Primer: Crypto assets included in a diversified portfolio - Q1 2025

Most investors assume crypto is too volatile, too uncorrelated, or simply too niche to belong in a serious investment portfolio. This paper challenges that assumption.

When allocating to any asset class, two key questions should be asked:

- What is the investment case for this asset?

- And more critically, what share of a portfolio, if any, should be allocated to it?

This primer focuses on the second. We apply a portfolio construction lens to digital assets to assess how they behave alongside traditional holdings like equities, bonds, and gold.

Using historical correlation data, stress events, and backtested allocations, we show that crypto is not only structurally different but additive. When managed thoughtfully and sized appropriately, cryptoassets can enhance diversification, improve risk-adjusted returns, and introduce new sources of potential upside.

Correlation of returns across asset classes

Understanding how assets move relative to one another is a key input in portfolio construction. Correlation analysis helps determine whether a new addition to a portfolio amplifies existing risks or introduces meaningful diversification. In this section, we examine a broad set of traditional and digital assets to assess how crypto fits into a multi-asset allocation framework.

Figure 1: Correlation Analysis Asset Universe

Source: 21Shares, Bloomberg, Yahoo Finance, Coingecko

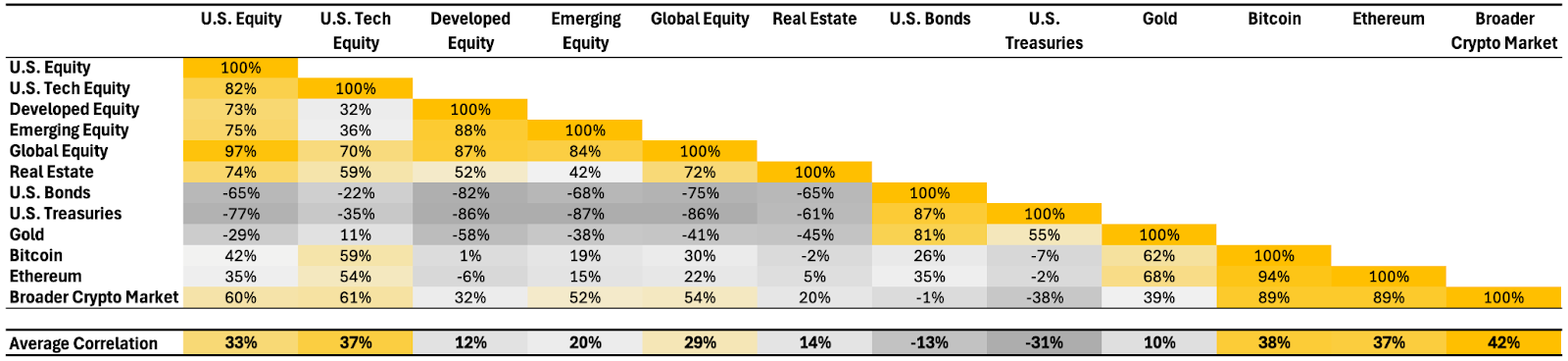

Over the full observation period from April 1, 2022 to March 31, 2025, Bitcoin, Ethereum, and the broader crypto market have exhibited consistently low correlations with traditional asset classes. This low correlation is a foundational reason why digital assets are increasingly considered within diversified portfolio frameworks.

Bitcoin’s average correlation with the rest of the asset universe sits at 36%, Ethereum at 38%, and the broader crypto market just below 40%. These levels are meaningfully lower than internal correlations among traditional assets, which often cluster above 60–70% — especially among equities, bonds, and real estate.

Figure 2: Correlation of Returns Across Asset Classes: April 1, 2022 - March 31, 2025

Source: 21Shares, Data from Bloomberg and Yahoo Finance. Correlation calculated on a 10D rolling return window from April 1, 2022, to March 31, 2025. Color Description: Yellow denotes high correlation across assets, grey denotes low or negative correlation across assets.

For investors, this underscores the role of crypto not just as a source of potential returns, but as an independent return stream. Cryptoassets behave materially differently than equities, fixed income, or commodities, and that differentiation introduces clear diversification benefits. However, to better understand how these relationships evolve, and where cryptoassets diverge most meaningfully, it’s worth examining each in isolation over time.

Bitcoin: an emerging store of value with market regime sensitivity

Over the full period, Bitcoin has exhibited modest correlation with both traditional risk assets and defensive assets, around 20% with gold and 35% with U.S. equities. Structurally, it shares many characteristics with traditional stores of value: finite supply, decentralized issuance free from counterparty risk, and censorship-resistance, which underpin its growing reputation as digital gold.

Over the long term, as global adoption deepens and volatility compresses, Bitcoin is expected to behave more like a traditional safe-haven asset, akin to gold. But today, it doesn’t fully mirror either end of the spectrum. Instead, Bitcoin occupies a unique middle ground, with tendencies that shift between risk-on and risk-off depending on the environment.

