An Indonesian Crypto Exchange, A World Cup NFT Collection, and More!

.webp)

This Week in Crypto

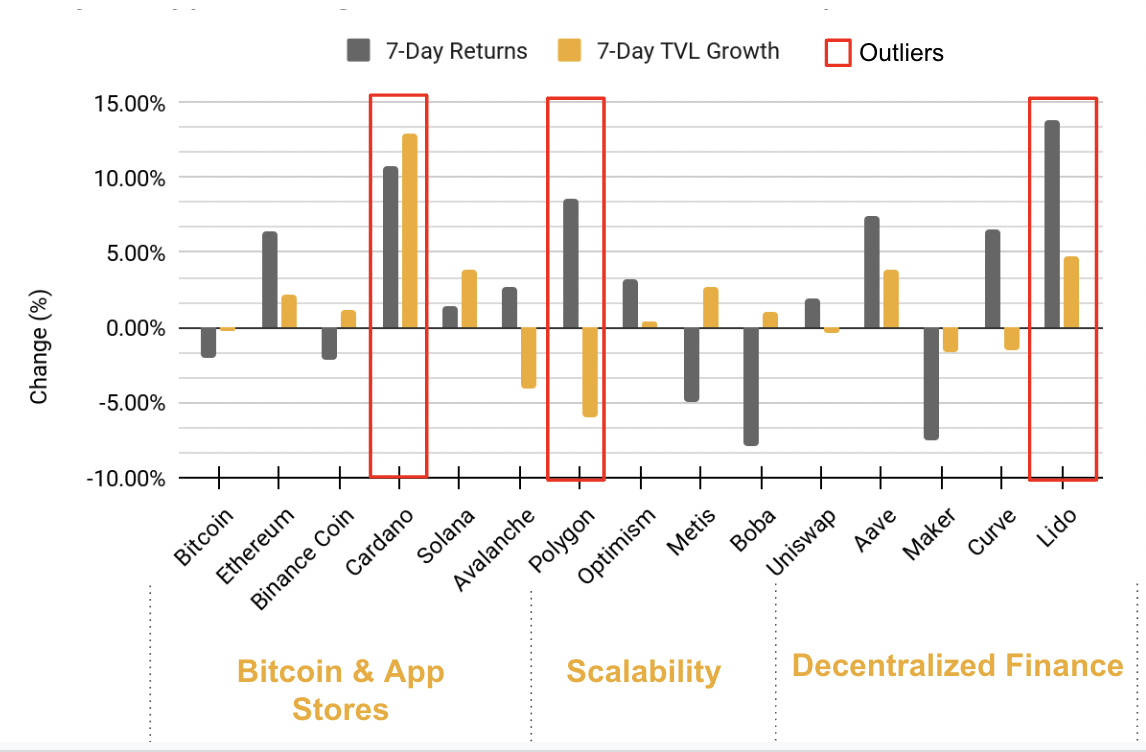

Over the past week, some assets and protocols in major crypto categories have experienced an uptick in their returns and TVL compared to those of the prior two weeks. As of writing, Bitcoin has declined in price by 2% over the past week, whereas Ethereum increased by 6.4%. As shown in the figure below, from left to right, the top 3 cryptoassets within these categories are Cardano, Polygon, and Lido, whose prices have gone up by 10.8%, 8.6%, and 13.8%, respectively, at the time of writing. Moreover, Cardano was the only asset to have its TVL surpass its returns regarding percentage change, where it recorded an almost 13% increase over the past week.

Figure 1: 7-Day Price and TVL Developments of Cryptoassets in Major Sectors

Source: 21Shares, Coingecko, DeFi Llama

Key takeaways:

- Bitcoin is in accumulation phase, shows the Puell Multiple indicator.

- Indonesia to launch crypto exchange, Brazil pushes for a DeFi liquidity pool.

- Firm behind the biggest ETH mining pool pivots to the staking business.

- FIFA is set to launch World Cup NFT collection.

