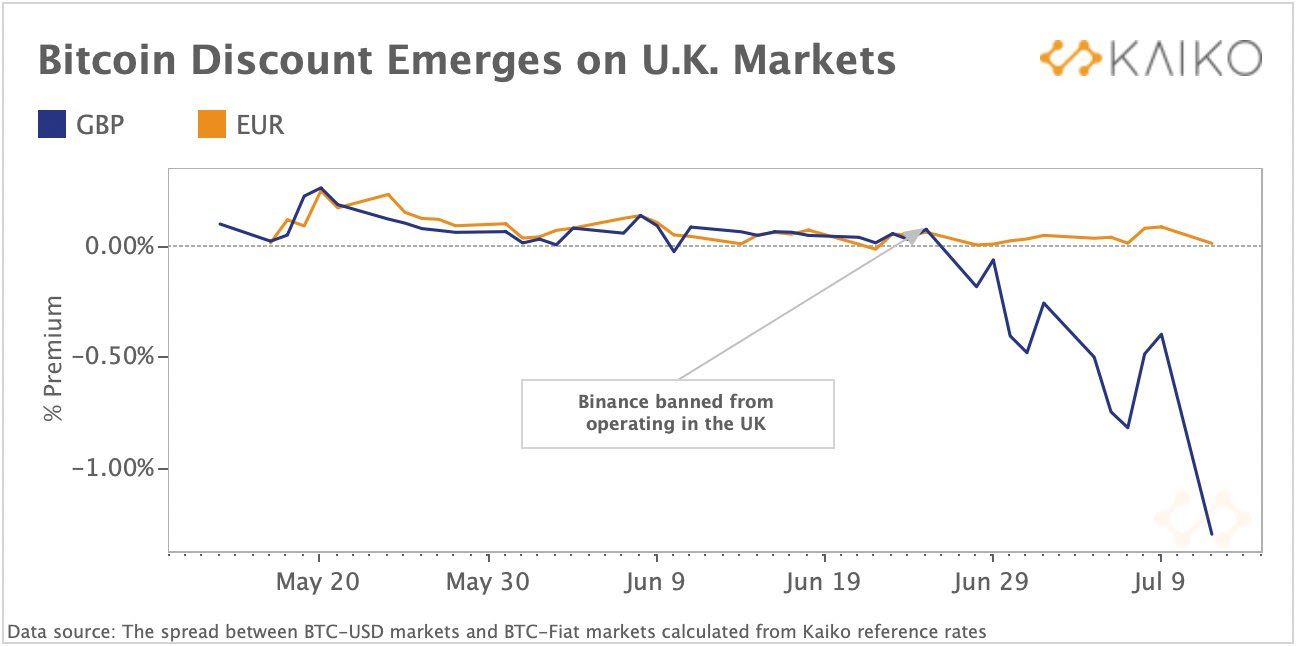

Binance is facing a renewed wave of clampdowns in the United Kingdom, Japan, and the Canadian province of Ontario. Within the UK, the financial conduct authority has issued a verdict asserting that Binance Markets Limited – the British division of the exchange – is banned from carrying out any regulated activities within the nation. Customers can still participate in spot trading cryptocurrencies through the Cayman-islands-based parent company; Binance.com. However, trading in the derivatives market – owing to it being a regulated financial sector in the country – must be halted, as per the FCA’s notice. The move was correspondingly complemented with Barclay’s ban on transferring clients’ funds to the exchange, joined with ClearJunction’s decision to halt processing transactions for the platform.

Japan’s financial service agency, on the other hand, delivered its second warning to the exchange. Within three years, the agency accused them of falsely operating in the country without proper registration. The ruling materialized following Japan’s move to produce specific guidelines and regulations for crypto businesses back in 2018. In Canada, Binance took a preemptive decision to halt its operations within the province following Ontario’s Securities Exchanges commission push against several other exchanges towards regulatory compliance via registration. The Cayman Islands monetary authority took a similar stance claiming Binance is not authorized to ‘run the exchange from the country’. Similarly, Thailand filed a criminal complaint against the exchange for its unlicensed operations.

Why does it matter?

Considering how Binance owns about 20% share of the crypto market, it’s a reasonable concern to consider the extent to which the potential disruption to their operations could affect the market. May that be, Binance is not a stranger to the legal scrutiny as it has taken measures to combat money-laundering, implementing better protections for consumers, and carrying out proper registration and licensing across the different jurisdictions it services around the globe. Binance has already instigated a hiring spree aimed at bolstering their compliance efforts by chartering the services of Jonathon Farnell – ex-director of compliance at eToro trading platform and someone with immense experience in regulated financial products – to act as the Europe-based director of compliance. He was also joined with Manuel Alvarez – former California department of financial protection and innovation head – taking on the chief administrative officer position of Binance.US arm shortly after.

Earlier in 2021, Binance had commissioned Rick McDonell – previous executive secretary of the financial action task force (global money laundering and terrorism financing watchdog) – as well as Josee Nadeau – preceding head of Canadian delegation to the FATF – for providing regulatory guidance and fortifying the exchange’s AML/CFT programs. Thus, the moves taken by Binance demonstrate the exchange’s determination towards consolidating its compliance efforts and adapting to the changing regulatory landscape. An inadvertent consequence of this legal tension could be clearing the way for the more compliant platforms like Kraken, Coinbase, and Bittrex. In such a case, competition could fill in the shoes of Binance and potentially eat up a portion of its market share.

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

.jpg)

_logo.svg)

.svg.png)