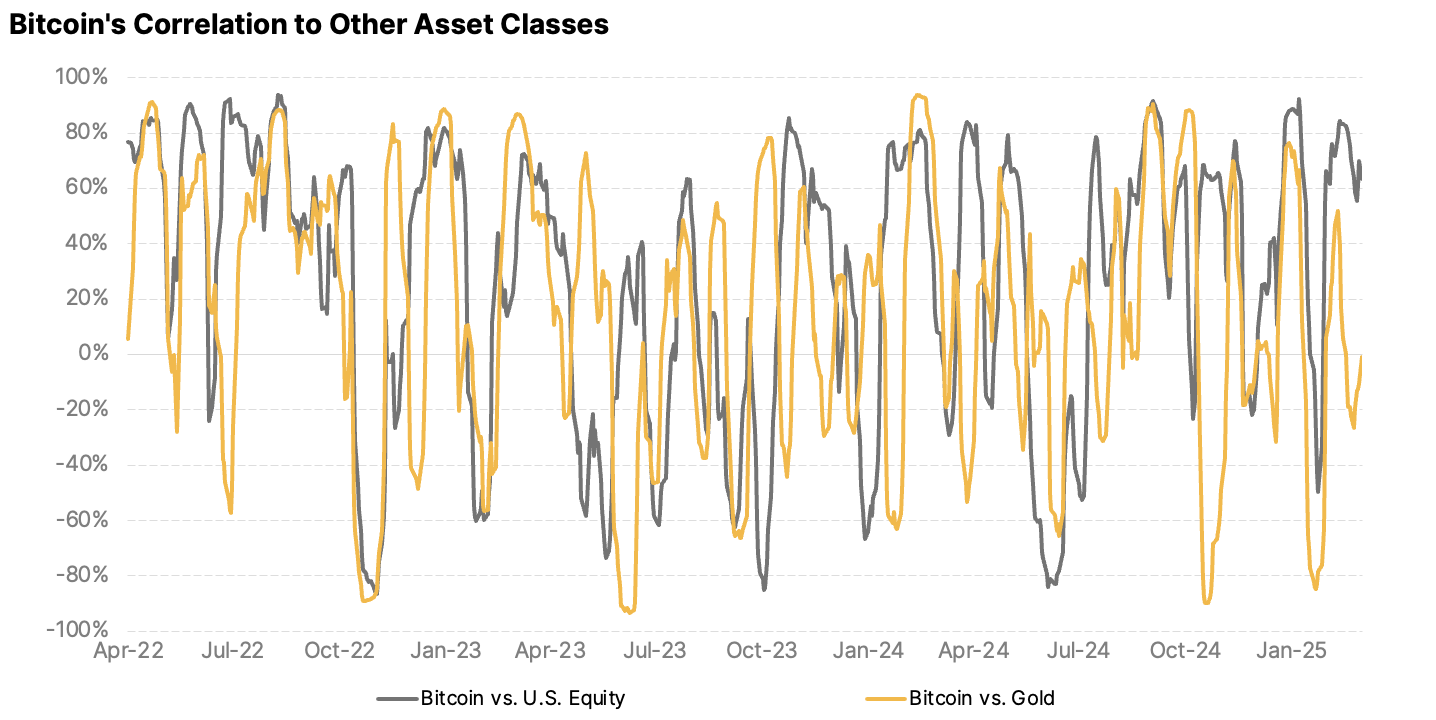

This dual nature is clearly illustrated in the rolling correlation chart below, which tracks Bitcoin’s relationship to both equities and gold. At times, it trades like a growth asset; at others, it behaves defensively, and occasionally, decouples entirely.

This makes Bitcoin unlike any other asset in the market. It is structurally independent, behaviorally adaptive, and still offers significant asymmetric upside relative to legacy safe-haven assets. For portfolio construction, Bitcoin stands out as both a potential long-term hedge, and a high-impact diversifier at present.

Figure 3: Bitcoin’s Correlation of Returns to Other Asset Classes: April 1, 2022 - March 31, 2025

Source: 21Shares, Data from Bloomberg and Yahoo Finance. Correlation calculated on a 20D rolling return window from April 1, 2022, to March 31, 2025.

Ethereum and broader crypto market: A frontier in digital innovation

Ethereum acts as a foundational layer within the crypto ecosystem, a programmable blockchain that enables developers to build decentralized applications across finance, gaming, social, and more. Much like iOS provides the base layer for mobile app development in Apple’s world, Ethereum provides the infrastructure for crypto-native innovation.

Ethereum serves as the foundational layer for the crypto industry, enabling decentralized applications across finance, gaming, identity, and more. Similar to how iOS supports the mobile app ecosystem, Ethereum allows for a wide range of blockchain-native activity. As such, it's often compared to innovation-led sectors like tech.

However, correlation data suggests a more nuanced story. Over the full period, Ethereum’s correlation with U.S. tech equities sits at 42%, and the broader crypto market sits even lower at 39%. As the chart below shows, these assets don't move consistently with tech equities, despite being built on similar themes.

This reflects the distinct return drivers that shape crypto markets — such as protocol-level growth, token economics, and regulatory developments. As a result, Ethereum and the broader crypto space offer a differentiated path to innovation exposure, with potential diversification benefits that go beyond what traditional tech holdings provide.

Figure 4: Ethereum & Broader Crypto Market’s Correlation of Returns to U.S. Tech Equity: April 1, 2022 - March 31, 2025

Source: 21Shares, Data from Bloomberg and Yahoo Finance. Correlation calculated on a 20D rolling return window from April 1, 2022, to March 31, 2025.

