Apple wants to enter Circle’s orbit. Why are stablecoins the tech world’s new darling?

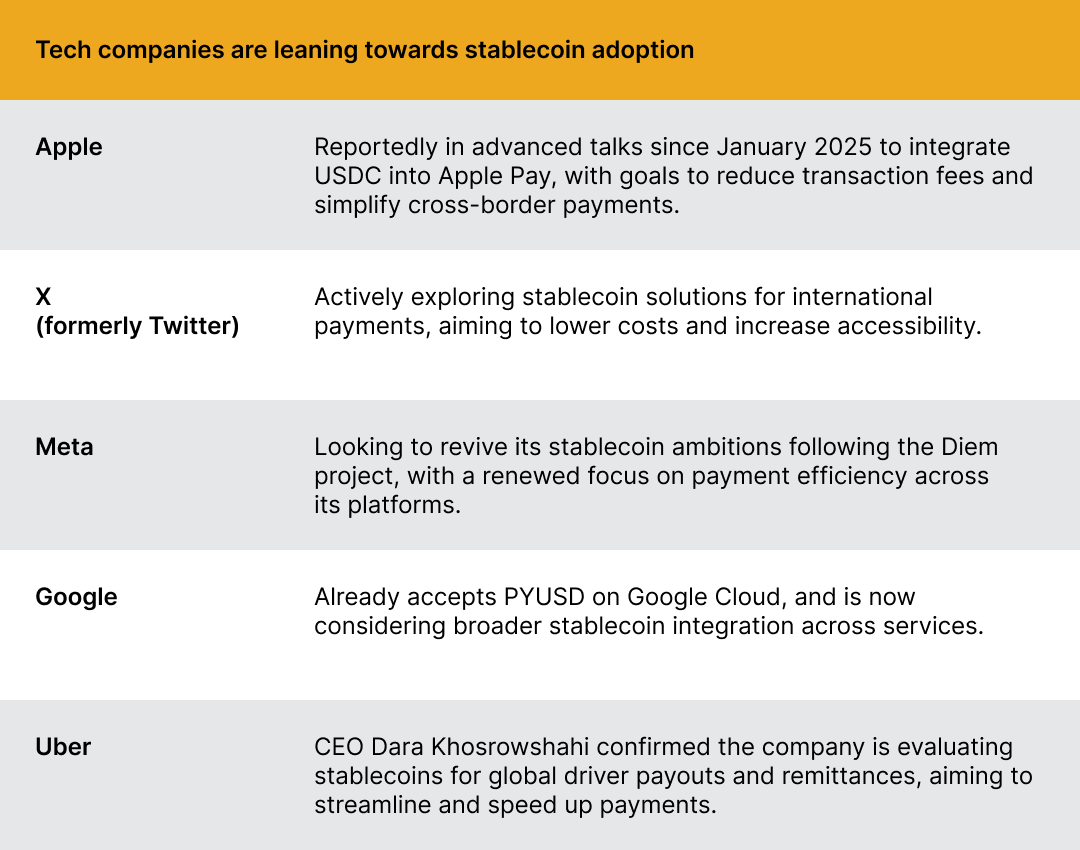

Stablecoin issuer Circle made a blockbuster debut on the New York Stock Exchange earlier this month. Now, tech giants like Apple, Meta, Google, and others are reportedly eyeing potential stablecoin integrations, a move that signals yet another powerful step in bridging digital assets with everyday technology.

Known for issuing the widely used stablecoin USDC, Circle already plays a vital role in blockchain transactions and fintech ecosystems. Last month in our newsletter, we highlighted how stablecoins are powering payment leaders like Mastercard and PayPal.

Now, with big tech exploring stablecoin adoption, it signifies a pivotal shift toward the convergence of traditional finance, crypto innovation, and big tech infrastructure.

Stablecoins are reshaping tech and finance, and investors should pay attention

Stablecoins are a type of cryptocurrency that is designed to maintain a consistent value, typically against an asset like the US dollar or a precious metal such as gold, and serve as a reliable and convenient medium of exchange. They have evolved to become an essential part of financial infrastructure, driving cost-effective cross-border payments, remittances, and global commerce.

As the chart below shows, organizations are primarily exploring stablecoins to drive revenue and access new markets, while also benefiting from transactional efficiencies. This indicates a strategic and proactive approach to adoption, focused on capturing market share, revenue, and customer satisfaction rather than simply reacting to competitors or regulations.

