Why is Bitcoin becoming an asset on corporate balance sheets?

Corporate Bitcoin accumulation is quickly evolving from a bold bet into a mainstream financial strategy. Bitcoin (BTC) is not just for HODLing (a buy-and-hold strategy), and is now being treated as a productive and collateral-ready asset on corporate balance sheets.

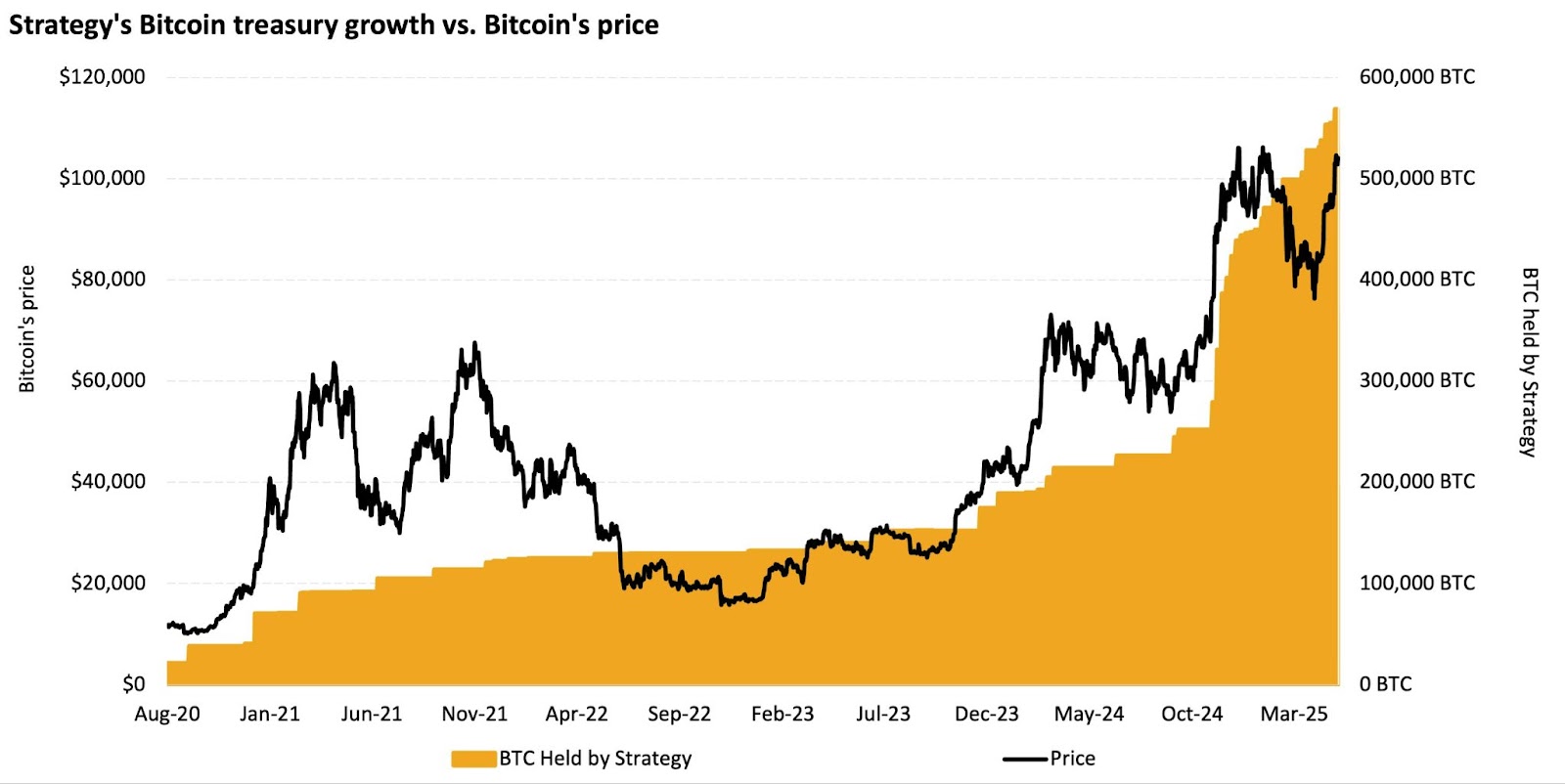

Last week, we explored how the Bitcoin accumulation trend took off with Michael Saylor’s Strategy and is now gaining momentum with companies like GameStop and MetaPlanet. Most recently, Twenty One Capital entered the arena with a $458 million Bitcoin purchase. The momentum continues, as Strategy recently increased its holdings to a staggering 568,840 BTC, accounting for 2.7% of Bitcoin’s total supply and valued at nearly $60 billion.

