Ethereum Staking 101: Why we don’t stake 100%

Ethereum staking has become one of the most important ways to earn passive income in crypto. It rewards participants for helping keep the Ethereum network secure, much like earning interest for supporting a financial system through bonds. When combined with the potential price gains, staking returns have often surpassed those of traditional assets.

As of September 2025, staking is being integrated into regulated US exchange-traded funds (ETFs), following the lead of European exchange-traded products, which have included it since 2019. There’s growing attention on how these funds manage rewards, risks, and liquidity for investors.

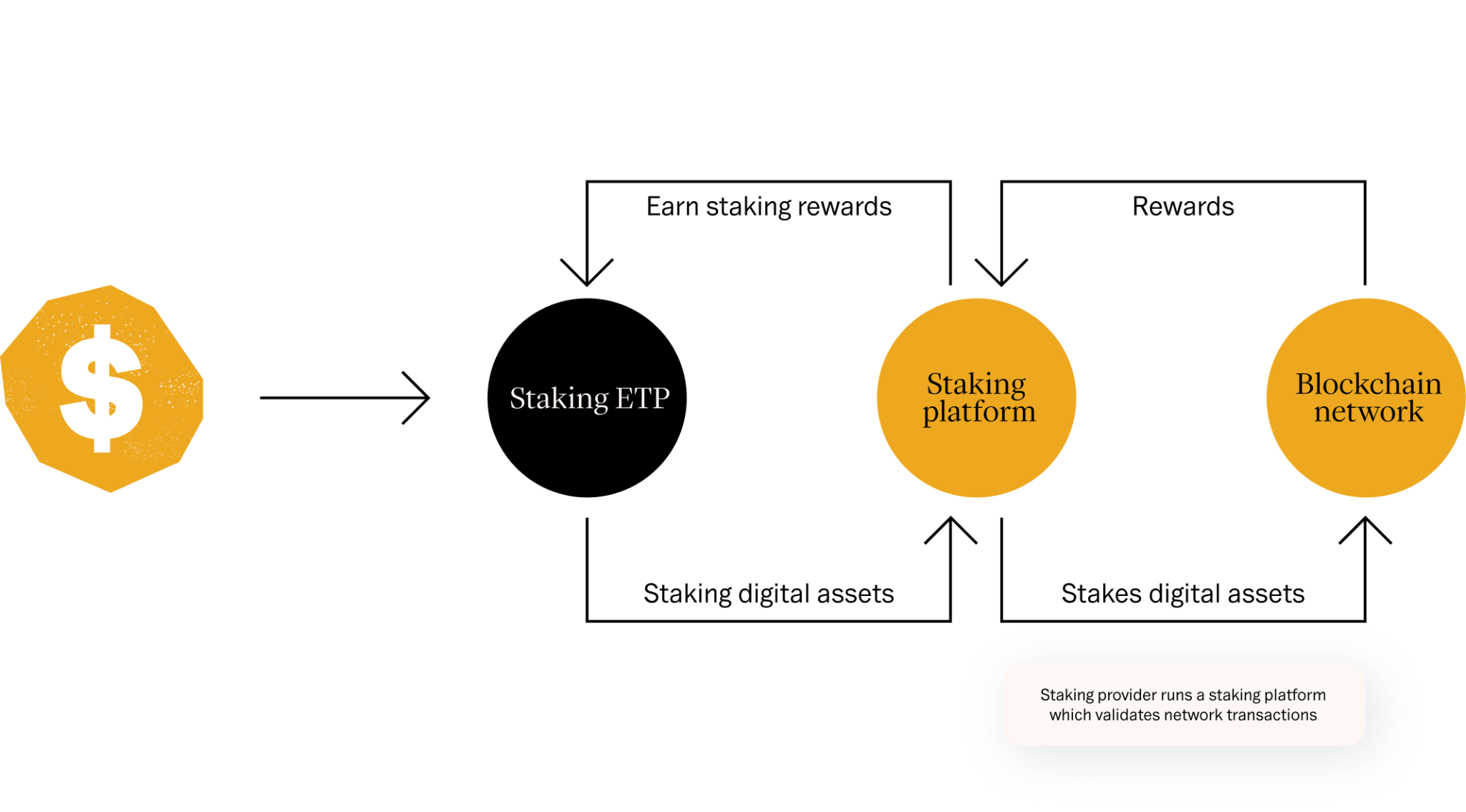

How does staking work in ETPs?

