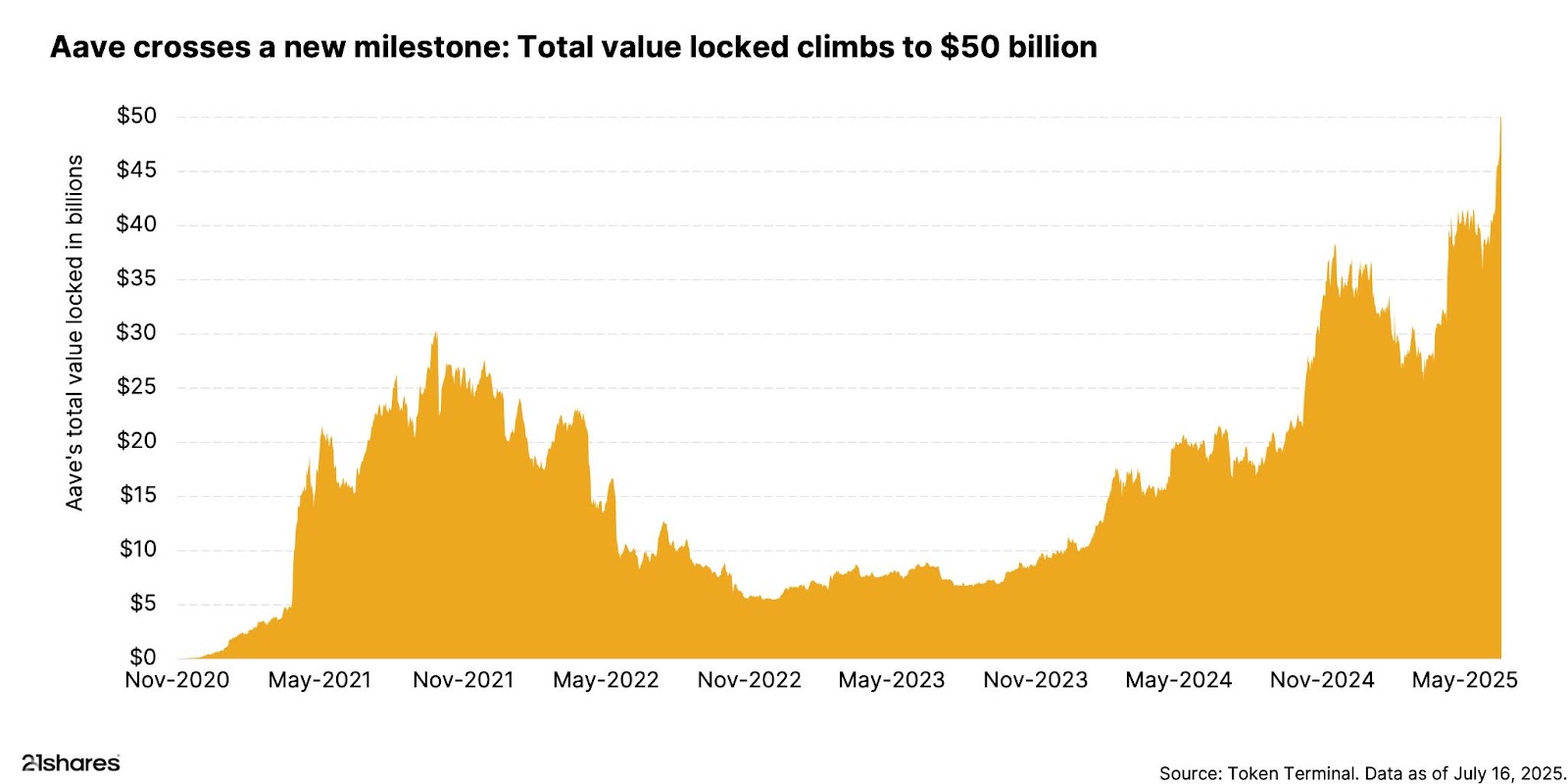

In the ever-evolving world of decentralized finance (DeFi), one name stands out as a beacon of innovation and growth: Aave. Recently, this powerhouse reached a monumental milestone, surpassing $50 billion in total value locked (TVL), an achievement that cements its status as the undisputed heavyweight of decentralized lending. Aave is the first lending protocol to achieve that milestone.

