Why Solana matters: Exploring its use cases and growing adoption

Solana is pushing the boundaries of what blockchains can achieve.

Recently surpassing BNB, the native token of the BNB Chain ecosystem, Solana (SOL) has claimed the #5 spot by market cap and outpaced the broader crypto market by 46% since August.

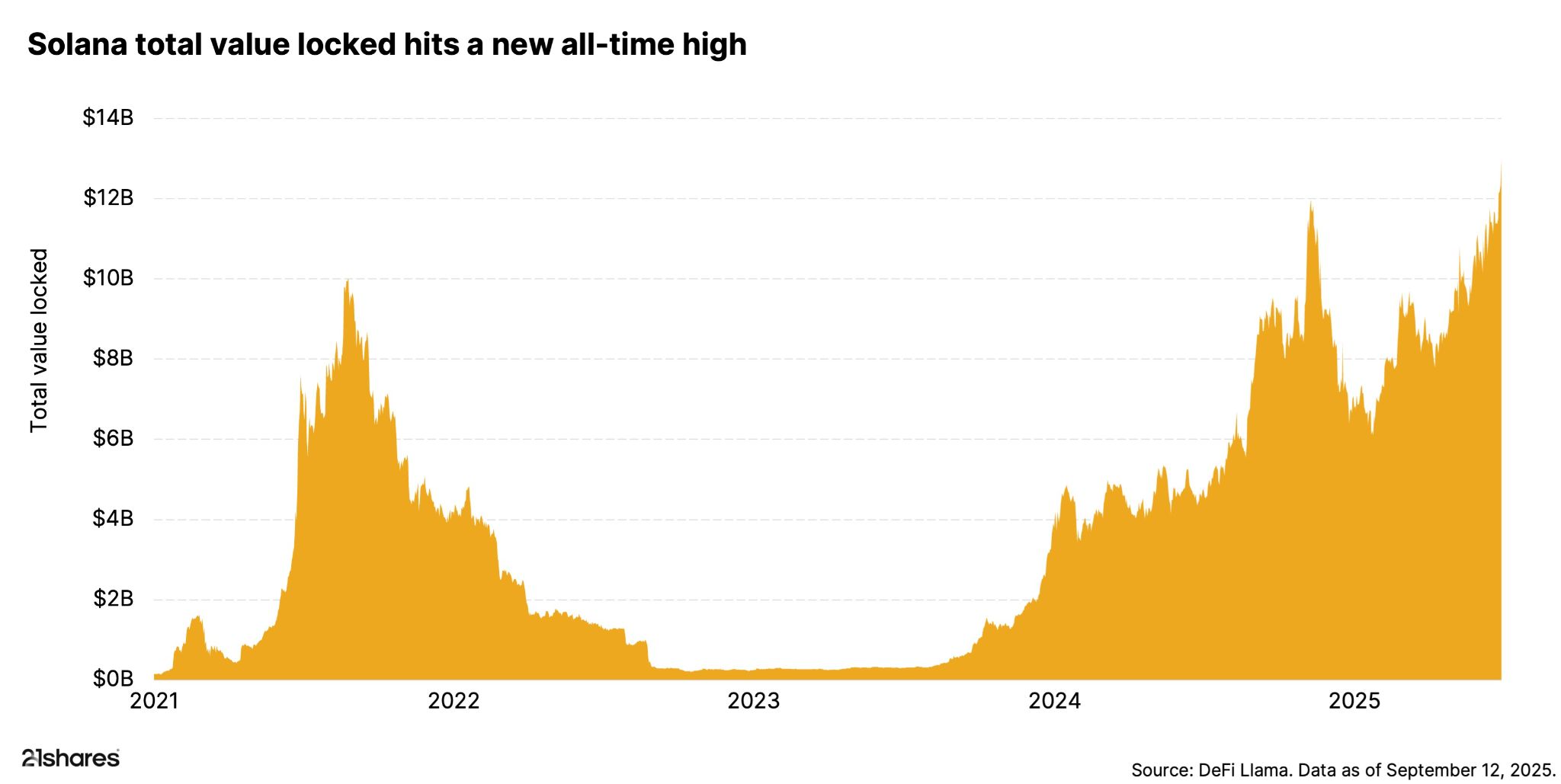

What’s fueling this momentum isn’t just market speculation; it’s powered by a surge in real-world use cases in recent weeks. This adoption is reflected in Solana’s new record-breaking total value locked (TVL), showing a growing number of users actively depositing funds and signaling strong engagement.