Staking through an ETP or an ETF combines efficiency and accessibility. Here’s how it works:

- Transparent setup: The ETP issuer “stakes” the Ethereum (ETH) held by certain ETPs using staking providers, such as Coinbase Cloud or Blockdaemon. These assets stay in segregated, cold-storage accounts under the safekeeping of the ETP issuer’s custodians.

- Network participation: The staking provider uses the ETP’s ETH to help validate transactions on the Ethereum network, earning rewards in return.

- Reward reinvestment: These rewards, distributed as new ETH, are reinvested into the ETP to enhance its long-term performance, with the ETP issuer typically taking a small fee to administer the process.

- ETPs maintain liquidity buffers: Unstaking (withdrawing staked ETH) involves waiting periods set by the Ethereum network, ranging from days to months. ETP issuers use proprietary systems to manage these timelines and adjust staking levels based on redemptions and market conditions. To ensure investors can buy or sell shares at any time, part of the ETH remains unstaked.

Staking through an ETP removes the technical complexity of doing it yourself. No need to run software, manage private keys, or worry about network penalties. Investors get the same exposure to staking rewards with:

- Institutional-grade custody

- Regulatory oversight

- Easy trading on traditional exchanges

- Simplified tax reporting

Why not stake 100%? Lessons from recent turbulence

The rationale boils down to risk management.

