What Happened?

- Donald Trump announced plans to establish a U.S. Crypto Strategic Reserve, with aims to diversify national assets and position the U.S. as the global crypto leader.

- The proposal, which could be partially funded by seized assets such as the $19B in Bitcoin held by the government, triggered immediate market spikes.

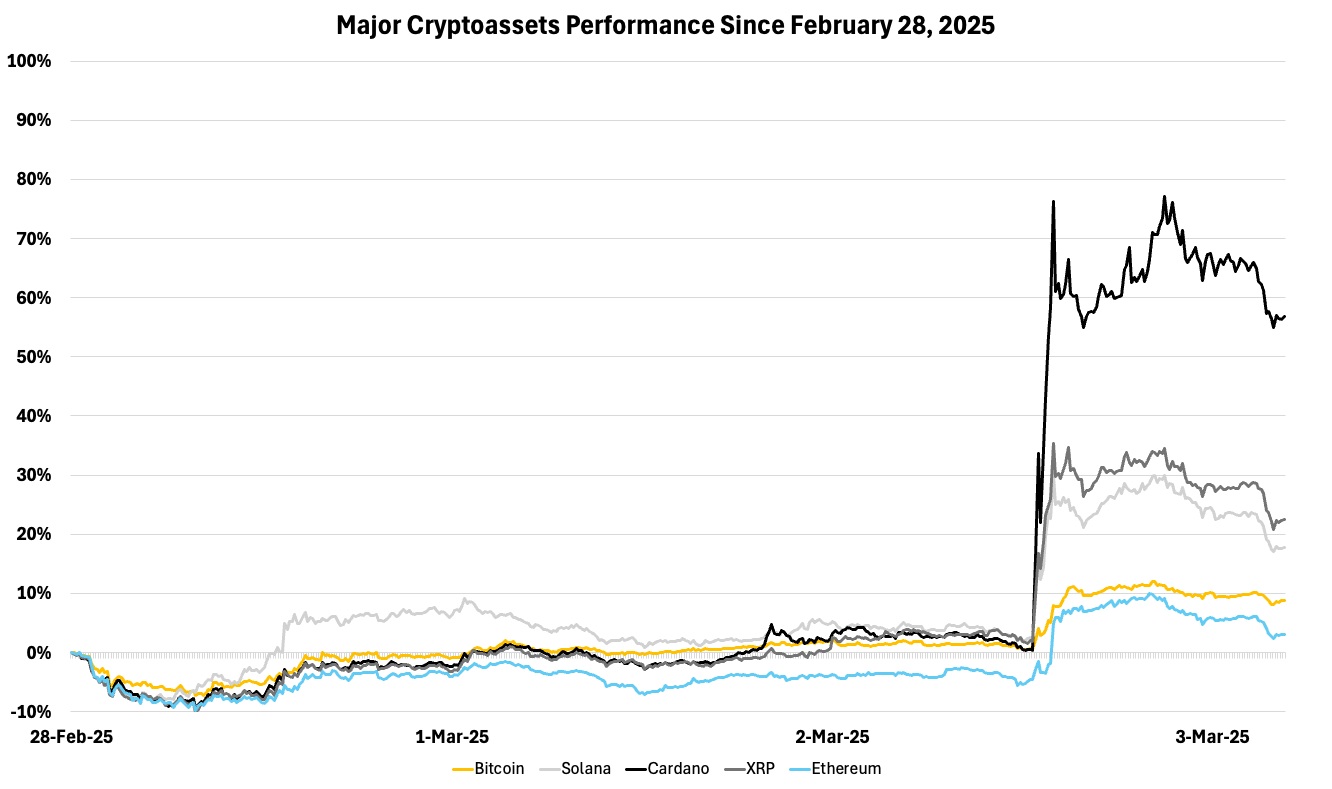

- Trump’s explicit mention of BTC, ETH, XRP, SOL, and ADA first triggered an initial surge in their prices.

- XRP, Solana, and Cardano saw the sharpest initial gains, with XRP surging 33%, Solana 26%, and Cardano spiking 69%. Bitcoin and Ethereum followed, rallying 11% and 13%, respectively (as of 3/3/2025).