Internal crypto correlations: High but expected to decouple over time

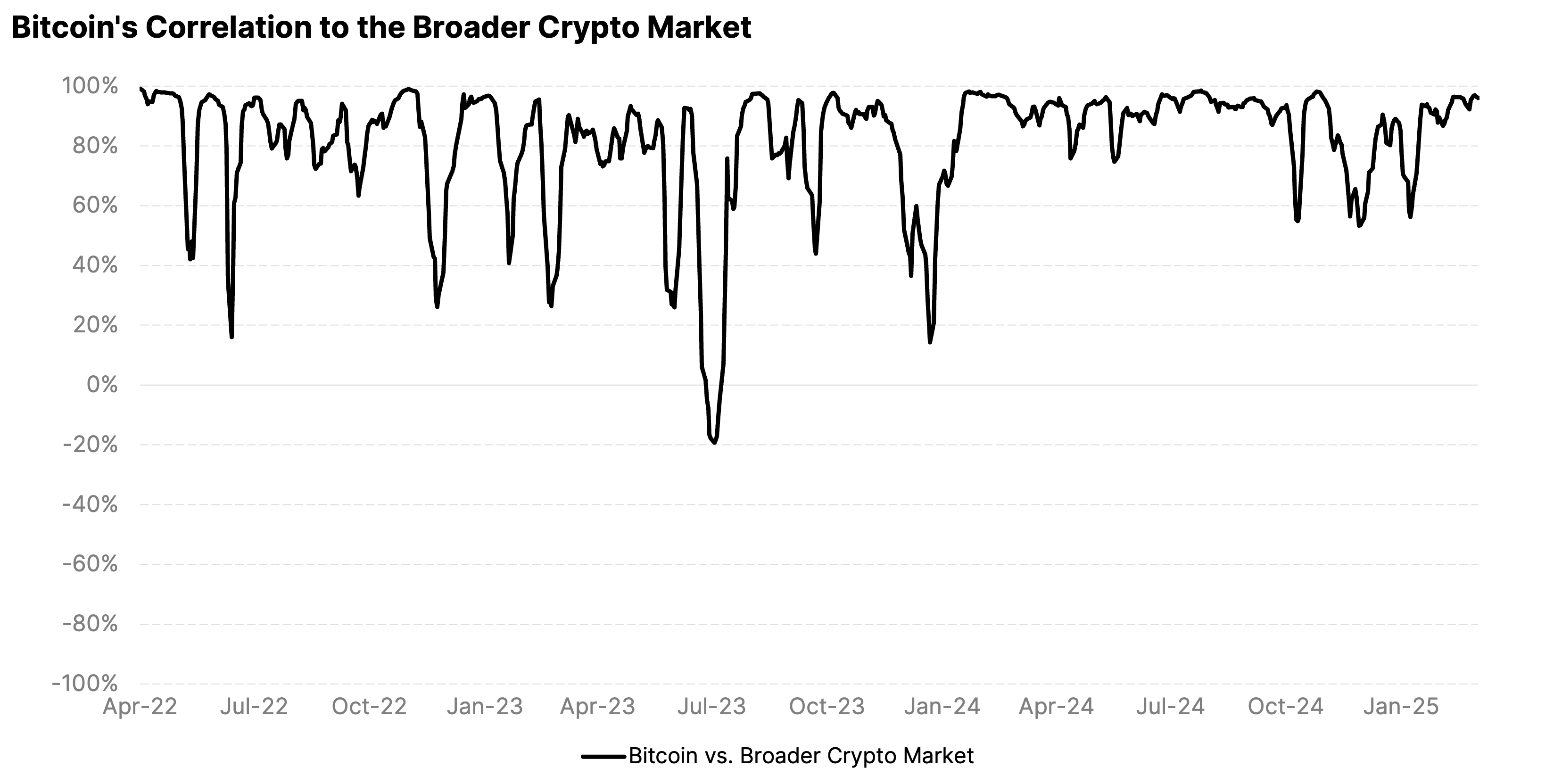

Cryptoassets have historically moved together, a natural feature of an emerging asset class with shared liquidity flows, sentiment, and regulatory sensitivity. Unsurprisingly, correlations across the crypto market remain elevated.

But this is beginning to change. As the space matures, distinct narratives and use cases, like real-world asset tokenization or the convergence of blockchain & AI are beginning to influence specific assets more than others, setting the stage for cryptoassets to be priced on their own fundamentals rather than simply following Bitcoin’s lead.

Bitcoin’s rolling correlation to the broader crypto market shows clear divergence points. In July 2023, Bitcoin briefly showed a negative correlation to the broader market, a momentary break from the norm. Over the past 12 months, these decouplings have occurred more frequently and less sporadically, suggesting Bitcoin, and eventually other cryptoassets, may be moving toward more independent cycles, opening the door to selective exposure and more nuanced allocation strategies within the asset class itself.

Figure 5: Bitcoin’s Correlation of Returns to the Broader Crypto Market: April 1, 2022 - March 31, 2025

Source: 21Shares, Data from Bloomberg and Yahoo Finance. Correlation calculated on a 20D rolling return window from April 1, 2022, to March 31, 2025.

Having examined how crypto behaves under typical market conditions, we now turn to periods of overwhelming market uncertainty. These moments provide a clear lens into how cryptoassets respond when volatility spikes and whether their diversification benefits remain intact when investors need them most.

Correlation of Returns During Distressed Times

March 2020: COVID-19

Periods of acute market stress often lead to a breakdown in diversification. Correlations across asset classes tend to spike as investors de-risk simultaneously and move toward liquidity. The COVID-19 crisis in March 2020 was no exception.

As shown in Figure 2, nearly all traditional asset classes experienced elevated correlations during this period, a clear reflection of the widespread selloff and flight to safety. Bitcoin and Ethereum were no different. Both assets saw a sharp increase in correlation with traditional equities, as well as a temporary convergence with gold. During the worst of the liquidity crunch, Bitcoin’s correlation with U.S. equities reached 46%, while Ethereum’s hit 44%.

Figure 6: Correlation of Returns Across Asset Classes: March 2020 (COVID-19 Crisis)

Source: 21Shares, Data from Bloomberg and Yahoo Finance. Correlation calculated on a 5D rolling return window from March 1, 2020 to March 31 2020. Color Description: Yellow denotes high correlation across assets, grey denotes low or negative correlation across assets.

However, the rolling correlation chart offers a more detailed view of Bitcoin’s behavior throughout the month. In mid. March, Bitcoin’s correlation with gold briefly surged, highlighting its perceived role, if only momentarily, as a safe-haven asset. But that quickly unwound, and by mid- to late-March, Bitcoin was once again moving in line with risk assets, as the market repriced an abundance in liquidity and risk appetite returned.

This intra-month volatility reinforces Bitcoin’s dual identity. While it may exhibit features of a store of value, it can still behave like a high-beta asset during sharp macro shocks. Its ability to move between roles makes it both challenging to categorize and valuable from a diversification perspective, particularly when timing and macro context are taken into account.

Figure 7: Bitcoin’s Correlation of Returns to Other Asset Classes: COVID-19

Source: 21Shares, Data from Bloomberg and Yahoo Finance. Correlation calculated on a 5D rolling return window from March 1, 2020, to March 31, 2020.

