Bitcoin Resists FUD While Everyone Moves to Solana: What Happened in Crypto This Week?

This Week in Crypto

- Mixed Reactions to Macro Data Pose Uncertainty

- Bitcoin Resists the FUD

- Moving to Solana Beach? Me Too!

Mixed Reactions to Macro Data Pose Uncertainty

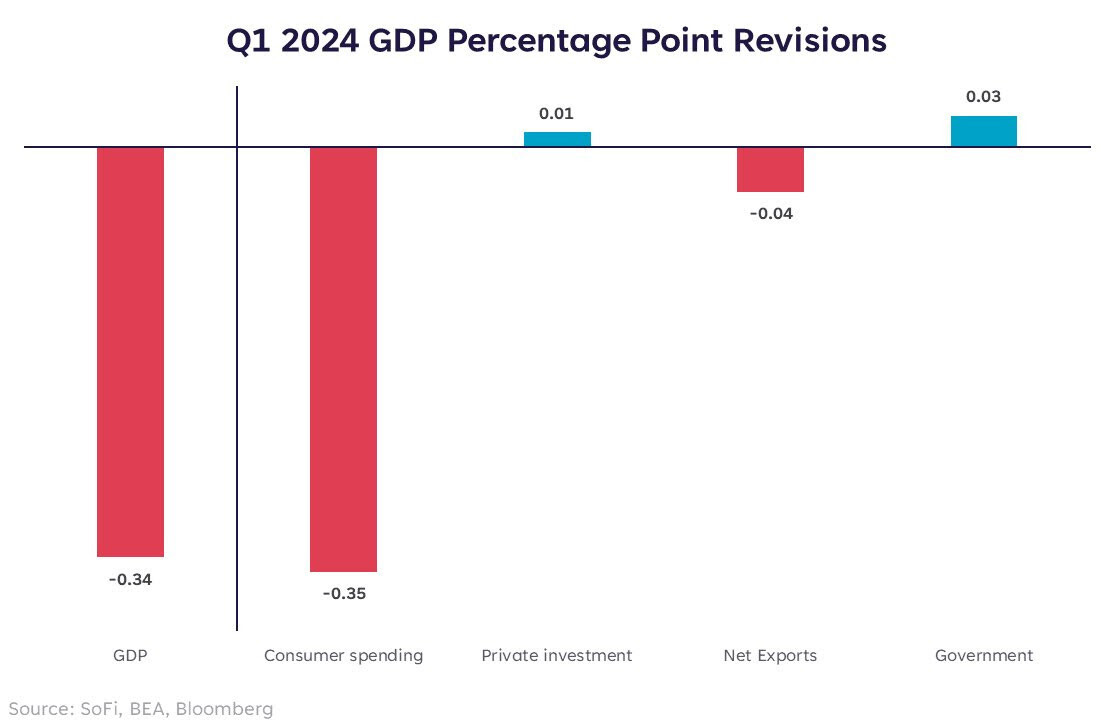

As inflation cooled in the U.S., consumer spending pulled the country’s economic growth to a record low. In the first quarter of this year, the GDP in the U.S. grew at the slowest rate since the reading of Q2 of 2022, increasing by 1.3% from last year. The main driver for this was consumer spending, decreasing by 0.35%, as shown in Figure 1. For the month of April, the Federal Reserve’s preferred measure of inflation, the Personal Consumption Expenditure (PCE), met expectations, increasing by 2.8% from last year while moving in this range for about five months now. Unless the next reading breaks the pattern, it will not be comforting for the Fed to move below the 23-year-high interest rates.