While the scale of these acquisitions is striking, the real story lies in how Strategy has led a new kind of corporate financial architecture around Bitcoin.

Source: 21Shares, Bitcointreasuries. Data as of May 9, 2025

Corporate finance goes Bitcoin-native

During its Q1 2025 earnings call, Strategy didn’t just report continued Bitcoin accumulation; it unveiled a strategic roadmap that could serve as a blueprint for a Bitcoin-native corporate finance model with the potential to reshape capital markets.

Despite reporting a year-over-year decline in traditional earnings, a reflection of broader macroeconomic headwinds, Strategy’s Q1 2025 update underscored its unwavering commitment to Bitcoin. In the first four months of the year alone, the company raised $10 billion in capital to fuel its acquisition strategy:

- $6.6 billion via At-the-Market (ATM) equity

- $2.0 billion through convertible notes

- $1.4 billion in preferred equity

To support its long-term Bitcoin strategy, Strategy announced the “42/42 Plan,” which aims to raise $42 billion in equity and $42 billion in fixed-income capital by the end of 2027.

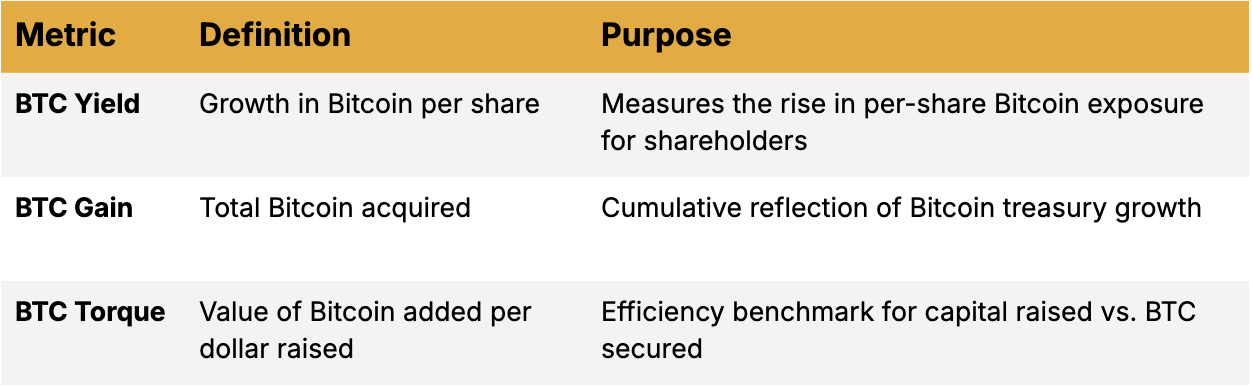

The structured roadmap is designed not only to fuel Strategy’s own Bitcoin acquisition but also to potentially serve as a replicable playbook for other corporations considering similar treasury policies. Critically, Strategy evaluates performance not with traditional key performance indicators like EPS (earnings per share) or EBITDA (earnings before interest, taxes, depreciation, and amortisation), but through a Bitcoin-native financial lens, guided by three proprietary metrics:

For 2025, Strategy has raised its internal targets:

- BTC Yield: 25% (up from 15%)

- BTC Gain: $15 billion (up from $10 billion)

These targets reinforce Strategy's commitment to maximizing Bitcoin-adjusted shareholder value despite recent macroeconomic volatility. As more corporations look to replicate this model, Strategy stands at the forefront of a new financial era.