- Further details on the implementation and regulatory framework are expected at Trump’s White House Crypto Summit on March 7. However, this aligns with Trump’s broader policy agenda on digital assets outlined in his executive order.

Figure 1: Bitcoin, Ethereum, XRP, Solana & Cardano Performance

Source: 21Shares, Glassnode

Data as of 3/3/2025

Why Does it Matter?

The shift from merely stockpiling seized digital assets to actively purchasing new digital assets as part of a Strategic Reserve represents a fundamental shift in policy.

- The stockpile merely reallocates dormant holdings, while the reserve introduces institutional-grade buying pressure:

- This shift transforms the government from a passive custodian into an active market participant, creating sustained buying pressure that could structurally elevate prices for included assets.

- This degree of legitimization through Government backing could accelerate institutional adoption and integration into traditional finance (e.g., ETFs, custody solutions).

- A strategic reserve may reduce crypto’s notorious volatility by acting as a buyer/seller of last resort, thus stabilizing the market further.

- U.S. crypto holdings could catalyze global regulatory shifts, triggering a strategic race among nations to swiftly establish frameworks for crypto engagement.

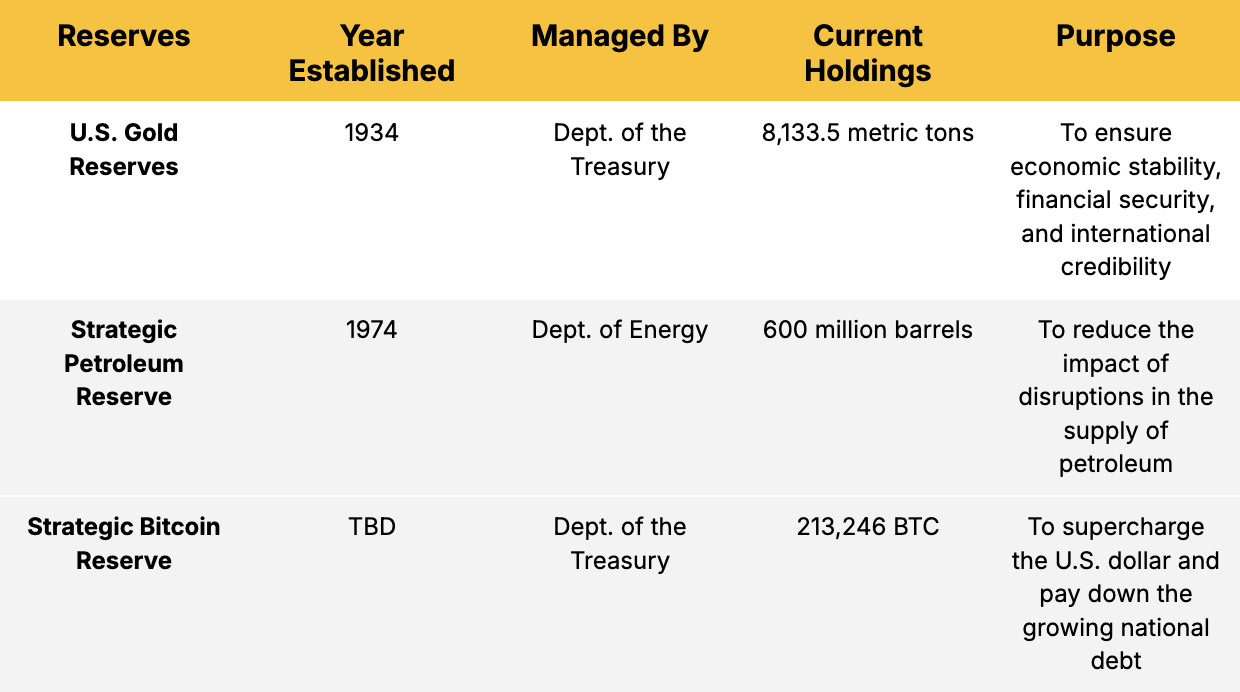

- As seen below, The U.S. has a long-standing strategy of establishing reserves across diverse asset classes to maintain a competitive edge. The current focus on crypto reserves aligns with this historical pattern, echoing similar initiatives the nation has successfully implemented in the past.