Spot and Derivatives Markets

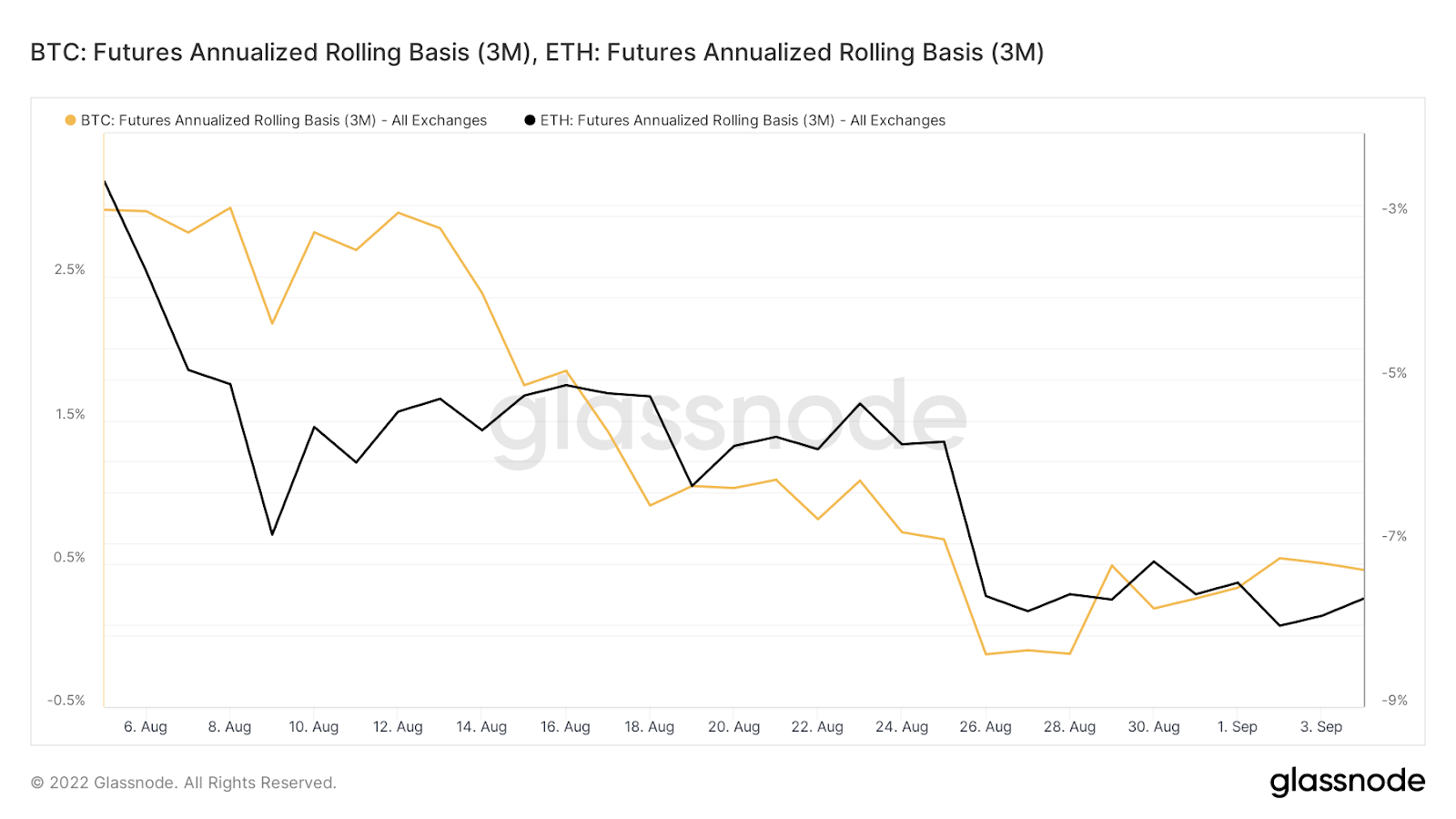

Figure 2: Comparison between futures annualized rolling basis of BTC and ETH

Source: Glassnode, 21Shares

The futures annualized rolling basis indicator measures the annualized yield accrued by buying a spot asset and simultaneously selling a futures contract on that asset that expires in three months. In other words, the indicator calculates the difference between the futures and spot positions and therefore examines the behavior of yields of holding periods. The futures annualized rolling basis for both asset classes has been in the backwardation phase, where Bitcoin futures recorded 0.46% and Ethereum futures recorded -7.68%. It is expected that the returns on Ethereum would fluctuate until the Merge is settled, nevertheless, the rates are up from the end of August, as shown in the figure, when the rolling bases of both cryptoassets were in the negative.

You can read more about the Merge in our deep dive here!

On-chain Indicators

Figure 3: Bitcoin Puell Multiple (365 SMA)

Source: Coinglass

The Puell Multiple is basically the ratio of daily coin issuance and the 365-moving average of daily coin issuance, ultimately showing the profitability of Bitcoin mining. The indicator recorded 0.44 on September 2, which means that miners' profitability is below its yearly average by 44%. As the figure shows, the indicator is currently at the "green zone", which is a kinder label than "minimum miner profitability," signalling for accumulation.

Macro and Regulations

The food and energy crisis in the Eurozone set inflation to unprecedented highs at 9.1%. Suffering the most, Germany passed a $64.68B economic package to ease pressure on households battling the energy crisis. On the other side of the Pacific, the US added 315K jobs to its economy, making the unemployment rate jump to 3.7%, a little higher than expected.

