Why Bitcoin’s weak “Uptober” may lead to a strong year-end

“Uptober” hasn’t lived up to its name so far. Bitcoin has traded down, though it is now almost flat for the month, raising concerns it could snap its six-year streak of positive October performance.

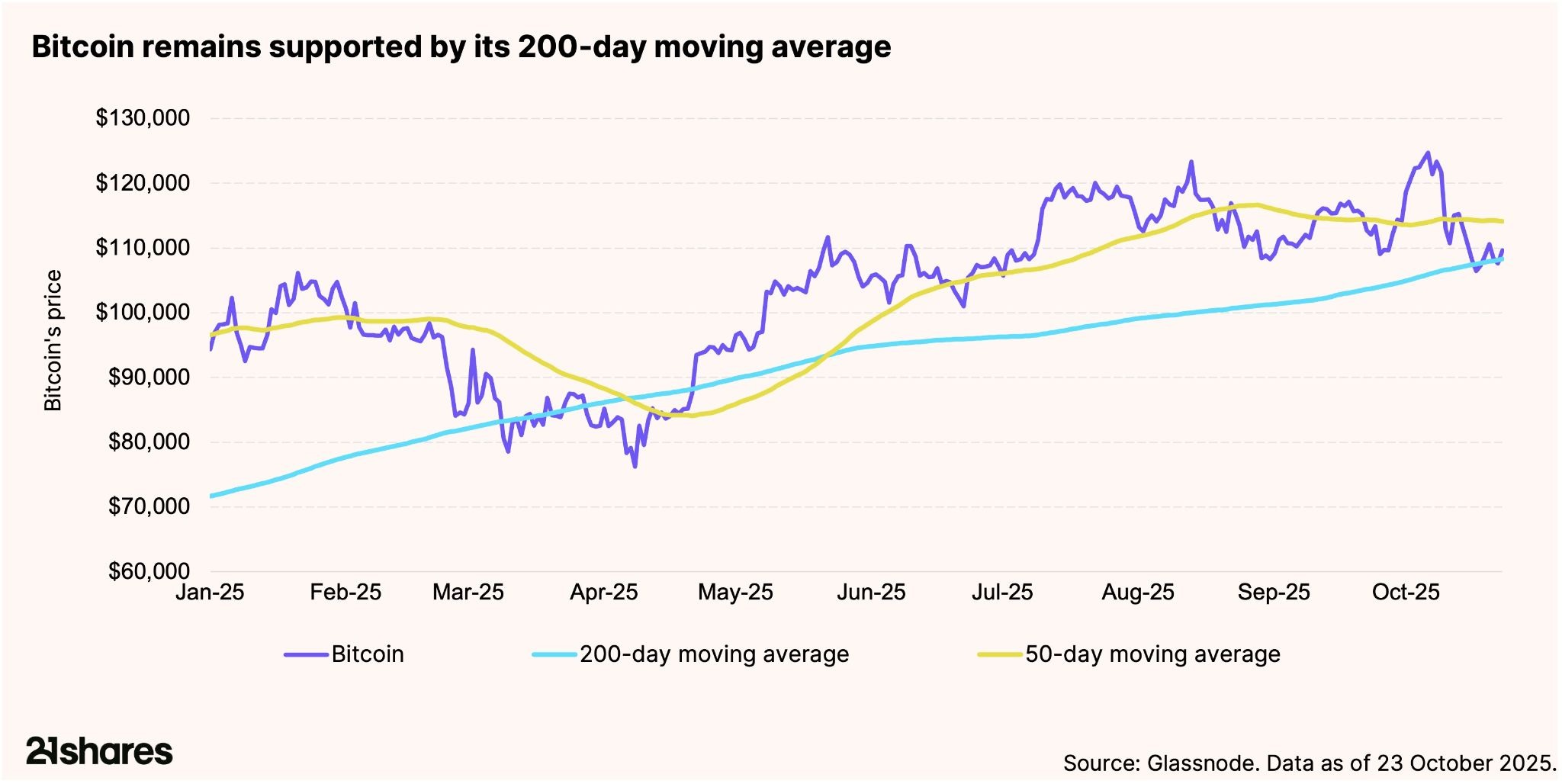

Technically, Bitcoin remains stuck in no-man’s land, trading below its 50-day moving average near $114,000 but clinging to its 200-day support around $108,000. The bounce from the recent CME futures gap closure has lacked conviction, with fading volume signaling market fatigue. A failure to move higher soon could invite a deeper retest of the $102,000 Binance wick recorded on October 10 or even the psychological $100,000 mark.

