A slice of Bitcoin gives a big portfolio boost

One of the most common questions investors ask is: What happens if I add Bitcoin to my portfolio, and how much should I allocate to it?

Here’s what our analysis shows.

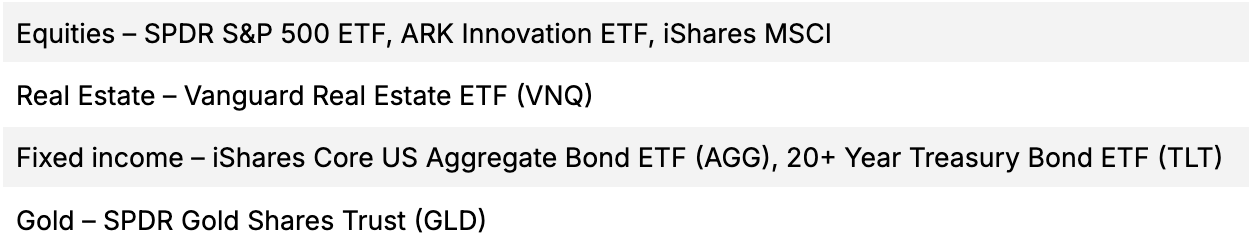

Correlation: Where crypto stands apart

Understanding how assets move in relation to one another is central to portfolio construction. Correlation analysis helps reveal whether a new asset amplifies existing risks or introduces meaningful diversification. To assess crypto’s fit, we examined a broad set of assets:

Figure 1: Correlation Analysis Asset Universe

Source: 21Shares, Bloomberg, Yahoo Finance, Coingecko

From July 1, 2022, to June 30, 2025, Bitcoin, Ethereum, and the broader crypto market maintained consistently low correlations with traditional asset classes. Bitcoin averaged 30%, Ethereum 34%, and the broader crypto market just under 35%. In contrast, traditional assets often clustered above 50%.

This makes crypto one of the few assets that can move differently from traditional investments like stocks or bonds. For investors, that’s a big deal as it means crypto can help diversify a portfolio and reduce overall risk.

Figure 2: Correlation of Returns Across Asset Classes: July 1, 2022 - June 30, 2025

Source: 21Shares, Data from Bloomberg and Yahoo Finance. Correlation calculated on a 10D rolling return window from July 1, 2022, to June 30, 2025. Color Description: Yellow denotes high correlation across assets, grey denotes low or negative correlation across assets.

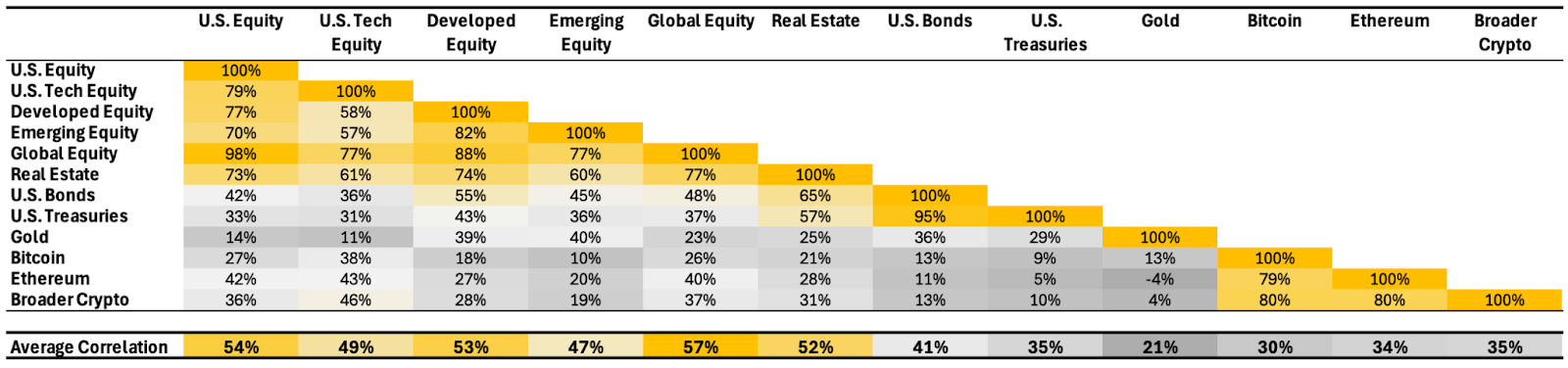

What happens if you add 5% Bitcoin to your portfolio?

Correlation is one thing, but how does crypto actually affect portfolio outcomes? To answer that, we built a balanced, multi-asset model portfolio designed to reflect the complexity of today’s investor allocations. Rather than relying on the traditional 60/40 split, we used a more modern framework:

Figure 3: Model Portfolio

Source: 21Shares, Bloomberg, Yahoo Finance, Coingecko.

To understand how crypto might fit in, we tested a 5% allocation in Bitcoin. The weight was sourced from US equities (2%), gold (2%), and real estate (1%) to reflect Bitcoin’s hybrid nature: part asymmetric growth potential, part emerging store of value, and potentially viewed as part of an alternatives sleeve.