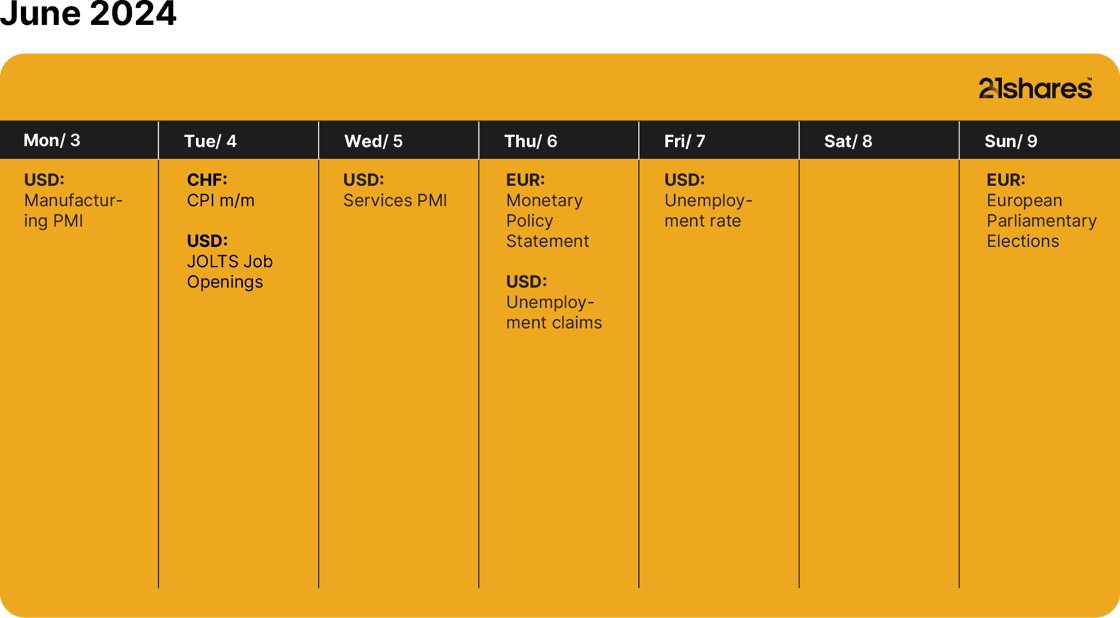

A key signal for cooling inflation came out on June 3, indicating that manufacturing activity and construction spending eased more than expected in May, as per the Manufacturing Purchasing Managers' Index (PMI) reading. Although the stickiness has pushed some Federal Reserve officials to rethink and relax the classic 2% target, some Fed high ranks are even considering hiking interest rates even higher.

Figure 1 – Consumer Spending Pulled Down the GDP for Q1 2024

Source: SoFi, BEA, Bloomberg

This week, some indicators are coming out to test the waters of the labor market. Less competition for talent should bode well for the economy, as companies won’t need to raise their prices to cater to increasing payrolls. Leading to a slight decrease in the Consumer Price Index for April, the labor market increased by 175K jobs, about a third of the monthly average, marking the slowest job gains in six months. Bitcoin rallied shortly after the announcement on May 15, after a sustained period of low volatility the previous month.

As shown in the calendar at the end of this newsletter, the Job Openings and Turnover Survey, along with unemployment claims and rates, are expected to shape up the Fed’s decision on interest rates on June 12. With consumer spending cooling, bringing down both the GDP and manufacturing PMI, inflation seems to be headed in the right direction. However, uncertainty still clouds monetary policy expectations with consecutive stagnant PCE readings, which unfortunately impeded progress to control inflation. That said, the market expects a rate cut as early as September, according to the CME FedWatch tool, which would ease borrowing costs and stimulate investment in risk-on assets like stocks and cryptoassets.

With the first presidential debate just a few weeks away, cryptoassets are getting a lot more political than they have been in the past. The Biden administration fulfilled its promise to veto the bill nullifying the 121st Staff Accounting Bulletin (SAB121) of the Securities and Exchange Commission (SEC). However, the veto message also conveyed the President’s intention to work with Congress to reach “a comprehensive and balanced regulatory framework for digital assets.”

So, what’s next? The bill, titled H.J.Res. 109, returned to the House and further consideration of the veto message and joint resolution will be held on July 10, 2024. Although unlikely, Congress can override the veto and SAB121 can still be overturned if the bill gets a two-thirds majority vote. As covered in our monthly review, the purpose of nullifying SAB121 is to diversify crypto custodians. So far, only four custodians are servicing the 11 Bitcoin spot ETFs, a major concern for Congress. Although Bitcoin was unphased by the veto, SAB121 would have a deeper market impact on financial firms so far discouraged from holding crypto on behalf of their clients due to the capital expenses stipulated by the current regulatory landscape. The bill nullifying the bulletin would have otherwise posed an advantage for investors who’ve also been discouraged from holding crypto outside traditional frameworks.

Bitcoin Resists the FUD

The Bitcoin market has been wrestling with fear, uncertainty, and doubt (FUD), especially with Mt. Gox moving $9B - for the first time in five years - to an unknown address last week, as discussed in our monthly review. Unfortunately, this week is no different. Mixed interpretations of macroeconomic data within the Federal Reserve seem to have reflected on Bitcoin’s short-term price movement, with $66K acting as a key support level. Moreover, the fly in the ointment was the news about the Japanese exchange, DMM Bitcoin, getting stripped of 4,502.9 BTC. The breach is considered the eighth largest of all time and the largest the industry has suffered since November 2022, when the now-collapsed FTX got exploited for $477M. As shown in Figure 2, the news led to a sell-off that sent Bitcoin to a local low of around $66K before it bounced back to near the $70K mark on June 3.

Figure 2 – Bitcoin’s Weekly Performance Against Key Events

Source: TradingView, 21Shares

Nonetheless, Bitcoin’s newest support level is still improving from last month’s level of approximately $57K. As noted in Figure 2, Bitcoin’s support levels have propelled the asset and helped it survive the week’s FUD. We expect low volatility and the sideways market to continue until the FOMC statement clears out uncertainty on June 12, unless institutional inflows help Bitcoin break the resistance level around $70K.