In the US, regulators are making rounds across the board to make sure the industry is in their grip.

- The FBI issued a public service announcement for DeFi investors around exploits and cyber security.

- In compliance with law enforcement, Binance froze a Tezos validator’s account.

- Coinbase, FTX, Binance, Kraken and KuCoin received congressional inquiries related to fraud prevention. This comes on the back of research conducted by the Federal Trade Commision back in June, alleging that there has been $1B lost in crypto-related fraud since 2021.

- California governor is scheduled to sign a controversial bill requiring crypto firms to obtain a license, similar to New York’s BitLicense, to operate in the state. The governor has until September 30 to sign or veto the bill.

Meanwhile, in Latin America, Brazil has been taking some progressive steps toward crypto adoption. The Brazilian central bank selected eight projects to advance through its innovation lab, including a DeFi liquidity pool from Itaú, the country's largest bank by total assets. What the central bank of Brazil wants to do is create a platform that allows custody, trading, and staking through blockchain and smart contracts. Similarly, in Asia, the Indonesian government announced plans to launch a crypto stock exchange by year-end or early 2023.

Last week also saw governments who previously announced unfavorable measures towards crypto take progressive measures in parallel. Iran, which previously banned crypto trading, ratified the use of crypto for processing imports and has also started licensing crypto miners under a new regulatory framework. Argentina, which took a $45B bailout from the IMF on the condition of banning the use of cryptoassets, is now accepting crypto as payment for taxes and fees in its province of Mendoza.

Crypto Infrastructure

The Merge and Tornado Cash. Ethermine, the world's largest Ethereum mining pool, unveiled it will offer ETH staking pools post-merge. The service expected to pay an annual 4.4% to its participants, paints a major pivot for the mining giant and reiterates the notion that ETHPOW is increasingly looking like a speculative play. This belief is backed by the continued refusal of several established service providers to extend support towards the newly contentious bifurcated chains. On the other hand, Antpool will cease support for ETH accounts and exclusively focus on other POW-powered networks following the Merge. The firm, holding the 10th largest pool in terms of hash rate, expressed that ETH2.0 carries a heightened risk of censorship due to the 'centralized vertical of validators' who might be forced to comply with regulators if the Tornado Cash saga reoccurs. Ethermine will continue servicing other POW networks like Ethereum Classic, whereas its hash rate keeps breaking through ATHs.

ETH competitors. Solana continued its trend of receiving infrastructural support expansion from some of the industry's giants. First, Coinbase reported they would launch archival nodes on the Solana blockchain to help developers scale and empower them to focus on their products instead of propping up the network's costly infrastructure. This feature will allow access to historical data, which can be further used to examine the chain's state at any moment and perform complex queries. Fireblocks also revealed their web3.0 engine now supports the Solana ecosystem. Their new offering will enable users and developers to access a plurality of DeFi and NFT dApps on the burgeoning network via a seamlessly tailored experience. Finally, Cardano unveiled a fixed date, September 22, to execute its much anticipated hard fork after the network had recently achieved three key significant milestones. Dubbed "Vasil," Cardano's improved blockchain is predicted to welcome lower transaction costs and increased network capacity alongside a more frictionless smart-contract development environment.

Arbitrum Season. The L2 solution had a busy week as it implemented the long-awaited migration to the 'Nitro' layer. The upgrade introduces improved fraud proofs alongside updated sequencers and call-data compression mechanisms, which all lead to processing higher transactions per second. Consequently, Arbitrum is expected to resume its incentivizing initiative dubbed Odyssey, the program responsible for rocketing the network's fees to levels higher than Ethereum's mainnet back in July. The improvements should now help the users enjoy a smoother experience while engaging with the ecosystem's projects involved in the program and earning NFTs in the process. This is more exciting as it primes the ETH ecosystem for fireworks post-merge. It is also worth noting that the recent developments caused the number of transitions to reach an ATH, while the TVL increased by an impressive 16% MoM at a time when the network still doesn't have a token or is engaged in the inorganic incentivization programs others have.

Decentralized Finance

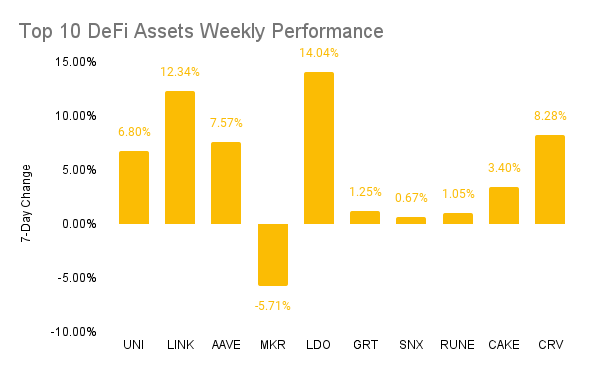

Figure 4: Top 10 DeFi Assets Weekly Performance

Source: 21Shares, Coingecko

The Merge and Tornado Cash. The Aave community has decidedly paused the ETH market as it prepares for the Merge slated for September 15. The proposal garnering 96% approval was informed by BlockAnaltica's research, where they highlighted the principal risk would be stemming from the overutilization of ETH to capitalize on the potential airdrop for the new POW forks. Meanwhile, DyDx gave an update on its reaction to the DOJ sanctions by briefing that the protocol is currently blocking less than 0.1% of accounts connected to the site.