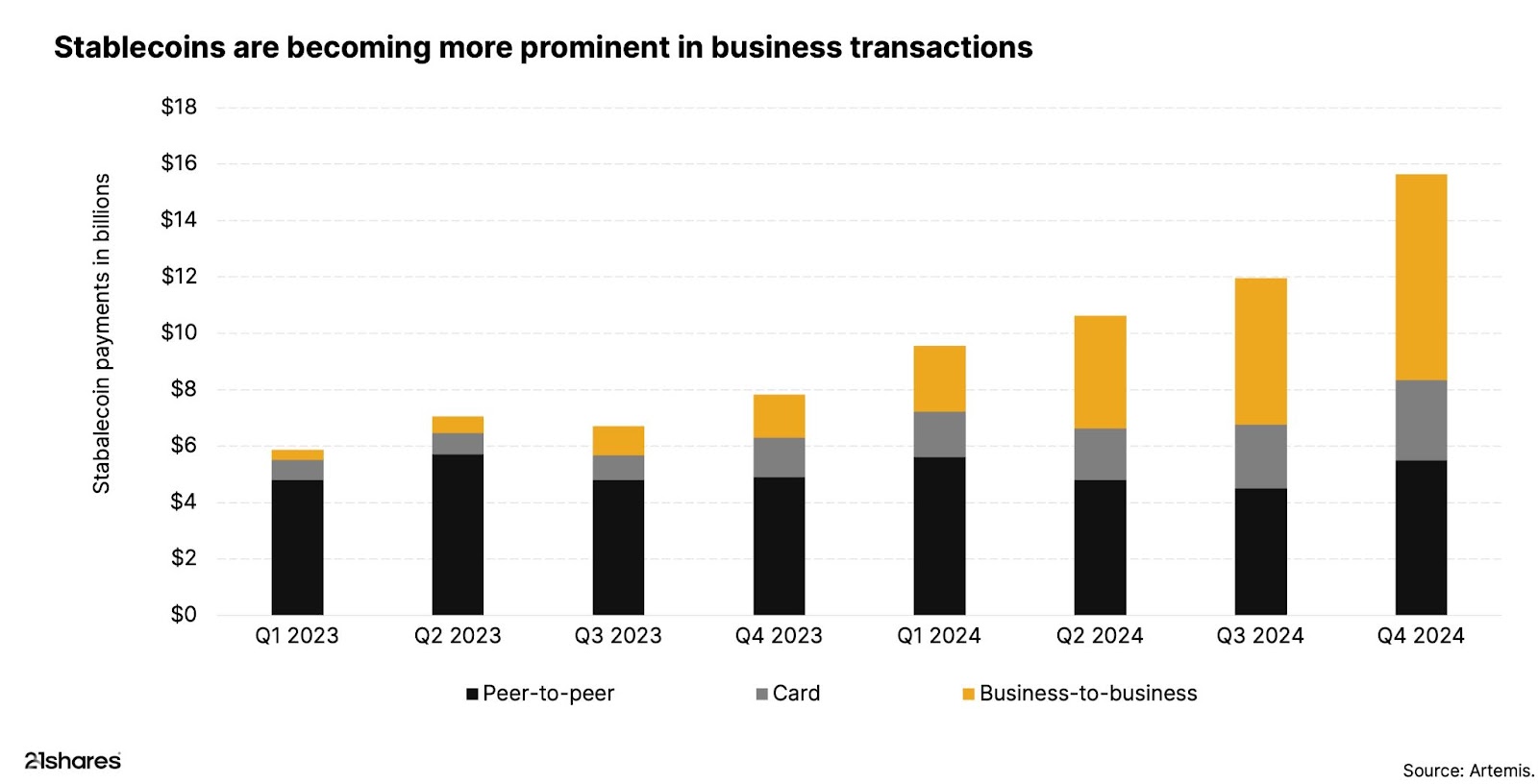

Moreover, stablecoin usage, depicted in the chart below, has already expanded beyond retail peer-to-peer transfers and is now moving into broader enterprise-level payment infrastructure.

Stablecoins’ share of decentralized finance (DeFi) revenue has surged to 30.8%, up from just 4.7% in June 2024. In 2025 alone, Solana has processed nearly $650 billion in stablecoin activity, whereas Ethereum has settled approximately $5.6 trillion.

Now, with corporate giants like Apple, Google, and others exploring stablecoin integration, demand is poised to accelerate even further. For Solana and Ethereum holders, this trend brings several promising tailwinds:

- Higher transaction fee revenue driven by increased stablecoin activity

- Greater developer engagement to build enterprise-grade applications

- Enhanced network effects through deeper integration with traditional finance

In short, Circle’s IPO is just the beginning of bringing stablecoins into the mainstream. With tech giants and the broader financial sector already getting involved, investors now have a unique opportunity to witness and participate in the evolution of money.

This report has been prepared and issued by 21Shares AG for publication globally. All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however, we do not guarantee the accuracy or completeness of this report. Crypto asset trading involves a high degree of risk. The crypto asset market is new to many and unproven and may have the potential not to grow as expected.Currently, there is relatively small use of crypto assets in the retail and commercial marketplace in comparison to relatively large use by speculators, thus contributing to price volatility that could adversely affect an investment in crypto assets. In order to participate in the trading of crypto assets, you should be capable of evaluating the merits and risks of the investment and be able to bear the economic risk of losing your entire investment.Nothing herein does or should be considered as an offer to buy or sell or solicitation to buy or invest in crypto assets or derivatives. This report is provided for information and research purposes only and should not be construed or presented as an offer or solicitation for any investment. The information provided does not constitute a prospectus or any offering and does not contain or constitute an offer to sell or solicit an offer to invest in any jurisdiction. The crypto assets or derivatives and/or any services contained or referred to herein may not be suitable for you and it is recommended that you consult an independent advisor. Nothing herein constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal recommendation. Neither 21Shares AG nor any of its affiliates accept liability for loss arising from the use of the material presented or discussed herein.Readers are cautioned that any forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors.This report may contain or refer to material that is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would subject 21Shares AG or any of its affiliates to any registration, affiliation, approval or licensing requirement within such jurisdiction.

.svg)

_logo.svg)

.svg.png)