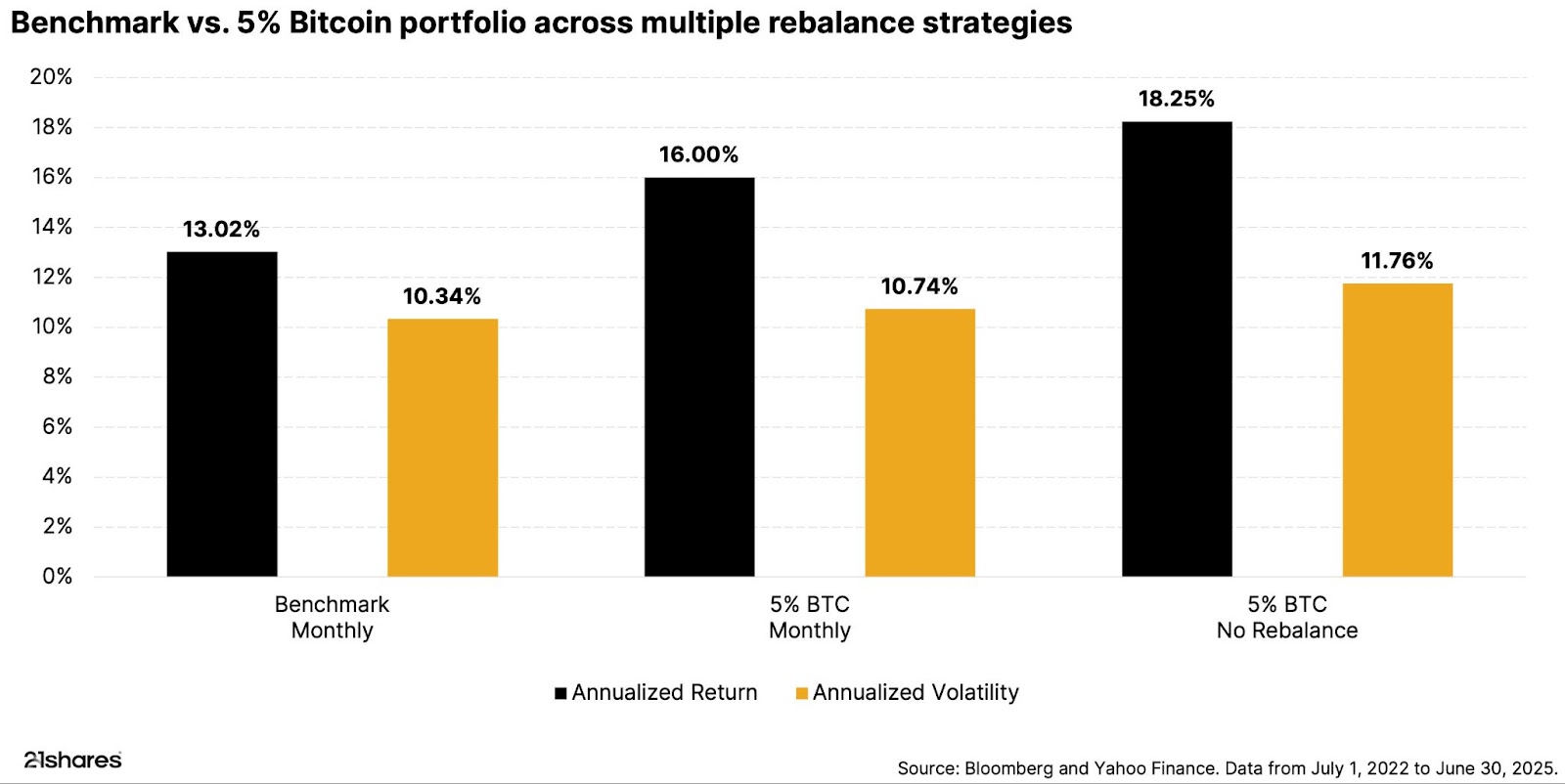

Stronger risk-adjusted returns: As shown in Figure 4, introducing a 5% Bitcoin allocation led to a clear uplift in both returns and efficiency. Cumulative returns rose to 65.34%, a gain of more than 20% over the benchmark.

Sharpe ratios improved even more dramatically, reinforcing that expanding exposure beyond a minimal allocation can strengthen overall performance.

Volatility remains manageable: Furthermore, annualized volatility remained stable. Across all strategies, it ranged from 10.74% to 11.76%, only slightly above the benchmark’s 10.34%, and still well within traditional risk tolerances.

This echoes a key finding: Bitcoin’s historical volatility doesn’t scale linearly at the portfolio level, especially when it’s a modest allocation within a diversified mix.