Furthermore, Bitcoin continues to play an increasingly growing role in politics. In the most recent example, presidential candidate Robert F. Kennedy Jr. announced at Consensus last week his recent purchase of 21 BTC, including three for each of his kids. Earlier in April, Kennedy also announced his intentions to bring the entire U.S. budget on-chain if elected president. In addition, investing in Bitcoin’s mining industry has also been a growing trend in 2024, with the latest being Senator Ted Cruz buying three Bitcoin miners in Texas. Finally, Donald Trump’s move to accept donations via the Lightning network makes him the first-ever presidential nominee to support campaign donations in Bitcoin.

This political allegiance to crypto, even if it’s just performative, reflects the changing stance towards this asset class and its underlying technology to serve as a backbone for the country’s economy rather than compete with it, which was the political approach adopted not too long ago. This shift does not only concur that crypto is here to stay but that Bitcoin and its hardcoded, scarce nature could even be a savior to an economy burdened with sticky inflation and public debt.

Moving to Solana Beach? Me Too!

Following a trend seen in 2024 by industry leaders like Uniswap and Aave, Solana has passed the proposal SIMD-0096 to revamp its fee structure. This critical shift was voted on in favor of 77% of voters and allocates 100% of priority fees to validators instead of the previous 50/50 split to burn half of the fee. While the change awaits mainnet implementation, it opens the door to revisit discussions on proposals like SIMD-0123 and SIMD-0109, which focus on block reward distribution and native tipping mechanisms. Regardless of the outcomes of these two proposals, the fee switch will significantly impact validator dynamics and the broader Solana economy.

A key reason behind the proposal is to address validators making “side deals” with users, inadvertently bypassing the fee structure. For context, users would previously need to double their priority fee to outbid a tip in the Solana ecosystem. This is because validators receive the full off-chain maximal extractable value (MEV) tips and, therefore would prefer processing these transactions over others. The proposal aims to fix this issue by giving validators the full priority fee, curbing their reliance on off-chain deals, and shifting their intentions from making financially beneficial deals to processing on-chain transactions, ultimately enhancing network security.

Solana’s activity this year may offer a glimpse into the potential impact of the fee switch proposal. The early 2024 memecoin boom saw a record of 2 million active addresses, boosting validator income, which peaked on March 18 with $5M in daily fees. However, the surge came at a cost, as network congestion caused roughly 70% of transactions to fail, as shown in Figure 3, which is not sustainable or acceptable for a protocol aiming to establish itself as a leading solution.

Figure 3 – Network Congestion Led to ~70% of Transactions to Fail

Source: 21co on Dune Analytics

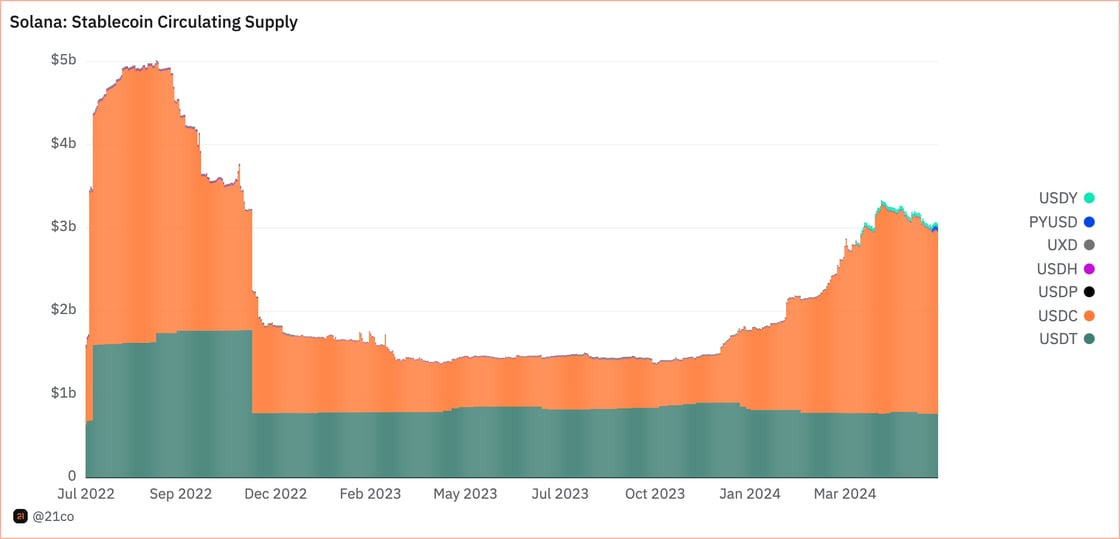

While memecoins brought Solana much-needed attention, more mature projects are now being implemented on the network. For instance, stablecoins have seen a rise in activity, following a nearly 2-year hiatus post-FTX, with $3B locked as shown in Figure 4. On this front, PayPal deployed its USD stablecoin on Solana, PYUSD, leveraging the protocol’s Token Extensions to facilitate unique features like Confidential Transfers, allowing the e-commerce leader to maintain confidentiality of transaction amounts while keeping other details visible for regulatory compliance. Their endorsement of Solana is massive for the network, given their status; however, it is not standalone! Recently, Visa piloted Solana stablecoins, Shopify integrated Solana Pay as a payment solution, and Stripe began accepting Solana USDC payments, underscoring the growing appetite for Solana as a settlement layer.