Figure 2: U.S. Reserves by Type

Source: 21Shares, River

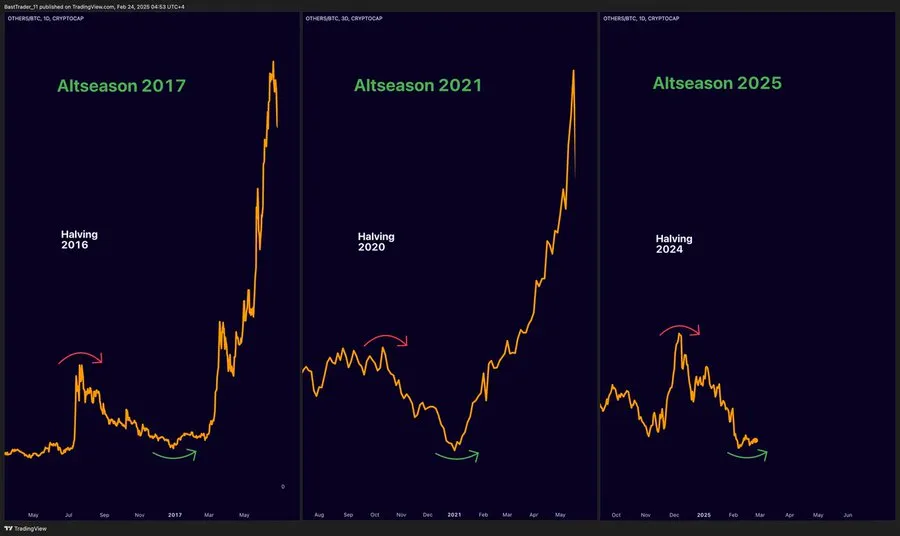

Should additional details about the proposed U.S. Crypto Strategic Reserve emerge by Friday, it could trigger a broader market rally and potentially ignite an altcoin season similar to previous cycles.

- This comes just after last week's market deleveraging, where we saw Bitcoin dip to a yearly-low of $78K and the total crypto market cap dip below the key support level of $3 trillion, total liquidations exceed $2B, and altcoins heavily underperformed. As highlighted in our most report, this presented a key buying opportunity, with many altcoins returning to historically attractive levels—potentially setting the stage for this renewed rally.

Figure 3: Alt-Season Throughout Previous Cycles

Source: TradingView

Assets to be Included in the Strategic Crypto Reserve: BTC, ETH, XRP, SOL, ADA

President Trump’s announcement of the U.S. Crypto Strategic Reserve marks a fundamental shift in the government's stance on digital assets, signaling a commitment to integrating cryptocurrencies into national reserves. The plan includes five leading assets—Bitcoin (BTC), Ethereum (ETH), XRP, Solana (SOL), and Cardano (ADA)—as part of a broader strategy to diversify holdings and solidify the U.S. as the global leader in blockchain innovation. While BTC and ETH have long been institutional favorites, the inclusion of XRP, Solana, and Cardano represents a notable recognition of their technological advantages and growing adoption. Below, we provide an overview of these three assets, their core value propositions, and their potential role in shaping the future of the U.S. Crypto Strategic Reserve.

XRP (Market Cap: $137 billion) - June 2012

Launched in 2012 by Ripple Labs, the XRP Ledger (XRPL) is one of the longest-standing and most well-established blockchain networks, designed to address inefficiencies in traditional financial systems. It serves as the foundation for RippleNet, a global payments network that leverages XRPL’s speed and cost efficiency. Its native gas token, XRP, enables transactions to settle in 3-5 seconds at a fraction of a cent, making it a key component of the network’s functionality. XRP also serves as a bridge currency for cross-border payments, facilitating seamless value transfer and acting as a settlement asset between parties. Ripple is striving to bring SWIFT to the blockchain by modernizing cross-border transactions with its decentralized network, offering a faster and more efficient alternative to legacy financial messaging systems. For a deeper dive into the blockchain, check out our XRP Research Report.

