Solana defies September trends, surging ahead of peers

The “September Effect” has long haunted investors, with the S&P 500 averaging -0.7% in the month over the past 20 years. Bitcoin has largely mirrored this trend, mainly posting negative returns in September since 2013, though this year it has remained resilient.

Solana, however, is rewriting the playbook. Outperforming many other cryptocurrencies, it’s surging, reclaiming its leadership among major altcoins, and turning September’s typical slump into a springboard for momentum as the market gears up for ‘Uptober,’ the historically bullish trend observed in October.

Solana is on the rise

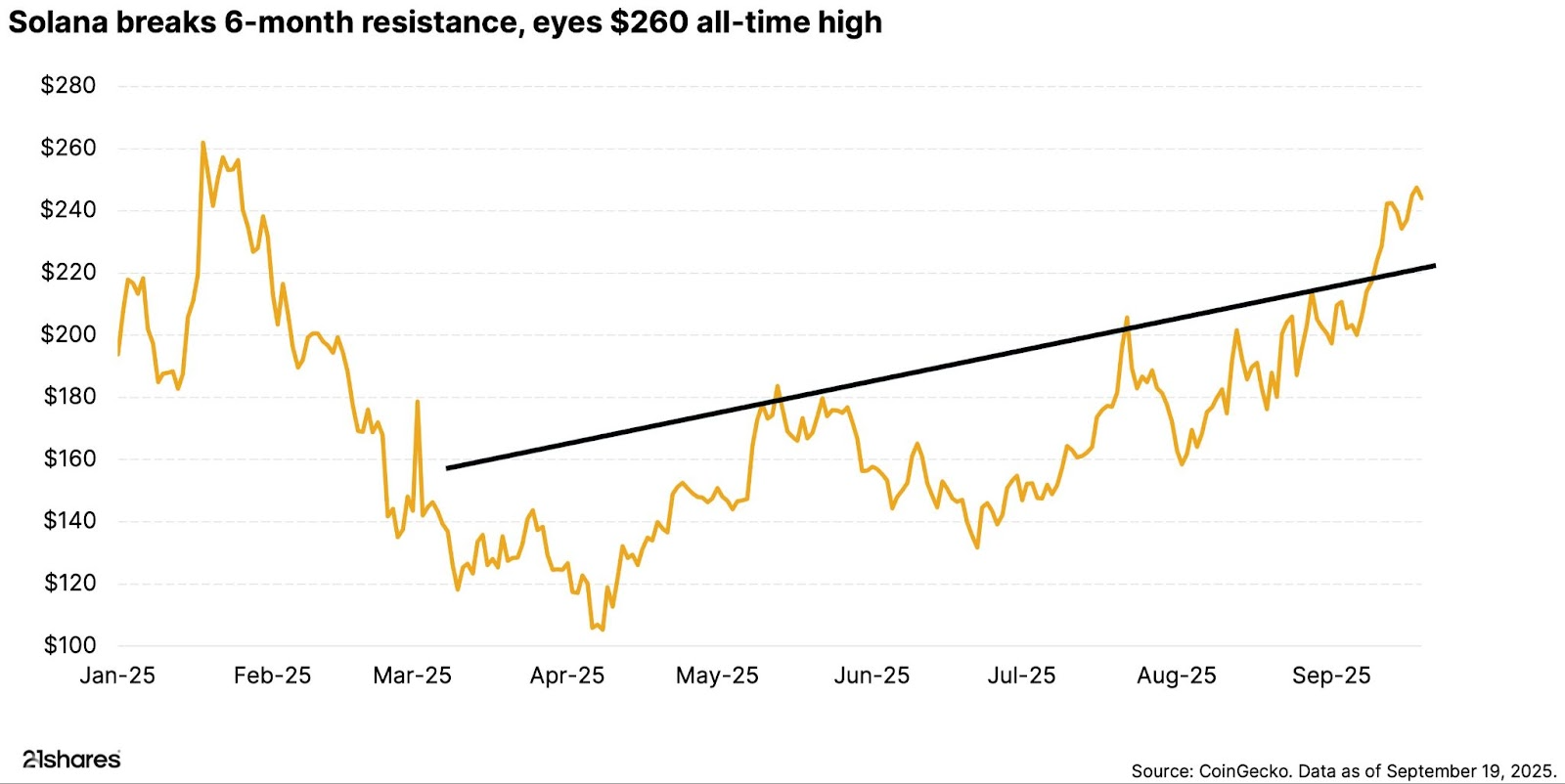

After clearing a six-month resistance and establishing $200 as a potential support, native token SOL now trades just below its $260 all-time high, a level that stands not only as the next resistance level, but also as the final barrier before entering a phase of price discovery.