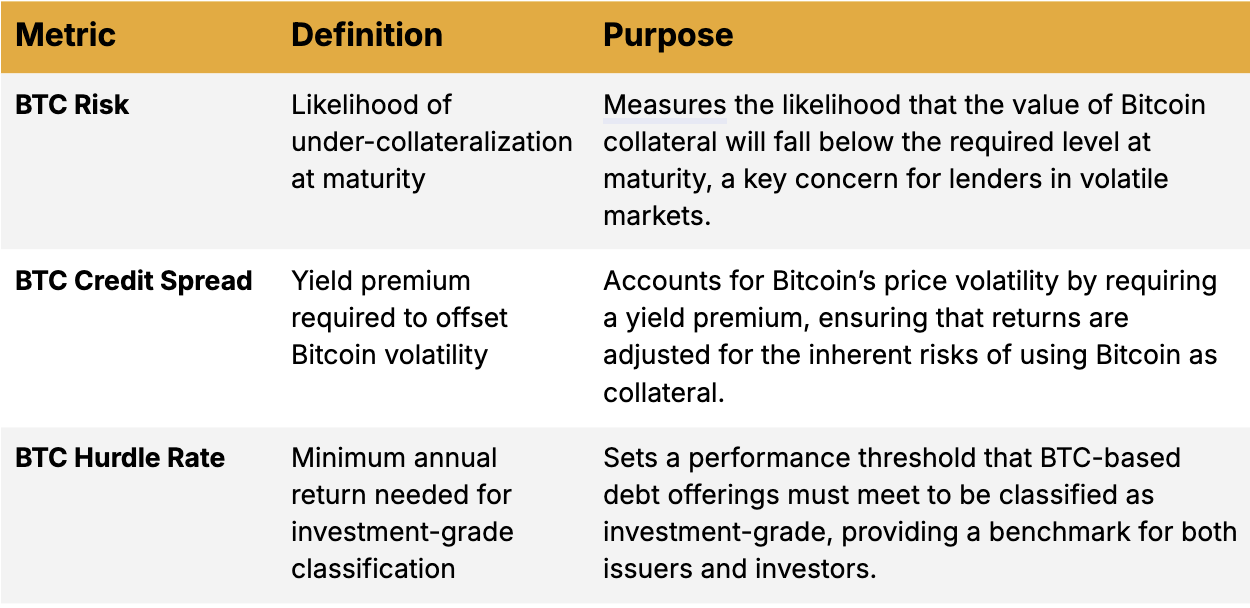

Redefining corporate credit markets with Bitcoin as collateral

Perhaps the most transformative pillar of Strategy’s framework is its initiative to use Bitcoin as collateral in corporate credit markets. Alongside its capital-raising efforts, the company introduced a dedicated structure for BTC-backed financial instruments, tailored to address Bitcoin’s unique risk profile:

With its convertible notes and preferred equity significantly overcollateralized by Bitcoin, Strategy is actively urging credit rating agencies to adopt a framework to potentially recognize BTC as a high-grade reserve asset.

If successful, this could lay the foundation for a Bitcoin-backed bond market, where companies issue debt secured by their BTC holdings. It would also allow institutions to tap into a new, collateralized digital asset class. Strategy’s approach is leading the way, laying the foundation for a future where Bitcoin-based finance could become standard, not just an experiment.

This report has been prepared and issued by 21Shares AG for publication globally. All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however, we do not guarantee the accuracy or completeness of this report. Crypto asset trading involves a high degree of risk. The crypto asset market is new to many and unproven and may have the potential not to grow as expected.Currently, there is relatively small use of crypto assets in the retail and commercial marketplace in comparison to relatively large use by speculators, thus contributing to price volatility that could adversely affect an investment in crypto assets. In order to participate in the trading of crypto assets, you should be capable of evaluating the merits and risks of the investment and be able to bear the economic risk of losing your entire investment.Nothing herein does or should be considered as an offer to buy or sell or solicitation to buy or invest in crypto assets or derivatives. This report is provided for information and research purposes only and should not be construed or presented as an offer or solicitation for any investment. The information provided does not constitute a prospectus or any offering and does not contain or constitute an offer to sell or solicit an offer to invest in any jurisdiction. The crypto assets or derivatives and/or any services contained or referred to herein may not be suitable for you and it is recommended that you consult an independent advisor. Nothing herein constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal recommendation. Neither 21Shares AG nor any of its affiliates accept liability for loss arising from the use of the material presented or discussed herein.Readers are cautioned that any forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors.This report may contain or refer to material that is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would subject 21Shares AG or any of its affiliates to any registration, affiliation, approval or licensing requirement within such jurisdiction.

.png)