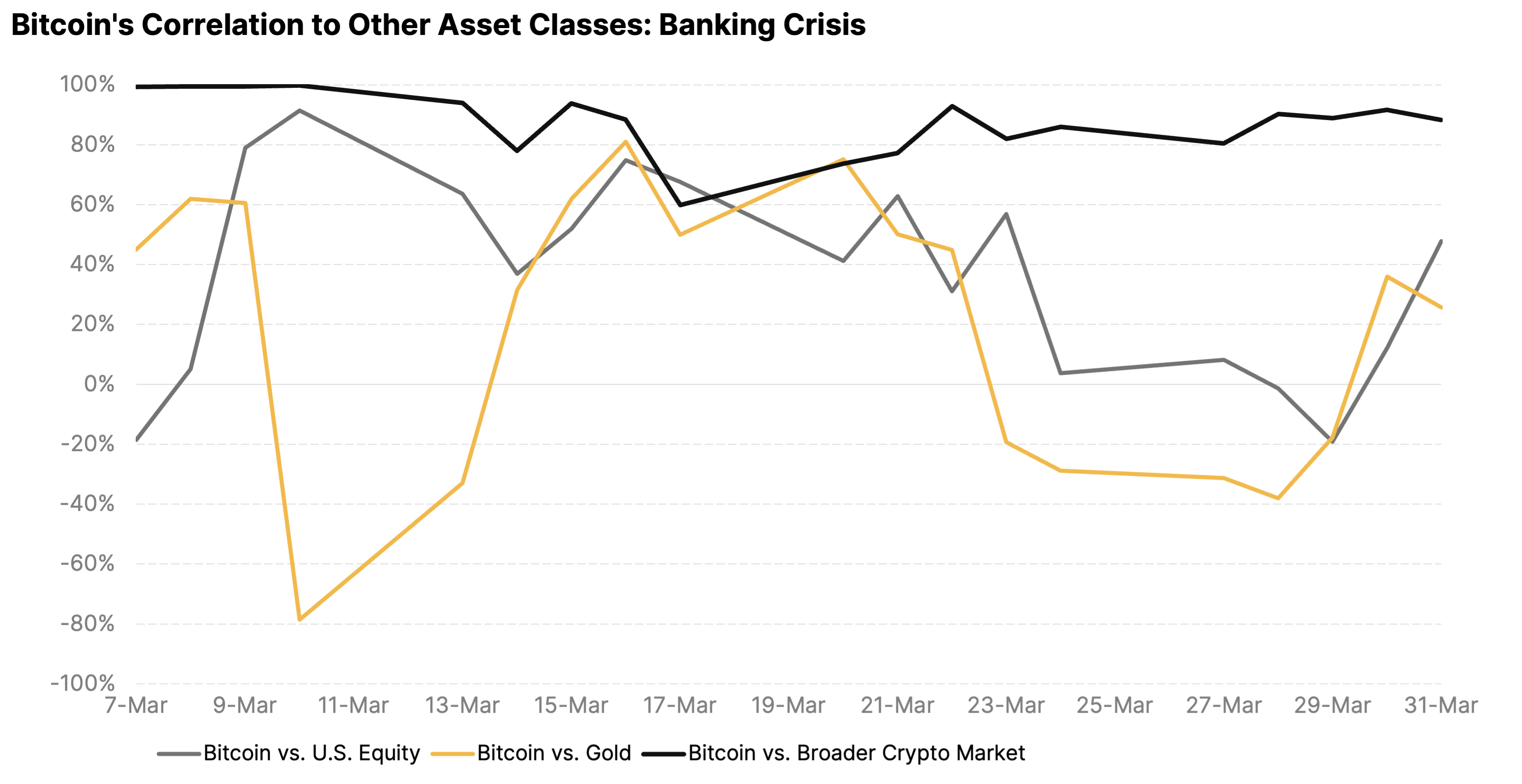

March 2023: Banking Crisis

Unlike prior episodes of market stress, the March 2023 regional banking crisis was centered on the stability of the traditional financial system, the very infrastructure that crypto was designed to operate independently of, and in some cases, challenge outright.

As shown in Figure 3, correlations between Bitcoin, Ethereum, and traditional risk assets were meaningfully lower than during the COVID-19 crash. Bitcoin’s correlation with U.S. equities dropped to just 42%, and Ethereum’s to 35%, far below the elevated levels seen in March 2020. Instead of collapsing alongside banks, crypto rallied: Bitcoin rose 23%, and Ethereum 25% over the month, as investors increasingly viewed the sector as a hedge against systemic banking risk.

Figure 8: Correlation of Returns Across Asset Classes: March 2023 (Banking Crisis)

Source: 21Shares, Data from Bloomberg and Yahoo Finance. Correlation calculated on a 5D rolling return window from March 1, 2023 to March 31 2023. Color Description: Yellow denotes high correlation across assets, grey denotes low or negative correlation across assets.

This shift is even more visible in the rolling correlation chart, where Bitcoin’s correlation with gold spiked sharply during the height of the banking crisis. At the same time, its correlation with equities fell, a reversal of the typical crisis dynamic. The crypto market, and Bitcoin in particular, briefly behaved more like traditional safe havens, attracting capital amid concerns of systemic risk.

This episode marks a notable divergence from previous stress events. While crypto still showed volatility, its performance, both in price and in correlation, reflected a growing recognition of its role as an alternative financial system. For allocators, this reinforces the case for crypto not only as a diversifier but as a potential hedge against traditional market vulnerabilities.

Figure 9: Bitcoin’s Correlation of Returns to Other Asset Classes: Banking Crisis

Source: 21Shares, Data from Bloomberg and Yahoo Finance. Correlation calculated on a 5D rolling return window from March 1, 2023, to March 31, 2023.