Cardano (Market Cap: $31 billion) - September 2017

Cardano is a research-driven blockchain designed for scalability, security, and sustainability, powered by its native token, ADA. Built on a unique layered architecture, it separates transaction settlement from computation, enhancing efficiency and flexibility. Cardano utilizes a Proof of Stake (PoS) consensus mechanism called Ouroboros, the first peer-reviewed and mathematically proven secure PoS protocol, which ensures decentralization, energy efficiency, and robust security. With a focus on formal verification and peer-reviewed development, Cardano supports smart contracts, DeFi, and real-world applications such as identity management and supply chain tracking, positioning itself as a robust platform for enterprise adoption and decentralized innovation.

Solana (Market Cap: $71 billion)- March 2020

Solana is a high-performance blockchain designed for scalability and mass adoption, powered by its native token, SOL. With a theoretical capacity of 65,000 transactions per second (TPS), it tackles key challenges in decentralized networks—slow speeds and high costs—by combining Proof of Stake (PoS) with a unique timekeeping mechanism, Proof of History (PoH). This architecture enables Solana to process thousands of transactions per second with minimal fees, making it an efficient settlement layer for DeFi, NFTs, gaming, remittances, AI, Decentralized Physical Infrastructure Networks (DePIN), and other emerging technologies. For a more in-depth analysis of the blockchain, you can read our Solana Research Primer.

Diversifiers to Bitcoin

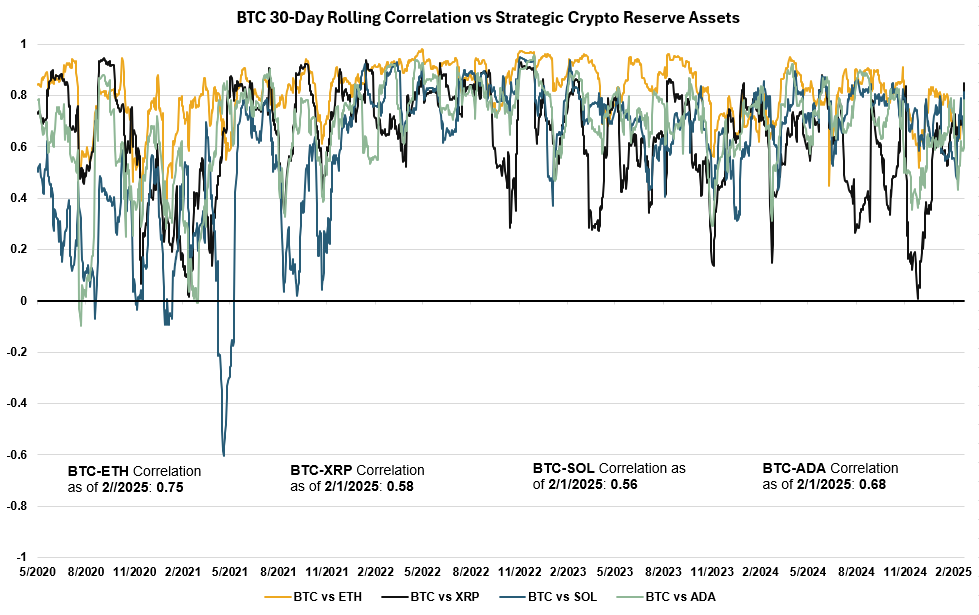

While Bitcoin remains the dominant cryptocurrency, the inclusion of Ethereum (ETH), XRP, Solana (SOL), and Cardano (ADA) in the U.S. Crypto Strategic Reserve introduces diversification benefits. Historical correlation data indicates that these assets exhibit varying degrees of correlation with BTC, suggesting they respond differently to market dynamics.

For instance, over the past year, Ethereum has maintained a relatively high correlation with BTC (~0.79), reinforcing its strong connection to broader market trends. However, XRP, Solana, and Cardano exhibit significantly lower correlations (~0.54, ~0.73, and ~0.69, respectively), highlighting their ability to provide differentiated exposure. XRP’s focus on enterprise payments and cross-border transactions sets it apart from Bitcoin’s store-of-value narrative, while Solana and Cardano offer exposure to high-throughput smart contract ecosystems with distinct technical frameworks. By incorporating these assets, the reserve mitigates concentration risk, broadens exposure to different sectors of the digital economy, and strengthens the U.S.'s strategic foothold in blockchain innovation.