Here are the key use cases for Solana, along with some recent notable developments:

Decentralized finance (DeFi)

Solana powers DeFi by combining speed, low fees, and scalability, allowing users and developers to trade, lend, stake, and build complex financial applications at scale. Platforms like Raydium and Jupiter allow users to trade tokens directly on-chain without intermediaries, with transaction speeds measured in milliseconds and fees under $0.01 per trade, perfect for high-frequency trading and instant swaps. Lending and borrowing protocols like Solend let users earn interest or access liquidity against their assets, while staking and liquidity provision offer additional opportunities to generate yield.

Digital asset Treasuries

Publicly traded companies are adopting Solana as part of their digital asset treasury strategies. By holding significant reserves of SOL, Solana’s native token, they can generate yield through staking, gain exposure to the network’s growth, and diversify beyond traditional assets, all while directly participating in Solana’s expanding ecosystem.

A notable example is Forward Industries (NASDAQ: FORD), which recently secured a $1.65 billion private investment in public equity (PIPE). The funding will support a Solana-focused digital asset treasury strategy, including acquiring SOL for working capital, facilitating future transactions, and building cryptocurrency treasury operations.

The PIPE was led by Galaxy Digital, Jump Crypto, and Multicoin Capital, collectively contributing over $300 million, marking one of the largest corporate moves into Solana-based treasury management to date.