Portfolio Analysis: Understanding the Impact of Crypto Allocations

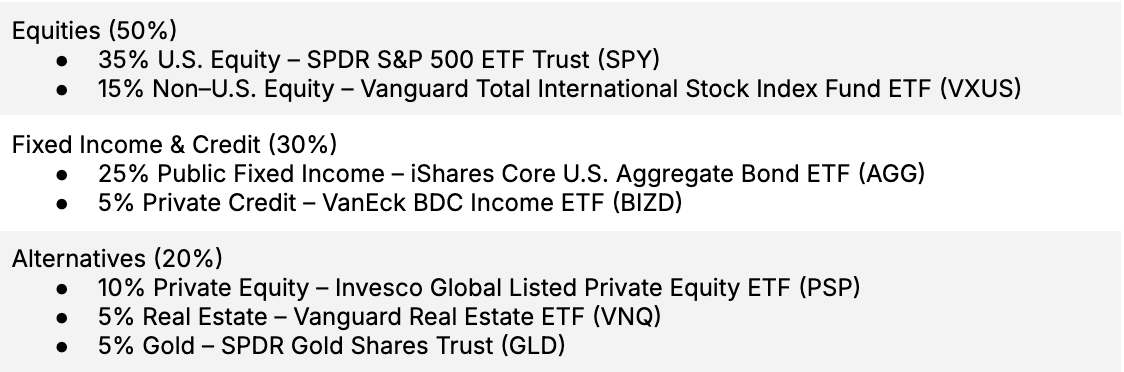

To understand how crypto fits within a diversified investment strategy, we test its impact on a balanced, multi-asset portfolio. Instead of defaulting to the traditional 60/40 equity-bond mix, we use a more representative model that better reflects the complexity of today’s investor portfolios.

Figure 10: Model Portfolio

Source: 21Shares, Bloomberg, Yahoo Finance, Coingecko.

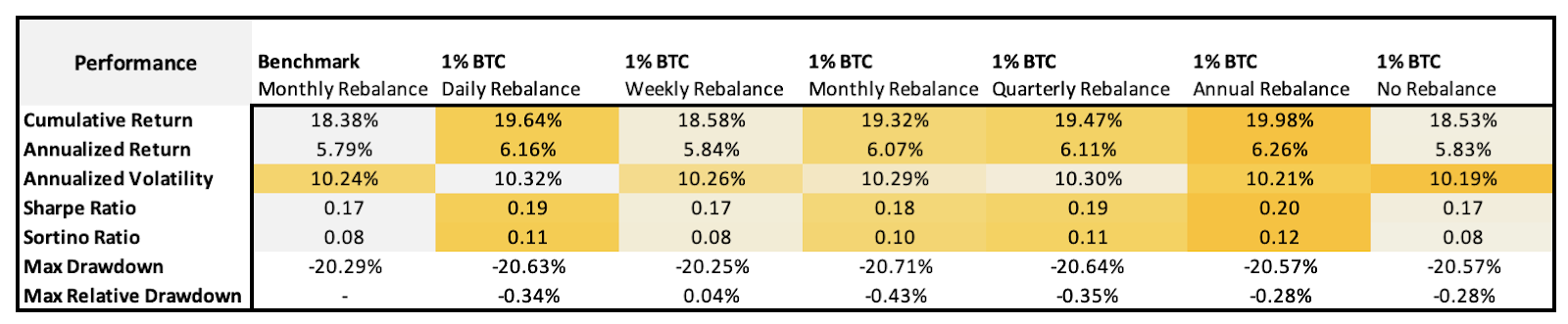

Introducing Bitcoin to the Model Portfolio: The 1% Test

To initially assess the impact of crypto to the portfolio, we introduced a 1% Bitcoin allocation, sourced equally from U.S. equities (SPY) and gold (GLD) to reflect Bitcoin’s dual nature as both a risk-on and risk-off asset. We tested this allocation across six rebalancing strategies to evaluate its effect on performance, volatility, and drawdowns.

Stronger risk-adjusted returns: As shown in Figure 11, adding just 1% Bitcoin improved both cumulative returns and Sharpe ratios across nearly all rebalancing frequencies. The benchmark portfolio returned 18.38% with a Sharpe ratio of 0.17. Portfolios with Bitcoin exposure reached as high as 19.98% in return and 0.20 on the Sharpe. Even at such a small weight, Bitcoin added meaningful upside and enhanced portfolio efficiency.

Rebalancing strategy matters: While the model portfolio benefited from the Bitcoin allocation, how rebalancing was applied made a clear difference. The non-rebalanced portfolio delivered the weakest outcome (18.53%), as the BTC sleeve gradually expanded and distorted the target asset mix, reducing overall efficiency. In contrast, quarterly and annual rebalancing stood out, delivering strong returns, better risk-adjusted outcomes, and contained volatility. These results also challenge the common belief that adding Bitcoin materially increases portfolio risk. A 1% allocation had minimal impact on overall volatility, and in some strategies, even reduced it slightly. As crypto matures and volatility continues to compress, this trend is likely to persist, reinforcing its case as a complementary asset in diversified portfolios.

Figure 11: Simple Growth Portfolio with a 1% BTC Allocation Across Different Rebalancing Strategies

Source: 21Shares, Data from Bloomberg and Yahoo Finance from April 1, 2022 - March 31, 2025.

Well-contained downside risk: A key concern with introducing new assets to a portfolio is whether they amplify downside risk. Figure 12 shows that with a 1% allocation, Bitcoin did not meaningfully increase drawdowns. Across all strategies, maximum drawdowns remained in line with the benchmark, with the largest deviation just –0.43%. Notably, the weekly rebalanced portfolio saw a slightly smaller drawdown of –20.25%, even improving resilience marginally. This reinforces a consistent message across our analysis: when properly sized and appropriately managed, Bitcoin can add value without materially increasing portfolio risk. It offers asymmetric upside potential while maintaining, or even improving risk controls.

Figure 12: Simple Growth Portfolio with a 1% BTC Allocation Across Different Rebalancing Strategies

Source: 21Shares, Data from Bloomberg and Yahoo Finance from April 1, 2022 - March 31, 2025.