Scalable DeFi. Solana has recently been on a roll as the network has been seeing heaps of developmental activity, ranking it as the second leading cryptocurrency in terms of GitHub commits. That said, Tsunami, the first decentralized exchange with a zero-fee swapping experience, announced its looming launch on SOL. Another exciting entrant was Kamino Finance, a concentrated liquidity market maker protocol designed to address AMM's inefficiencies and one resembling the Uniswap V3 market on Ethereum. Finally, Cardano's first money market protocol is ready to launch. Aada finance is expected to deploy on the network's mainnet on September 13, introducing the first DeFi primitive to the POS network and marking a new era.

In light of Lido's dominance over the liquid staking vertical and Coinbase's recent entry into the sub-sector, BNB has introduced soft-staking in a partnership with Ankr, Stader, pStake. The instrument should increase the utility of its native token by enabling further compatibility within the network's DeFi ecosystem and freeing up idle capital. Similarly, the Lido community put forward a new proposal to unleash a cross-chain framework to implement liquid staking across the Cosmos universe. The solution is nominated to be deployed on the Neutron chain, as it would allow staking the 40+ cosmos-based chains in a trust-minimized manner, without the need to build up customizable smart contracts for each new aspiring chain. Lido's product would be the second in line after Stader's liquid-staking solution

NFTs and Metaverse

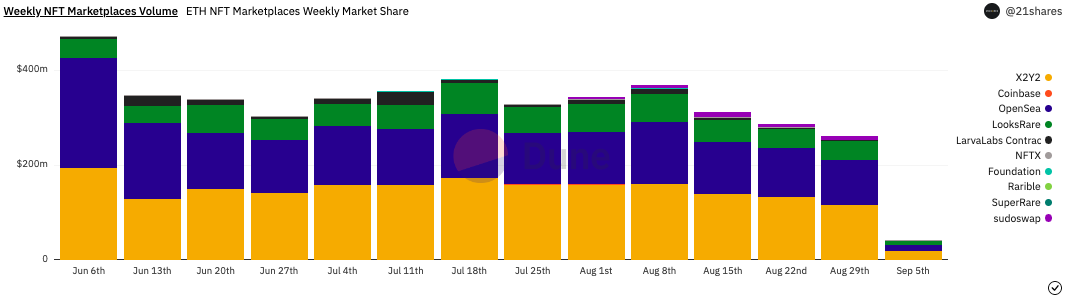

Trading volume of non-fungible tokens (NFTs) on Ethereum-based marketplaces has declined by 9.6% over the past week. Whereas it has jumped by 62.98% and 36.43% on Binance Chain and Solana respectively. You can visit this link to check our live charts on Dune Analytics; our dashboard made it to the top 10 last week.

Figure 5: Weekly NFT volume on ETH-based marketplaces

Source: 21Shares, Dune Analytics

In the lead-up to the Merge, excitement has been circulating among NFT marketplaces, with some expressing exclusive support for the proof-of-stake ETH. Looksrare announced it would not support any proof-of-work forks of Ethereum. Opensea also warned that it would only recognize NFTs on the proof-of-stake chain.

Blockchain analytics company, Elliptic, published a report showing that the “report scams” channels of most mainstream NFT servers registered over 75,000 messages since July 2021, of which 76% were sent in 2022.

Figure 6: Number of messages reporting scams across select NFT-related servers

Source: Elliptic. Note: Not all messages are scam reports – some may be replies or requests for further information

Market sentiment hasn’t slowed down adoption. Crypto bank Sygum will be the first Swiss bank to open a hub on the metaverse on September 27, as it will launch “Decentraland Hub” during a live streaming event on Decentraland. Tacobell is also partnering with Decentraland to offer US couples the chance to have a virtual wedding. As the Football World Cup simulation game approaches, launching on September 27 as well, FIFA is scheduled to launch a World Cup NFT collection on Algorand. Socios, a crypto project specialized in creating fan tokens, is building a Web3 rewards-and-engagement program for the Argentine Football Association and has extended its deal to provide the $ARG fan token to the football association through at least 2026.

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

.jpg)