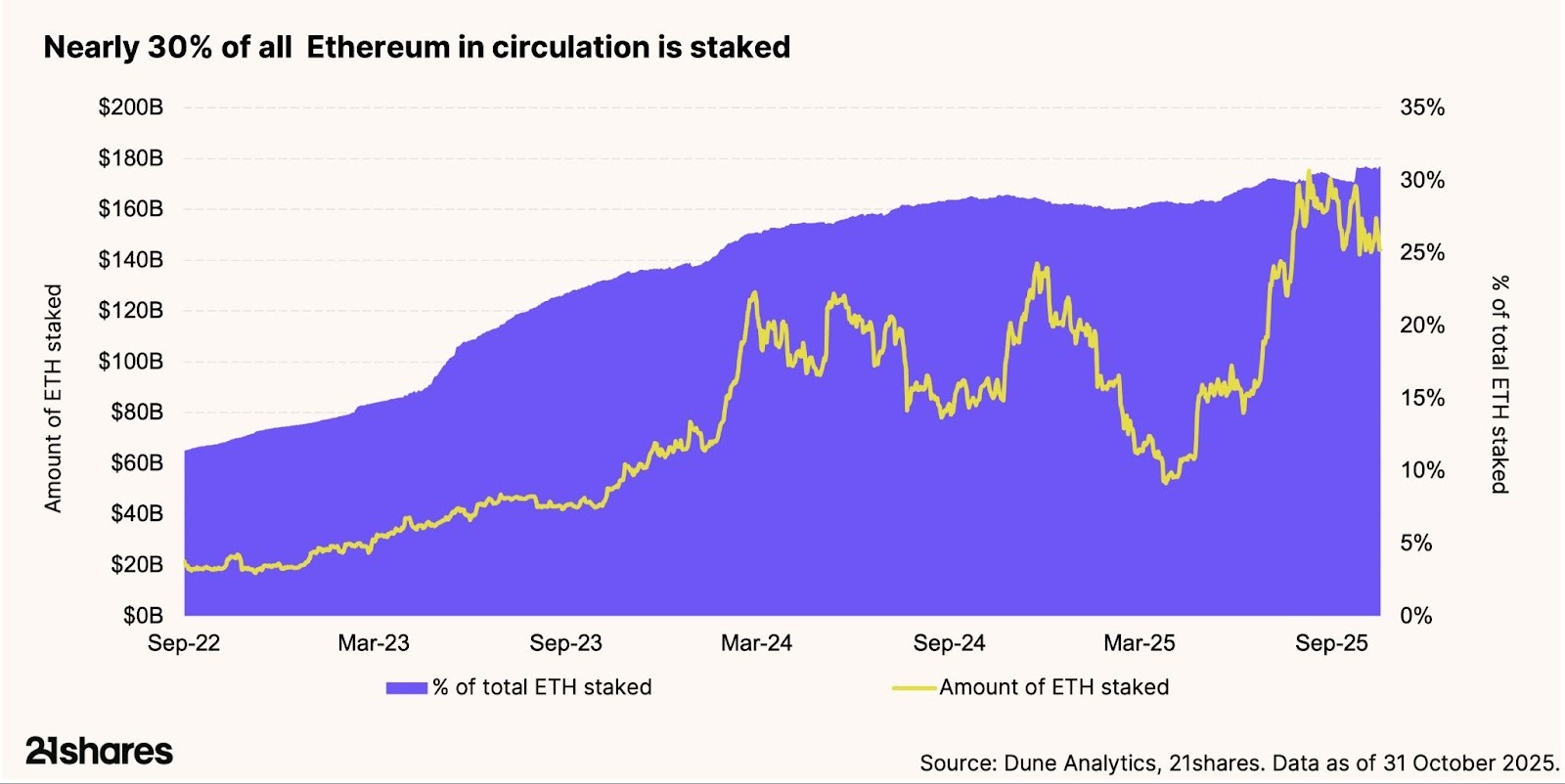

Last month, a security breach at Kiln1, one of the industry’s major staking providers, exposed a key vulnerability. Hackers compromised Kiln’s API, redirecting a $41 million Solana withdrawal. In response, Kiln paused operations and began mass unstaking clients’ ETH. This sudden rush into Ethereum’s exit queue injected billions of dollars’ worth of ETH, pushing withdrawal times from about 20 days to more than 45 days, the longest delays in the network’s history. Even now, as shown in the chart below, over 2.5 million ETH remain lined up for withdrawal, keeping the queue highly congested.

Nearly 30% of all Ethereum in circulation is currently staked, a record level of participation. While that demonstrates confidence in the network, it also concentrates risk: A sudden drop in staking yields or investor confidence could cause mass withdrawals, which would further clog Ethereum’s exit queue, delaying redemptions across the market.

How do ETPs protect investors, and what are the risks?

One approach is imperative: protecting liquidity and investor confidence over maximizing short-term yield.

For issuers of staking ETPs, staking too much, say, over 90% of assets, creates a major risk. In a withdrawal backlog, they might struggle to meet investor redemptions, eroding trust and liquidity.

Although not risk-free, one solution that avoids this pitfall is through a dynamic staking strategy. ETP Issuers adjust staking levels based on market conditions and redemption flows, keeping ample unstaked reserves on hand. This buffer ensures that investors can redeem their shares smoothly, even during periods of extreme volatility.

The bigger picture: Diligence over yield

As US crypto ETFs begin to incorporate staking, infrastructure security, and liquidity management are coming under greater scrutiny. Incidents like Kiln’s highlight how a single operational weakness can ripple across the entire ecosystem.

In this environment, design, discipline, and durability matter more than ever. That’s why ETP issuers don’t stake 100% of assets; it's not a limitation but a deliberate choice rooted in risk management.

As Ethereum’s exit queues gradually normalize, the lesson is clear: vigilance today prevents crises tomorrow.

Footnotes:

- Nijkerk, Margaux. “Kiln Exits Ethereum Validators in ‘Orderly’ Move Following SwissBorg Exploit.” The Block, 10 Sept 2025. Accessed 2 Nov 2025. https://www.theblock.co/post/370141/kiln-exits-ethereum-validators.

This report has been prepared and issued by 21Shares AG for publication globally. All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however, we do not guarantee the accuracy or completeness of this report. Crypto asset trading involves a high degree of risk. The crypto asset market is new to many and unproven and may have the potential not to grow as expected.Currently, there is relatively small use of crypto assets in the retail and commercial marketplace in comparison to relatively large use by speculators, thus contributing to price volatility that could adversely affect an investment in crypto assets. In order to participate in the trading of crypto assets, you should be capable of evaluating the merits and risks of the investment and be able to bear the economic risk of losing your entire investment.Nothing herein does or should be considered as an offer to buy or sell or solicitation to buy or invest in crypto assets or derivatives. This report is provided for information and research purposes only and should not be construed or presented as an offer or solicitation for any investment. The information provided does not constitute a prospectus or any offering and does not contain or constitute an offer to sell or solicit an offer to invest in any jurisdiction. The crypto assets or derivatives and/or any services contained or referred to herein may not be suitable for you and it is recommended that you consult an independent advisor. Nothing herein constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal recommendation. Neither 21Shares AG nor any of its affiliates accept liability for loss arising from the use of the material presented or discussed herein.Readers are cautioned that any forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors.This report may contain or refer to material that is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would subject 21Shares AG or any of its affiliates to any registration, affiliation, approval or licensing requirement within such jurisdiction.

.svg)