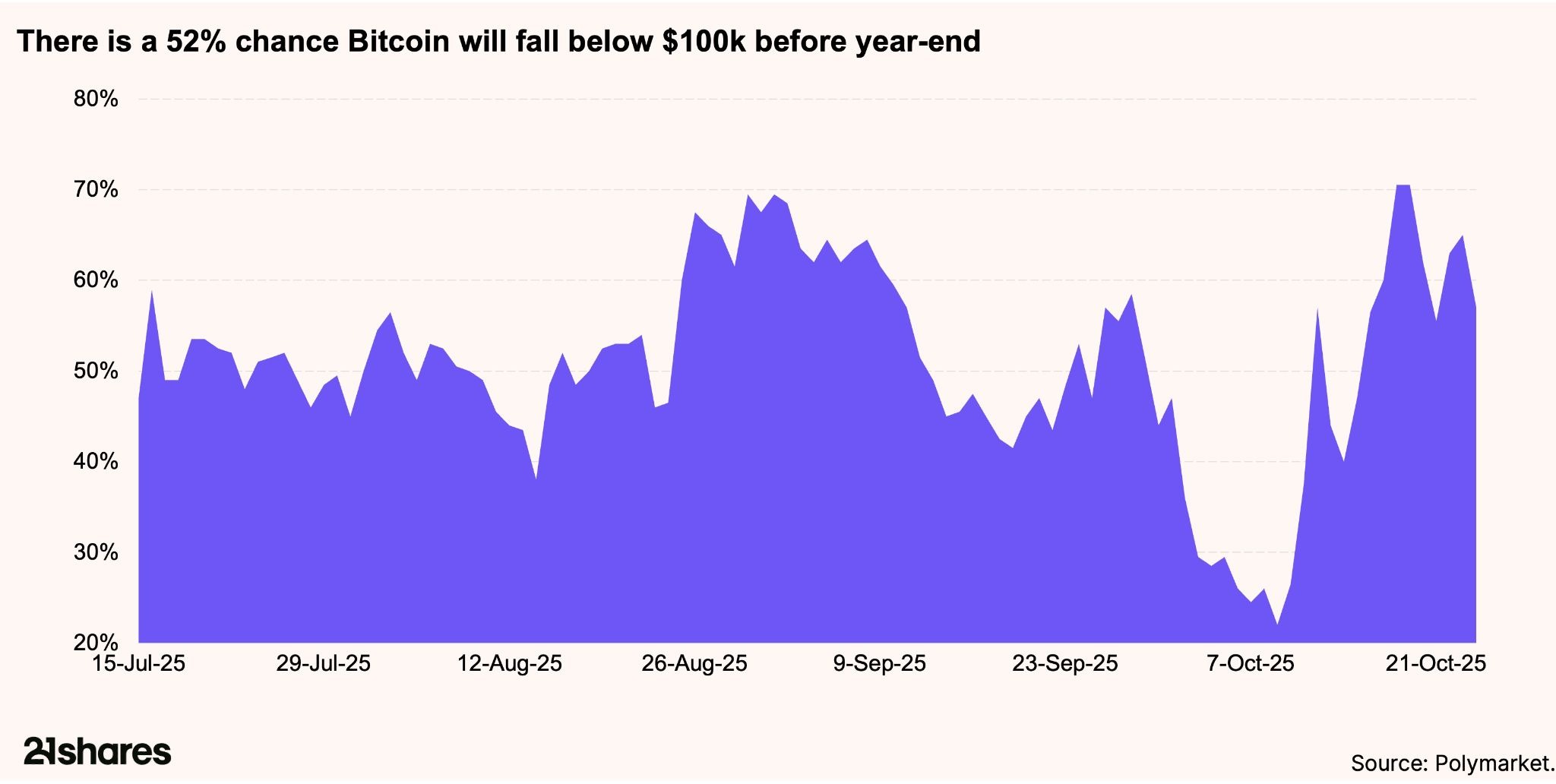

This market malaise has also left participants divided on Polymarket, the largest blockchain-based prediction market. Odds of Bitcoin dipping below $100,000 before year-end have risen to 52%, up significantly in the past two weeks. Yet, despite short-term uncertainty, valuations appear attractive, and we expect the rally to resume into the year-end.

From lagging to leading: Why could Bitcoin flip the script?

That recent market crash was triggered by President Trump's proposed 100% tariffs on Chinese imports, which reignited trade-war fears and drove Bitcoin’s correlation with the S&P 500 above 60%.

However, signs suggest this rhetoric is more negotiation than policy. Trump has hinted at de-escalation, and talks point toward a milder resolution. Digital assets have already responded, with this week’s mini-rally hinting at a broader recovery if tensions continue to ease, much like the post-Liberation Day rebound, when the total crypto market cap surged over 50% in just six weeks.

The duality of Bitcoin

Bitcoin remains both a risk-on growth asset and a systemic hedge. It has trailed gold by nearly threefold this year, with gold up over 50% after reaching new highs last week, leaving room for Bitcoin to regain favor for the debasement trade as year-end approaches.

Its price also tends to lag shifts in global liquidity by two to three months. With the Federal Reserve signaling an end to quantitative tightening, improving liquidity could be a key tailwind. Since 2020, Bitcoin has gained 10-20% in the 15-30 days following major global disruptions, underscoring its evolving role as both growth proxy and defensive asset.

Q4 catalysts to watch

Crypto-native drivers have been scarce, but several catalysts may soon arrive.

- The expected US government reopening in November could accelerate regulatory and ETF approvals.

- Institutional funds: 155 ETF filings across 35 different digital assets are already in the pipeline, and that number could surpass 200 within a year, signaling a rush toward broader market access.

- Regulatory advancements: The pending CLARITY Act, 401(k) Bitcoin allocation proposals, and other legislative efforts could boost further confidence in the industry.