Figure 4: BTC 30-Day Rolling Correlation vs Strategic Crypto Reserve Assets

Source: 21Shares, Glassnode

Key Catalysts & What’s Next?

The upcoming Crypto Summit on Friday, co-chaired by David Sacks and Donald Trump, will focus on establishing regulatory frameworks for blockchain innovation, specifically addressing:

- Stablecoin oversight mechanisms to balance market freedom with consumer protection

- Sacks and Rep. Bo Hines will spearhead working sessions aimed at harmonizing state/federal crypto policies.

- Strategic crypto reserves will be established with the five assets mentioned earlier, along with additional details regarding asset inclusion and funding mechanisms.

- This could open the doors for additial assets to be included, such as the ones listed below:

Figure 5: Cryptoassets by Categories

Made In USA (Top 20 excl. Stablecoins)

World Liberty Financial

Dogecoin (DOGE), Hedera (HBAR), Chainlink (LINK), Stellar Lumens (XLM), Avalanche (AVAX), Sui (SUI), Litecoin (LTC), Bitcoin Cash (BCH), Uniswap (UNI), NEAR Protocol (NEAR), Aptos (APT), Ondo (ONDO), Aave (AAVE), OFFICIAL TRUMP (TRUMP), Algorand (ALGO), Render (RENDER), Movement (MOVE)

Ethena (ENA), Tron (TRX), Aave (AAVE), Ondo (ONDO)

Source: 21Shares, CoinMarketCap

However, it was also proposed that the U.S. could remove capital gains taxes for US-based crypto assets

- This could potentially trigger sell-offs of non-U.S. crypto assets as investors rebalance portfolios toward tax-advantaged holdings which would amplify concentrated buying pressure for compliant coins

- Incentivize blockchain projects to domicile development/issuance operations stateside, potentially reviving the ICO model under SEC-reviewed frameworks

This week also features a series of macro and crypto-specific events that could further influence market momentum, particularly concerning inflation and Ethereum:

- Monday: Manufacturing PMIs

- Tuesday: Tariff deadline for Mexico and Canada

- Wednesday: ADP employment report, Non-manufacturing PMIs, Ethereum “Pectra” upgrade testnet deployment

- Thursday: US jobless claims

- Friday: Employment situation report, FED Chair Powell speech, White House Crypto Summit.

Risks & Uncertainties

- Execution Risks: No clarity exists on funding (new purchases vs. seizures) or management frameworks. Markets could correct sharply if Friday’s summit fails to detail mechanics, much like what happened following Trump’s Inauguration.

- Reputational Risk: President Donald Trump's announcement to include XRP, SOL, and ADA in the U.S. strategic crypto reserve has sparked concerns over potential reputational risks, including perceptions of favoritism and conflict of interest.

- Critics argue that Bitcoin’s unmatched scarcity makes it the only asset suitable for a strategic reserve, while other assets lack the same monetary robustness or decentralization to justify their inclusion.

- Dollar Implications: Large-scale crypto acquisitions might pressure the U.S. dollar’s dominance, though proponents see diversification as a hedge against inflation.

- Utilizing seized assets for crypto purchases minimizes the need for new capital expenditure, thereby reducing potential inflationary pressure on the U.S. dollar and maintaining greater currency stability.

- Executive Order Limitations: Presidents can't unilaterally create permanent crypto reserves without congressional approval. Orders must align with existing laws or declare emergencies, but no current statute authorizes crypto reserves.

- Congress controls federal spending, making direct crypto purchases without appropriated funds unconstitutional.

- Implementation Challenges and Workarounds: Using seized crypto assets (e.g., from Silk Road) could bypass new spending but faces legal restrictions. Repurposing these assets or expanding the Treasury's authority would require legislative changes.

- Trump's plan relies on complex legal maneuvers rather than direct purchases, highlighting the need for adapted legal frameworks to enable a crypto reserve.

.svg)

_logo.svg)

.svg.png)