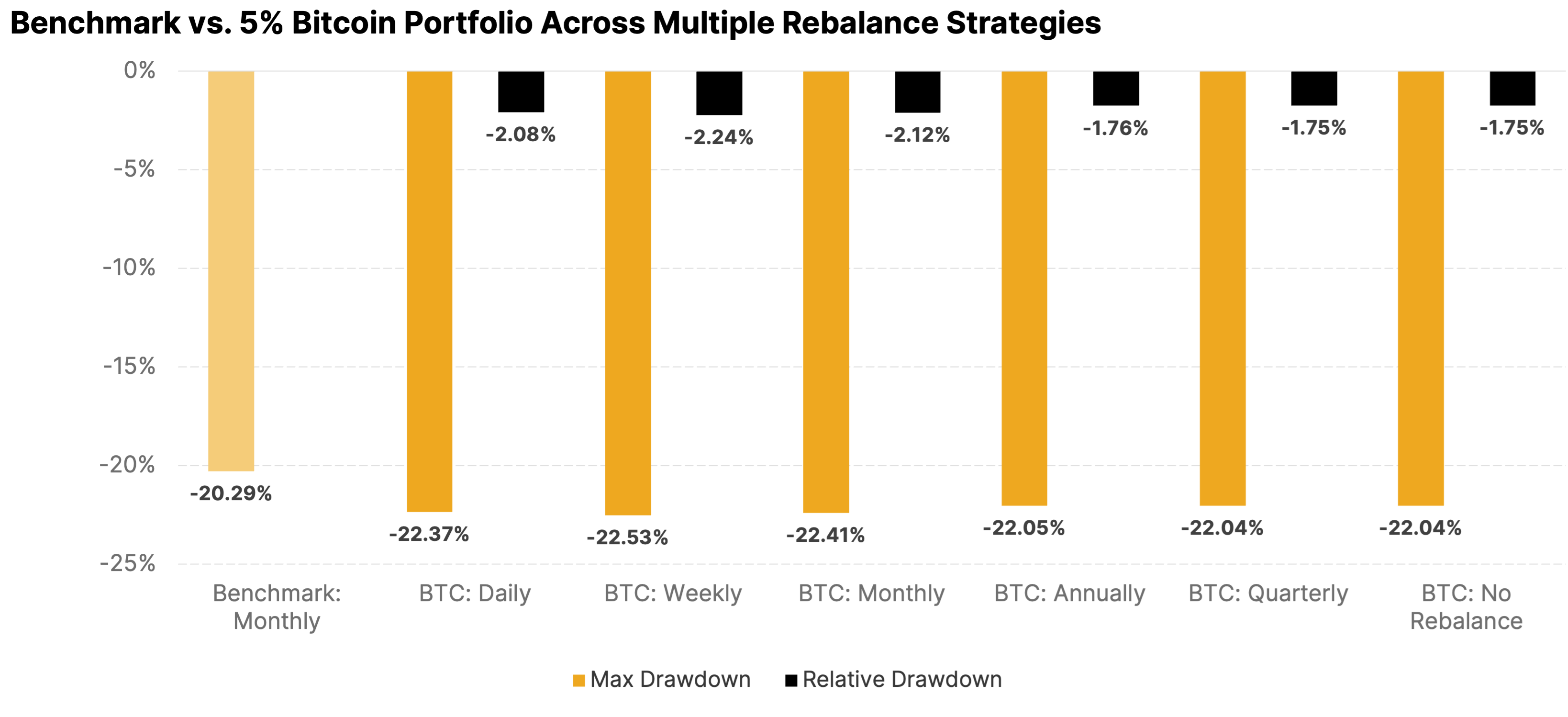

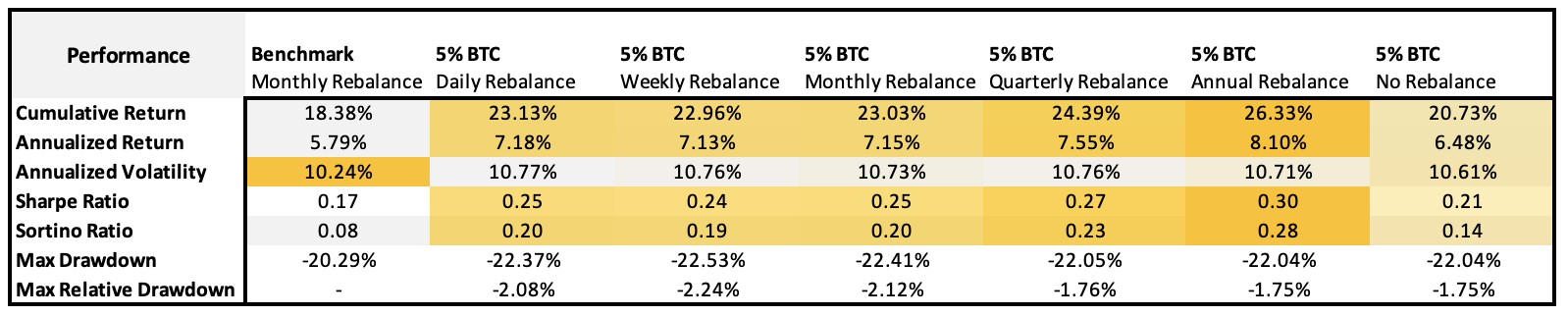

Scaling Up: The 5% Bitcoin Allocation

For investors looking to move beyond a minimal allocation and explore a more meaningful exposure to Bitcoin, we tested a 5% allocation to the model portfolio. The additional weight was sourced from U.S. equities (2%), gold (1%), and real estate (1%), reflecting Bitcoin’s blended characteristics as both a risk-on and risk-off asset, as well as its likely role as part of the alternatives sleeve in modern multi-asset portfolios, justifying the reallocation from real estate.

Stronger risk-adjusted returns: As shown in Figure 13, increasing the Bitcoin allocation to 5% led to a material uplift in both returns and risk-adjusted performance. Cumulative returns jumped to a high of 26.33%, a gain of nearly 8% compared to the benchmark. Sharpe ratios rose even more dramatically, with the best-performing strategy nearly doubling the benchmark’s Sharpe (0.30 vs. 0.17). This shows that expanding exposure beyond a minimal allocation doesn’t just boost absolute returns it also strengthens portfolio efficiency, especially when rebalancing is used to keep the exposure disciplined.

Volatility remains manageable: Despite a larger allocation, volatility remained remarkably stable. Across all strategies, annualized volatility hovered between 10.61% and 10.77%, only marginally above the benchmark’s 10.24%, and still well within acceptable bounds for a traditional portfolio. This reinforces the point made in the 1% test: Bitcoin’s historical volatility doesn’t translate linearly to the portfolio level, especially when it’s a small sleeve in a broadly diversified mix.