A journey from ETHLend to Aave

Aave, Finnish for “ghost”, has its roots in 2017 as ETHLend, one of the pioneers of decentralized lending. Its mission was clear: to eliminate intermediaries and revolutionize borrowing and lending through smart contracts on Ethereum. In 2018, ETHLend rebranded to Aave, switching from a simple peer-to-peer lending model to a more sophisticated liquidity pool-based approach. This strategic pivot has allowed Aave to flourish in the DeFi ecosystem and stand as a pillar of innovation.

Aave’s unstoppable momentum

The numbers speak volumes. In the second quarter of 2025 alone, Aave’s TVL surged by an astonishing 52%, outpacing the overall DeFi sector, which grew by a modest 26% in comparison. Here’s a glimpse into Aave’s standout metrics:

- Generating nearly $94 million in annualized revenue

- Commanding 60% of the total DeFi lending market

- Accounting for nearly 20% of all DeFi TVL

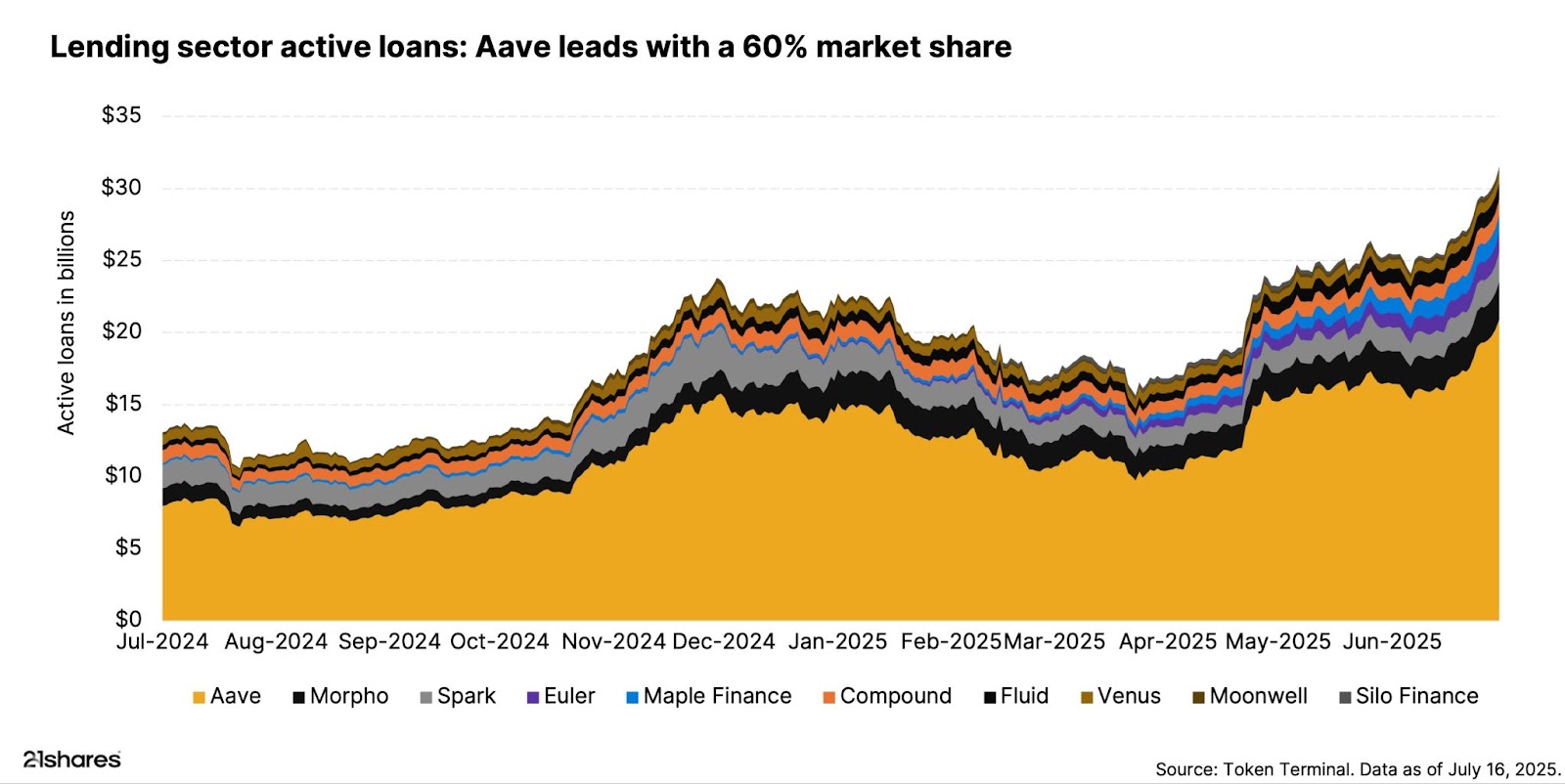

- ETH depositors earned $267.3 million worth of ETH annually

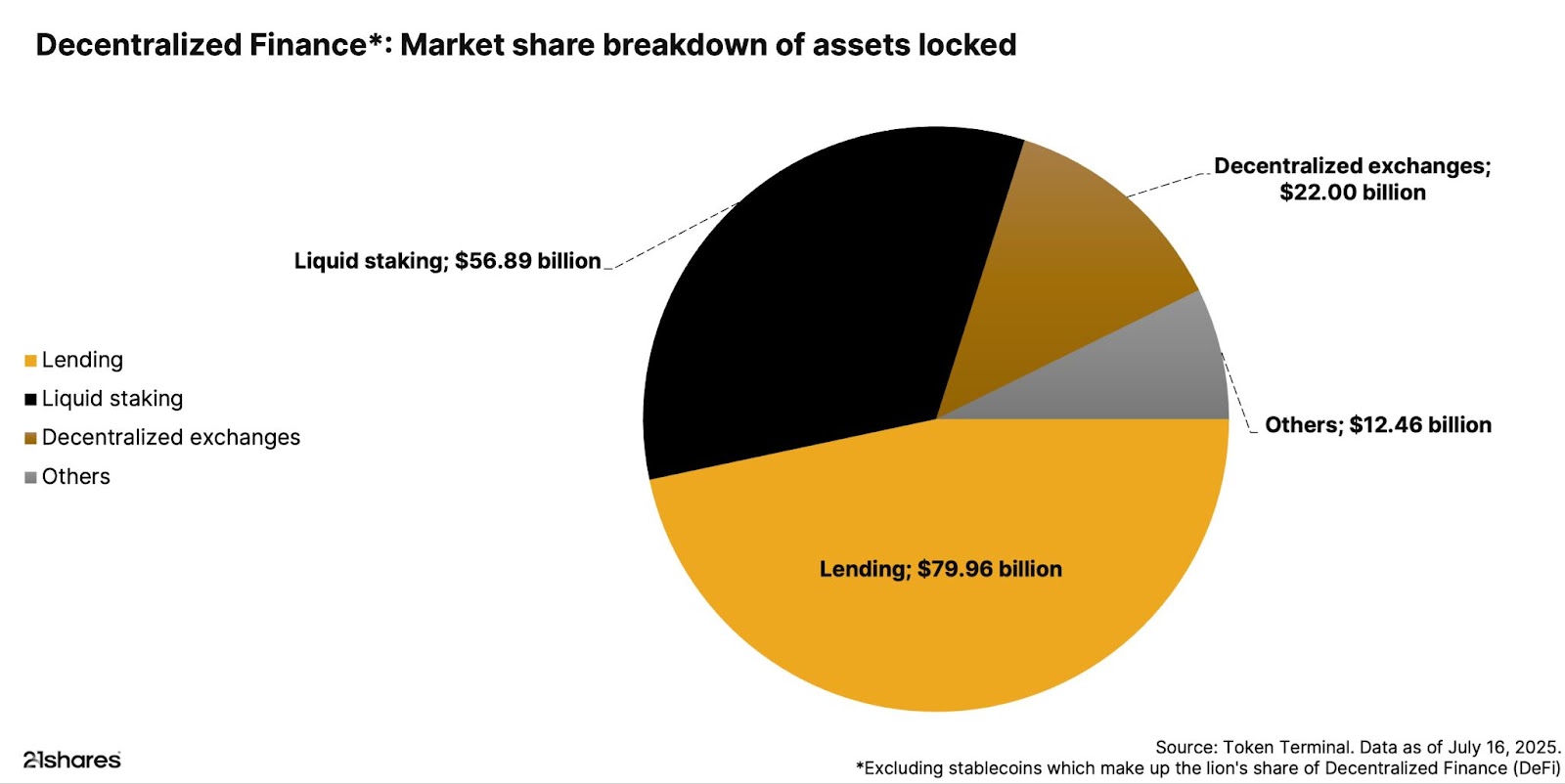

As DeFi returns to growth, with a total TVL of $419 billion, Aave’s dominance in the lending space is undeniable. With nearly $80 billion in TVL, lending is emerging as the clear frontrunner, driven by users seeking risk-adjusted yield opportunities and robust on-chain credit markets. But it’s not just about locked value. According to a recent report, Aave’s share of total deposits and borrows has jumped from 40% to 60%, accounting for $16.5 billion. The protocol also revealed that cumulative borrows have now surpassed $775 billion.

Despite a strong increase in competition in the DeFi lending and borrowing space, Aave has grown its market share and dominance significantly.

Why Aave is winning

Aave’s continued rise can be attributed to a combination of factors:

- Cross-chain coverage: Aave operates on more than a dozen blockchains, including Ethereum and its Layer 2 solutions, such as Arbitrum, Optimism, and Base. This extensive reach ensures deep liquidity and accessibility for users across different ecosystems.

- Institutional adoption: With the upcoming launch of Horizon, an initiative focused on institutional DeFi products, Aave is attracting the attention of fintech companies and traditional finance players alike. This growing acceptance signals a shift towards mainstream adoption of DeFi.

- Stablecoin layer: The launch of GHO, Aave’s native overcollateralized stablecoin, has added a new dimension of utility to the platform, boasting a market cap of $312 million and is poised for wider adoption.

- Flight to quality: In a post-risk-off market, users are increasingly favoring well-audited, battle-tested DeFi protocols with a track record. Aave’s track record positions it as a safe haven for users seeking reliable financial solutions.

With a near-majority control of DeFi lending and increasing traction on Ethereum’s Layer 2s, Aave isn’t just surviving the bear-to-bull transition in DeFi. It’s thriving and setting the pace for what’s next.

What's coming next

Aave shows no signs of slowing down. The upcoming V4 upgrade promises to introduce a new “Hub and Spoke” design aimed at unifying fragmented liquidity and enhancing capital efficiency. This upgrade will introduce account abstraction and native real-world asset vaults, propelling Aave into new territories.

Moreover, the Aave DAO is exploring proposals to support Bitcoin Layer 2 networks and expand GHO’s reach to additional blockchains. This mix of technical refinement and product expansion positions Aave to scale beyond a crypto-native user base, inviting a new wave of investors to join the journey.