- Global momentum: The UK, Hong Kong, South Korea, and Japan are unlocking fresh institutional flows into Bitcoin ETPs and further legitimizing institutional adoption.

Together, these intersecting catalysts point to a potential regime shift. While short-term volatility persists, long-term investors may find this consolidation phase less of a warning and more of an opportunity.

This report has been prepared and issued by 21Shares AG for publication globally. All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however, we do not guarantee the accuracy or completeness of this report. Crypto asset trading involves a high degree of risk. The crypto asset market is new to many and unproven and may have the potential not to grow as expected.Currently, there is relatively small use of crypto assets in the retail and commercial marketplace in comparison to relatively large use by speculators, thus contributing to price volatility that could adversely affect an investment in crypto assets. In order to participate in the trading of crypto assets, you should be capable of evaluating the merits and risks of the investment and be able to bear the economic risk of losing your entire investment.Nothing herein does or should be considered as an offer to buy or sell or solicitation to buy or invest in crypto assets or derivatives. This report is provided for information and research purposes only and should not be construed or presented as an offer or solicitation for any investment. The information provided does not constitute a prospectus or any offering and does not contain or constitute an offer to sell or solicit an offer to invest in any jurisdiction. The crypto assets or derivatives and/or any services contained or referred to herein may not be suitable for you and it is recommended that you consult an independent advisor. Nothing herein constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal recommendation. Neither 21Shares AG nor any of its affiliates accept liability for loss arising from the use of the material presented or discussed herein.Readers are cautioned that any forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors.This report may contain or refer to material that is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would subject 21Shares AG or any of its affiliates to any registration, affiliation, approval or licensing requirement within such jurisdiction.