Figure 13: Simple Growth Portfolio with a 5% BTC Allocation Across Different Rebalancing Strategies

Source: 21Shares, Data from Bloomberg and Yahoo Finance from April 1, 2022 - March 31, 2025.

Rebalancing strategy matters: While rebalancing is often seen as a tool to manage downside risk, in this case, its value is more evident in preserving portfolio efficiency. As seen in Figure 14, maximum drawdowns were relatively consistent across strategies, with the non-rebalanced portfolio showing a similar downside risk to the best-performing strategy.

But the difference shows up clearly when looking at performance and Sharpe ratios. The non-rebalanced portfolio, despite having a similar drawdown profile, delivered noticeably weaker results: 20.73% return with a Sharpe of 0.21, compared to 26.33% and a Sharpe of 0.30 for the quarterly rebalanced version. The cost of not rebalancing isn’t necessarily deeper drawdowns, it’s the opportunity cost of diluted performance, which makes a meaningful difference when allocating to assets with asymmetric return potential like Bitcoin.

Figure 14: Simple Growth Portfolio with a 5% BTC Allocation Across Different Rebalancing Strategies

Source: 21Shares, Data from Bloomberg and Yahoo Finance from April 1, 2022 - March 31, 2025.

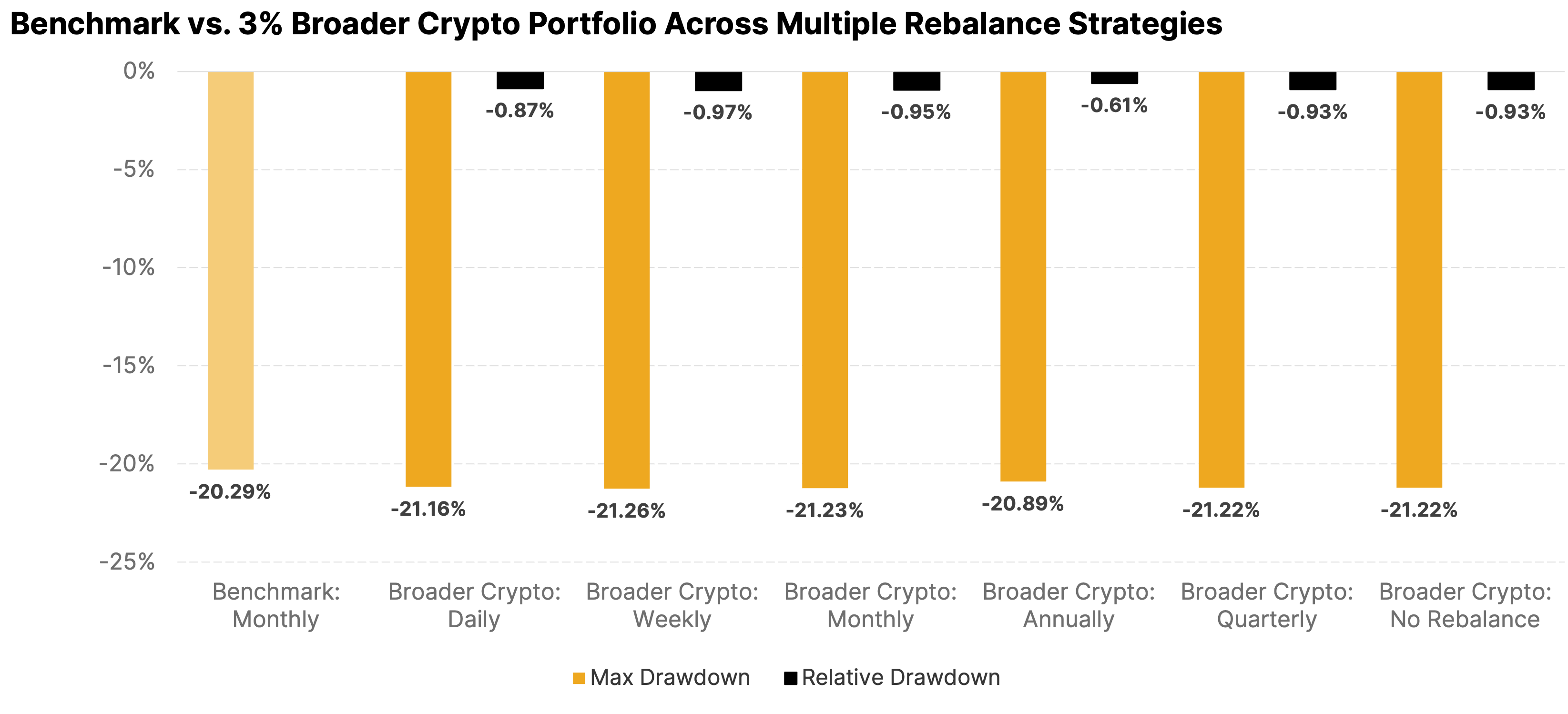

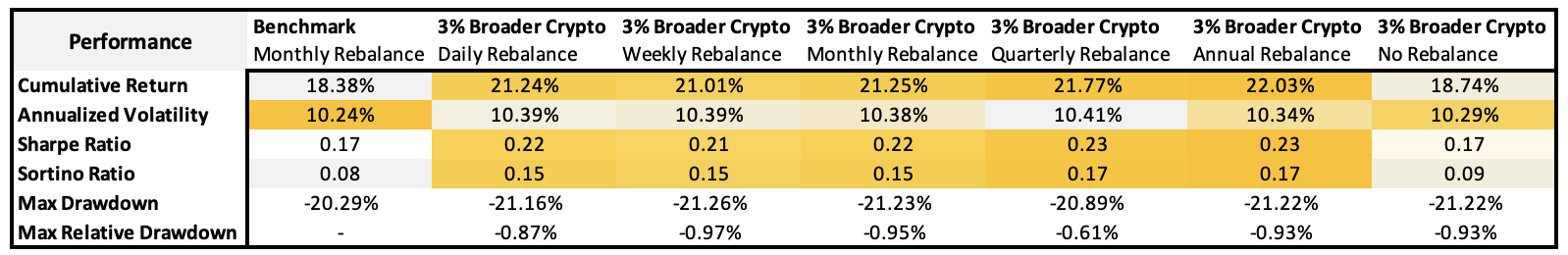

A Measured Step Further: 3% Allocation to the Top 5 Cryptoassets

For investors looking to diversify beyond Bitcoin, but in a measured and balanced way, we tested a 3% allocation to an equal-weighted basket of the top five cryptoassets by market cap. The allocation was sourced from a mix of U.S. equities, gold, and real estate, aligning with crypto’s role as both a high-growth play and a component of the alternatives sleeve.