Figure 4: Simple Growth Portfolio with a 5% BTC Allocation Across Different Rebalancing Strategies

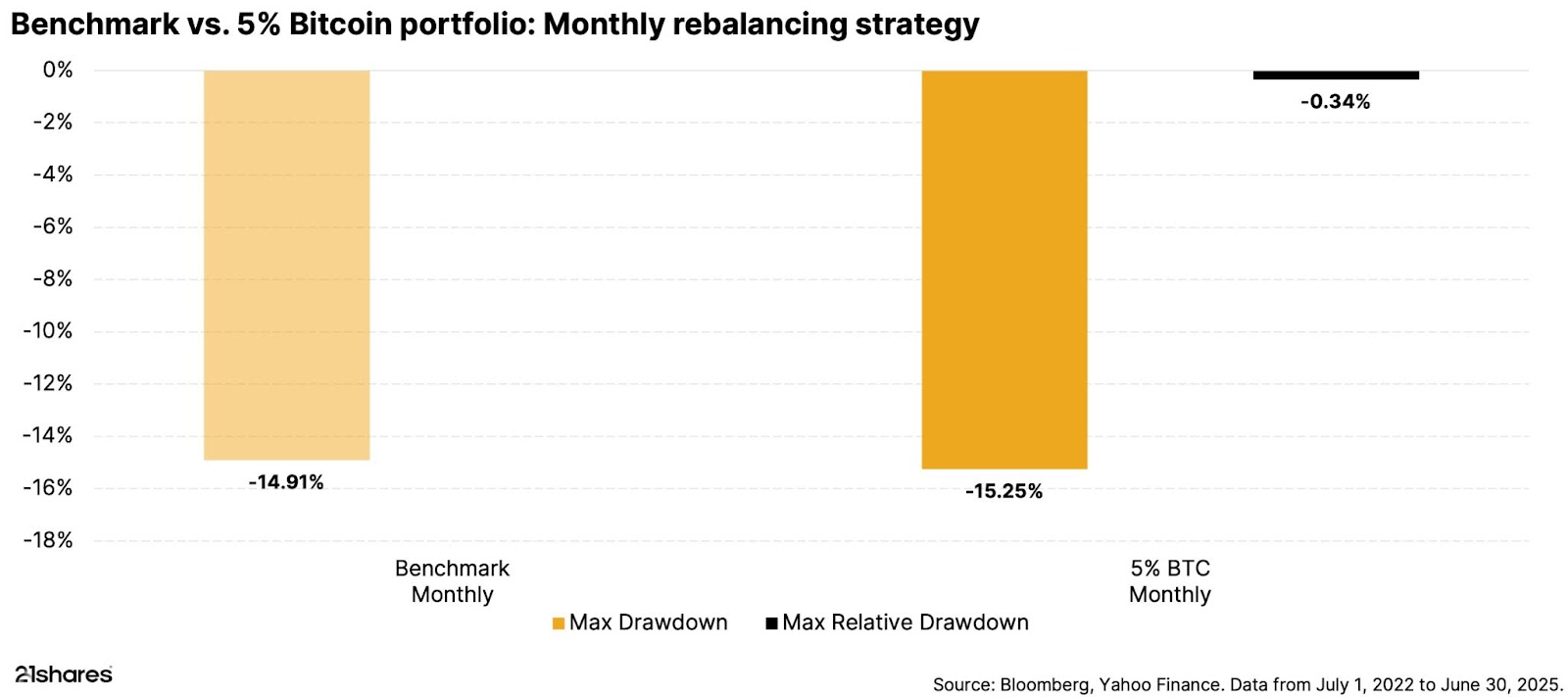

Well-contained downside risk: A common concern with crypto exposure is increased drawdown risk. Yet even at 5%, drawdowns remained tightly clustered. The worst-case scenario saw a max drawdown increase by just 0.52% at -15.43% versus the benchmark’s -14.91%. Most rebalanced strategies stayed even closer.

The key takeaway? Adding a small amount of Bitcoin to your portfolio doesn’t significantly increase risk. Historically, it boosted your returns while still staying within the safety limits of a typical investment strategy.

Figure 5: Simple Growth Portfolio with a 5% BTC Allocation Across Different Rebalancing Strategies

The Real risk? Missing the opportunity

Crypto is still growing, and any investment should match your goals and risk comfort. But two things stand out: Bitcoin is getting less volatile, and its price trend is moving up.

Want to see the full analysis? Check out our Q2 Portfolio Allocation Report for detailed backtests and examples.

This report has been prepared and issued by 21Shares AG for publication globally. All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report. Crypto asset trading involves a high degree of risk. The crypto asset market is new to many and unproven and may have the potential to not grow as expected.

Currently, there is relatively small use of crypto assets in the retail and commercial marketplace in comparison to relatively large use by speculators, thus contributing to price volatility that could adversely affect an investment in crypto assets. In order to participate in the trading of crypto assets, you should be capable of evaluating the merits and risks of the investment and be able to bear the economic risk of losing your entire investment.

Nothing in this report does or should be considered as an offer by 21Shares AG and/or its affiliates to sell or solicitation by 21Shares AG or its parent of any offer to buy bitcoin or other crypto assets or derivatives. This report is provided for information and research purposes only and should not be construed or presented as an offer or solicitation for any investment. The information provided does not constitute a prospectus or any offering and does not contain or constitute an offer to sell or solicit an offer to invest in any jurisdiction.

Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax, or other advice and users are cautioned against basing investment decisions or other decisions solely on the content hereof.