Moreover, last week’s widely expected 0.25% rate cut likely kicked off a new easing cycle. Traders had priced it in, and while Powell’s comments briefly cooled risk appetite, the dovish tone ultimately kept markets supported.

Solana’s relative strength tells an even sharper story: the SOL/ETH ratio bottomed in August and has since moved higher, signaling a clear rotation as, for the first time since April, Solana is outperforming Ethereum. Positioning backs this trend as well; open interest in SOL perpetuals has climbed to year-to-date highs, while funding stays neutral. That combination points to conviction-driven flows rather than speculative excess.

What’s driving Solana?

What sets this move apart is the depth and diversity of the underlying catalysts powering it:

1. Treasury flows: Solana is attracting unprecedented institutional capital. Forward Industries has already staked 6.8M SOL ($1.58B) and is pursuing a $4B equity raise, potentially scaling its holdings to 4.3% of the total supply. Pantera Capital is following with a planned $1.25B raise to launch a dedicated Solana treasury. Adding momentum, Brera Holdings rebranded as Solmate after a $300M oversubscribed deal backed by Pulsar Group, ARK Invest, RockawayX, and the Solana Foundation. Together, these initiatives represent billions in committed buy pressure, with more capital ready to enter.

2. ETF verdict: The first US spot Solana ETF faces a final SEC ruling on October 10, 2025. Bloomberg analysts assign a 95% approval probability, and with comparable European ETPs performing strongly, approval could open the door to broad institutional and retail participation.

3. Onchain momentum: Solana’s ecosystem is expanding in tangible ways. Total value locked (TVL) stands at $13B, stablecoins onchain have surged 6x YoY to $12B, and tokenized assets surpassed $500M, drawing traditional finance onto Solana’s high-throughput rails.

4. Firedancer and Alpenglow on track: Innovation continues to accelerate. Jump Crypto’s Firedancer validator client targets over 1M+ transactions per second (TPS) with a late-2025 mainnet launch. Meanwhile, the Alpenglow upgrade passed with 98.9% approval, setting the stage for 150 milliseconds finality by early 2026.

Conclusion

With BTC and ETH anchoring the market, Solana is stepping into the spotlight. Strong institutional treasury flows, the potential approval of a spot ETF, rising on-chain activity, and significant protocol upgrades are aligning, positioning SOL not only as a leading altcoin but also as a key indicator for the broader crypto market rally.

This report has been prepared and issued by 21Shares AG for publication globally. All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however, we do not guarantee the accuracy or completeness of this report. Crypto asset trading involves a high degree of risk. The crypto asset market is new to many and unproven and may have the potential not to grow as expected.Currently, there is relatively small use of crypto assets in the retail and commercial marketplace in comparison to relatively large use by speculators, thus contributing to price volatility that could adversely affect an investment in crypto assets. In order to participate in the trading of crypto assets, you should be capable of evaluating the merits and risks of the investment and be able to bear the economic risk of losing your entire investment.Nothing herein does or should be considered as an offer to buy or sell or solicitation to buy or invest in crypto assets or derivatives. This report is provided for information and research purposes only and should not be construed or presented as an offer or solicitation for any investment. The information provided does not constitute a prospectus or any offering and does not contain or constitute an offer to sell or solicit an offer to invest in any jurisdiction. The crypto assets or derivatives and/or any services contained or referred to herein may not be suitable for you and it is recommended that you consult an independent advisor. Nothing herein constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal recommendation. Neither 21Shares AG nor any of its affiliates accept liability for loss arising from the use of the material presented or discussed herein.Readers are cautioned that any forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors.This report may contain or refer to material that is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would subject 21Shares AG or any of its affiliates to any registration, affiliation, approval or licensing requirement within such jurisdiction.