Stronger risk-adjusted returns: As seen in Figure 15, a 3% broader crypto allocation outperformed the benchmark across all rebalancing strategies, with returns rising from 18.38% to 22.03%, and Sharpe ratios improving from 0.17 to 0.23. Even when expanding beyond just Bitcoin, a modest, diversified crypto allocation provided a clear uplift in performance, reinforcing the role of broad-based exposure as a valuable addition to a balanced portfolio.

Rebalancing strategy matters: As with previous Bitcoin allocations, while the model portfolio benefited from the crypto exposure, how it was rebalanced had a clear impact. The non-rebalanced portfolio delivered the weakest result, as the crypto sleeve gradually expanded, distorting the intended asset mix and reducing overall efficiency. In contrast, quarterly and annual rebalancing delivered the strongest performance, allowing the portfolio to capture the asset class’s long-term appreciation while maintaining balance through disciplined rebalancing.

Figure 15: Simple Growth Portfolio with a 3% Allocation to Top 5 Crypto Across Different Rebalancing Strategies

Source: 21Shares, Data from Bloomberg and Yahoo Finance from April 1, 2022 - March 31, 2025.

Well-contained downside risk: As with previous tests, the 3% allocation did not meaningfully increase downside risk, with drawdowns staying closely in line with the benchmark. As shown in Figure 16, the largest drawdown occurred in the weekly rebalanced portfolio at –21.26%, just under 1% above the benchmark. All other strategies fell within a similarly tight range, demonstrating that even with broader crypto exposure, portfolio resilience was largely preserved. This reinforces the broader theme throughout our analysis: when appropriately sized, crypto exposure continues to offer a compelling upside profile, without materially altering the risk characteristics of a balanced, long-term portfolio.

Figure 16: Simple Growth Portfolio with a 3% Allocation to Top 5 Crypto Across Different Rebalancing Strategies

Source: 21Shares, Data from Bloomberg and Yahoo Finance from April 1, 2022 - March 31, 2025.

Conclusion: Volatility is falling, but price may not wait

Throughout this report, we’ve explored the role that cryptoassets can play within a multi-asset investment strategy. Across correlation analysis, crisis scenarios, and portfolio backtests, one message consistently emerged: modest crypto allocations have historically improved portfolio efficiency without meaningfully increasing risk. Small sleeves of 1–3% delivered improved returns, higher Sharpe ratios, and limited drawdown impact when structured and rebalanced appropriately. From a portfolio construction standpoint, the diversification case is empirical.

Still, crypto remains an evolving market, and every investment process involves more than just backtests. As always, past performance is not indicative of future results, and any allocation should reflect individual risk tolerance and investment goals.

That said, two trends are happening in real time: Bitcoin’s volatility is compressing, and its price is structurally rising. This pattern suggests a maturing asset class, one where the long-term opportunity may outweigh near-term hesitation. For investors still on the sidelines, the real trade-off may not just be volatility but opportunity cost. For those evaluating its role in a long-term strategy, the key question is shifting: not if to allocate, but when.

Figure 17: Bitcoin’s Price vs. Realized Volatility

Source: 21Shares, Data from Glassnode from April 1, 2010 - March 31, 2025.

Appendix

The tables below provide a detailed summary of portfolio outcomes across different crypto allocation sizes and rebalancing strategies.

Figure 18: Simple Growth Portfolio with a 1% BTC Allocation Across Different Rebalancing Strategies

Source: 21Shares, Data from Bloomberg and Yahoo Finance from April 1, 2022 - March 31, 2025.

Figure 19: Simple Growth Portfolio with a 5% BTC Allocation Across Different Rebalancing Strategies

Source: 21Shares, Data from Bloomberg and Yahoo Finance from April 1, 2022 - March 31, 2025.

Figure 20: Simple Growth Portfolio with a 3% Allocation to Top 5 Crypto Across Different Rebalancing Strategies

Source: 21Shares, Data from Bloomberg and Yahoo Finance from April 1, 2022 - March 31, 2025.

This report has been prepared and issued by 21Shares AG for publication globally. All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however, we do not guarantee the accuracy or completeness of this report. Crypto asset trading involves a high degree of risk. The crypto asset market is new to many and unproven and may have the potential not to grow as expected.

Currently, there is relatively small use of crypto assets in the retail and commercial marketplace in comparison to relatively large use by speculators, thus contributing to price volatility that could adversely affect an investment in crypto assets. In order to participate in the trading of crypto assets, you should be capable of evaluating the merits and risks of the investment and be able to bear the economic risk of losing your entire investment.

Nothing herein does or should be considered as an offer to buy or sell or solicitation to buy or invest in crypto assets or derivatives. This report is provided for information and research purposes only and should not be construed or presented as an offer or solicitation for any investment. The information provided does not constitute a prospectus or any offering and does not contain or constitute an offer to sell or solicit an offer to invest in any jurisdiction. The crypto assets or derivatives and/or any services contained or referred to herein may not be suitable for you and it is recommended that you consult an independent advisor. Nothing herein constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal recommendation. Neither 21Shares AG nor any of its affiliates accept liability for loss arising from the use of the material presented or discussed herein.

Readers are cautioned that any forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. This report may contain or refer to material that is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would subject 21Shares AG or any of its affiliates to any registration, affiliation, approval or licensing requirement within such jurisdiction.

.svg)

_logo.svg)

.svg.png)