Figure 4 – Rise in Solana Stablecoin Supply

Source: 21co on Dune Analytics

Other major implementations include the interoperability protocol LayerZero, with additional projects like Pendle, GMX, and Aave set to follow suit and move to Solana. As the network continues to attract high-profile projects and transaction volumes rise, ensuring the network's scalability to handle increased activity is crucial. With the number of validators down to 1850 from 2850 in early 2023, SIMD-0096 could incentivize more validators to join, boosting capacity for its ambition to establish itself as a “retail” smart-contract platform and rival Ethereum’s dominance.

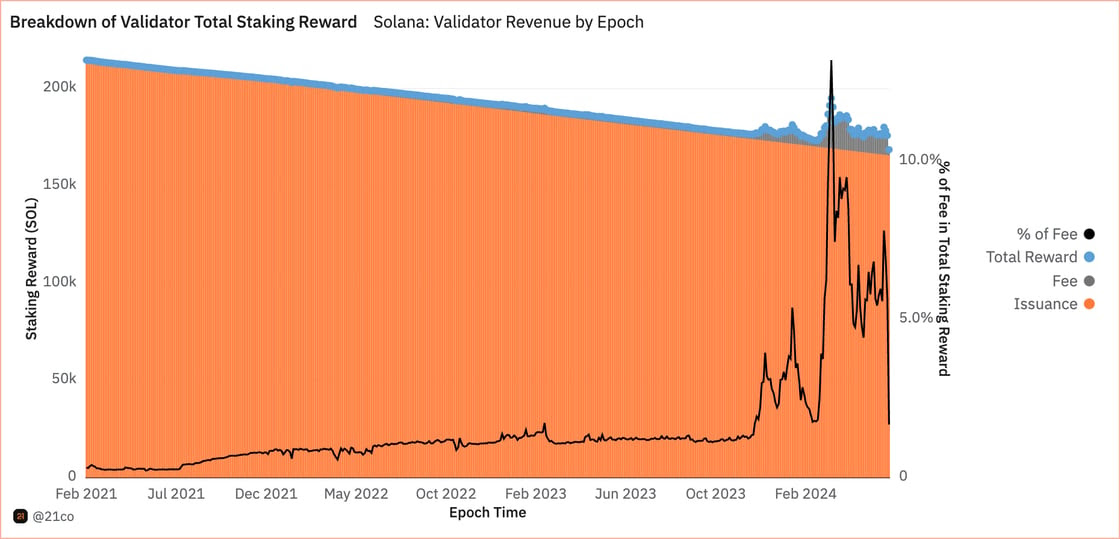

As more validators are incentivized to join the network amid the rise in activity, the fee switch proposal becomes even more critical for validator revenue. With more people staking Solana, the staking rewards earned by each validator will likely decrease. Currently, the staking yield, based on token issuance, makes up 95% of validator income but is gradually shrinking, as shown in Figure 5. This decrease highlights the importance of transaction fees as a future revenue stream for validators. By making transaction fees more attractive to validators, SIMD-0096 can help ensure strong network security in the future, as the enhanced revenue could help offset the declining staking yield, incentivizing validators to stay active over a longer time horizon.

Figure 5 – Breakdown of Validator Rewards

Source: 21co on Dune Analytics

Solana’s approved proposal overhauls its fee structure by giving validators 100% of priority fees, aiming to appropriately incentivize validators to process transactions and potentially attract more validators, which is especially timely as Solana implements more mature projects. The fee switch incentivizes long-term network security, as priority fee rewards are doubled, which represent a growing portion of validator revenue. That said, the proposal does challenge Solana’s inflation management. Previously, burning half of the priority fees helped control the token’s supply, and the Solana Foundation may need new solutions to prevent excessive inflation to ensure long-term sustainability. The potential impact of the fee switch on SOL’s inflation rate will be monitored given the long-term investor impact. Nevertheless, SIMD-0096 is set to be a crucial milestone for Solana to position itself as a significant player in the crypto industry, and the aforementioned associated proposals will also be closely followed as they play a key role in growing Solana’s validator activity.

This Week’s Calendar

Source: Forex Factory, 21Shares

.jpg)