This report has been prepared and issued by 21Shares AG for publication globally. All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however, we do not guarantee the accuracy or completeness of this report. Crypto asset trading involves a high degree of risk. The crypto asset market is new to many and unproven and may have the potential not to grow as expected.Currently, there is relatively small use of crypto assets in the retail and commercial marketplace in comparison to relatively large use by speculators, thus contributing to price volatility that could adversely affect an investment in crypto assets. In order to participate in the trading of crypto assets, you should be capable of evaluating the merits and risks of the investment and be able to bear the economic risk of losing your entire investment.Nothing herein does or should be considered as an offer to buy or sell or solicitation to buy or invest in crypto assets or derivatives. This report is provided for information and research purposes only and should not be construed or presented as an offer or solicitation for any investment. The information provided does not constitute a prospectus or any offering and does not contain or constitute an offer to sell or solicit an offer to invest in any jurisdiction. The crypto assets or derivatives and/or any services contained or referred to herein may not be suitable for you and it is recommended that you consult an independent advisor. Nothing herein constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal recommendation. Neither 21Shares AG nor any of its affiliates accept liability for loss arising from the use of the material presented or discussed herein.Readers are cautioned that any forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors.This report may contain or refer to material that is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would subject 21Shares AG or any of its affiliates to any registration, affiliation, approval or licensing requirement within such jurisdiction.

.svg)