Stablecoin adoption and payments

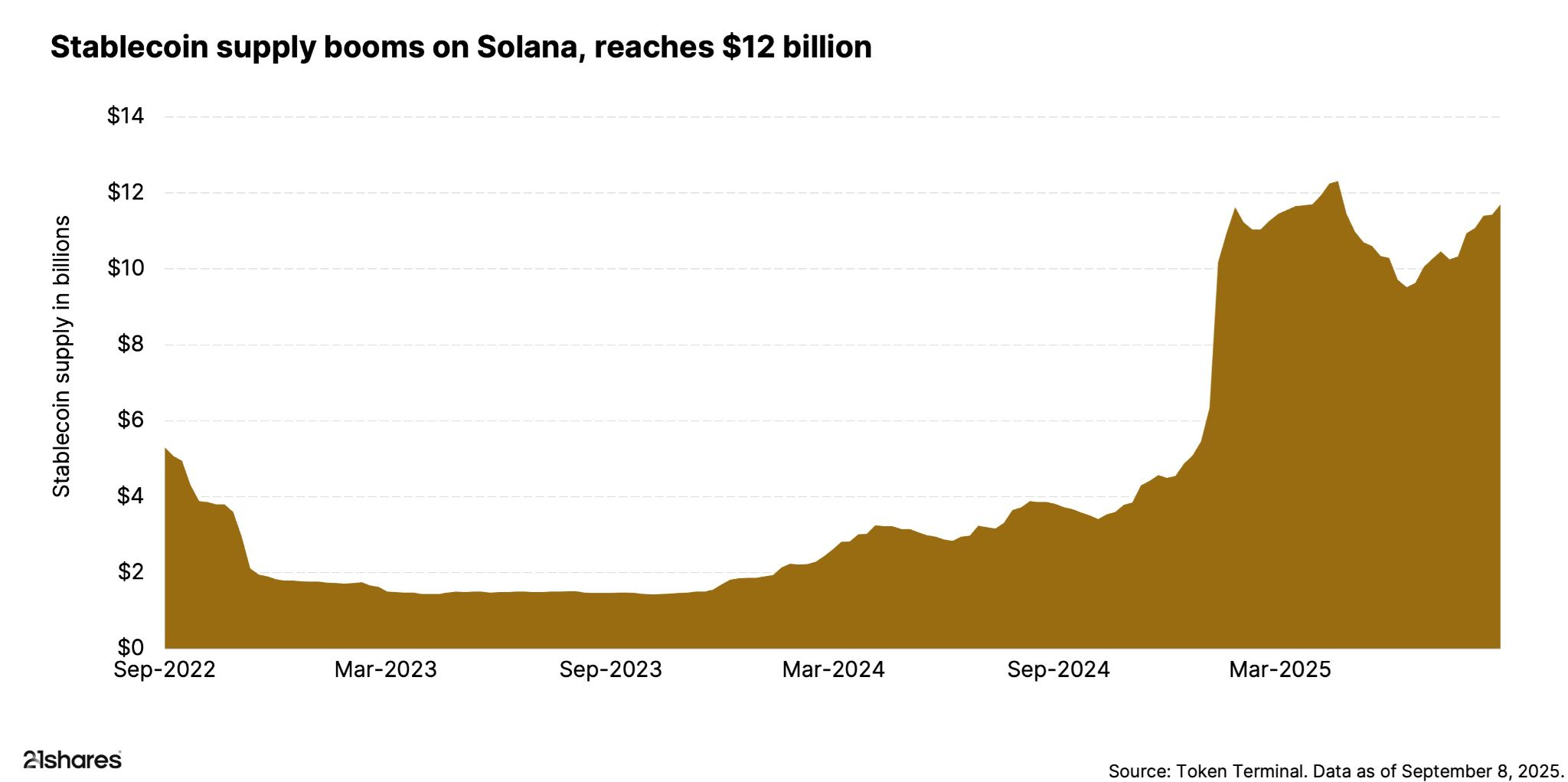

Stablecoin adoption on Solana has skyrocketed, with more people and businesses using digital dollars like USDC and USDT for payments, trading, and other financial activities. In less than a year, total usage has grown nearly sixfold, climbing from $2 billion in early 2024 to over $12 billion by early 2025. The chart below illustrates this dramatic growth.

The surge is driven by Solana’s unmatched efficiency: near-instant transaction speeds and ultra-low fees that average just $0.004, even at peak demand.

And it’s about to get even faster. Earlier this month, the network approved the Alpenglow upgrade, which aims to slash transaction finality from roughly 12.8 seconds to just 150 milliseconds–an 85x improvement.

Tokenization

Solana is emerging as a leader in real-world asset (RWA) tokenization, bringing stocks, commodities, real estate, and more onto the blockchain. Earlier this month, Solana’s RWA total value locked hit a new all-time high of $500 million, underscoring accelerating adoption.

Crypto exchange Kraken has launched xStocks on Solana, offering tokenized US equities and expanding access to investors across the European Union. Building on that momentum, Galaxy Digital became the first Nasdaq-listed company to issue SEC-registered equity on a public blockchain, partnering with fintech firm Superstate to tokenize its Class A common stock ($GLXY) on Solana.

This report has been prepared and issued by 21Shares AG for publication globally. All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however, we do not guarantee the accuracy or completeness of this report. Crypto asset trading involves a high degree of risk. The crypto asset market is new to many and unproven and may have the potential not to grow as expected.Currently, there is relatively small use of crypto assets in the retail and commercial marketplace in comparison to relatively large use by speculators, thus contributing to price volatility that could adversely affect an investment in crypto assets. In order to participate in the trading of crypto assets, you should be capable of evaluating the merits and risks of the investment and be able to bear the economic risk of losing your entire investment.Nothing herein does or should be considered as an offer to buy or sell or solicitation to buy or invest in crypto assets or derivatives. This report is provided for information and research purposes only and should not be construed or presented as an offer or solicitation for any investment. The information provided does not constitute a prospectus or any offering and does not contain or constitute an offer to sell or solicit an offer to invest in any jurisdiction. The crypto assets or derivatives and/or any services contained or referred to herein may not be suitable for you and it is recommended that you consult an independent advisor. Nothing herein constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal recommendation. Neither 21Shares AG nor any of its affiliates accept liability for loss arising from the use of the material presented or discussed herein.Readers are cautioned that any forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors.This report may contain or refer to material that is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would subject 21Shares AG or any of its affiliates to any registration, affiliation, approval or licensing requirement within such jurisdiction.