How Maple Finance is DeFi’s answer to private credit

Maple Finance is a decentralized credit marketplace built on blockchain rails. In simple terms, it enables institutions to borrow and lend in crypto without relying on opaque intermediaries, slow approvals, or excessive collateral requirements.

Think of it as a cross between a money-market fund and a private-credit platform, but fully onchain. Lenders (LPs) provide liquidity to professionally managed pools, while borrowers, market makers, trading firms, or crypto businesses draw loans at pre-agreed rates and terms. Everything from issuance to repayment happens transparently via smart contracts.

Private credit has grown to over $1.5 trillion, up sixfold in a decade, as investors seek stable, uncorrelated returns. Even a small portion moving onchain represents a multibillion-dollar opportunity, and Maple is already proving it works.

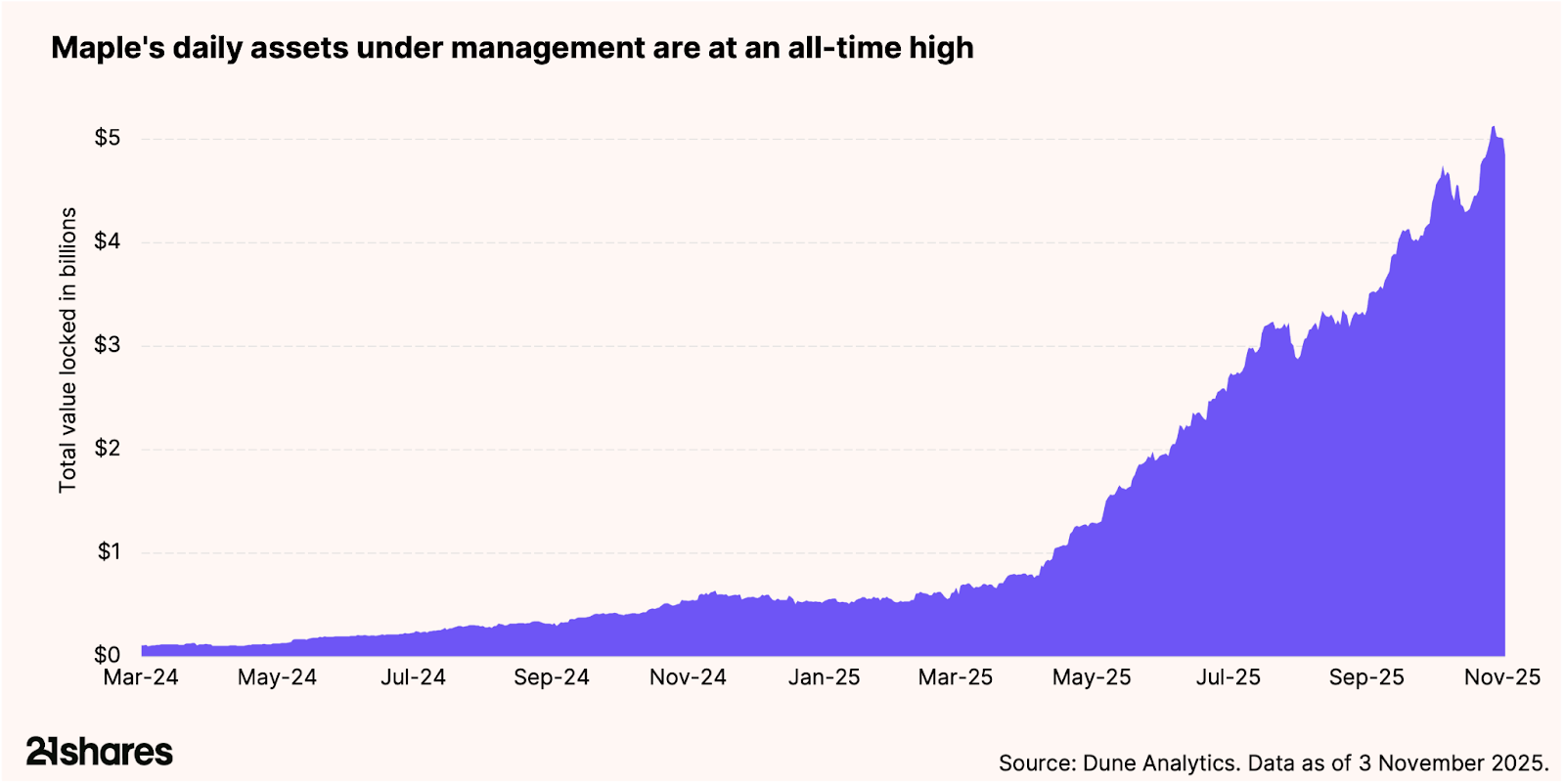

Maple’s assets under management (AUM) recently hit an all-time high, underscoring its positions as the largest onchain asset manager. Since launching in 2021, Maple has originated over $12 billion in loans, paid $109,909,437 in interest to LPs, and maintained a 99% repayment rate, a record unmatched in decentralized lending.

Solving real-world friction

Traditional corporate borrowing involves layers of friction: intermediaries, custodians, manual settlements, and weeks of paperwork. Private credit and repo markets, though lucrative, remain closed to many players due to high minimums and complexity.

Maple removes these barriers. It replaces paperwork and intermediaries with automated credit rails, giving institutions direct access to global capital and yield opportunities once reserved for large funds.

If TradFi lending is like mailing a check, Maple is like instant payment via Revolut or TWINT, but for institutional loans.

Bridging TradFi discipline with DeFi transparency

Maple combines the structure of traditional lending with blockchain’s openness. Its credit pools are KYC-verified and AML-compliant, making it safe for regulated entities to operate onchain.

It delivers:

- Access: Borrowers raise capital without intermediaries.

- Transparency: Loans and repayments are visible in real time.

- Compliance: KYC/AML ensures regulatory trust.

- Efficiency: Capital moves globally, 24/7, through automated flows.

What makes Maple stand out

Early DeFi protocols relied on overcollateralized loans, which protected lenders but excluded real businesses. Maple introduced under-collateralized lending, bringing credit assessment onchain while keeping it transparent and data-driven.

- Real usage: Credit relationships with trading firms and DeFi protocols.

- Onchain reporting: No hidden risk or opaque books.

- Automation: Interest accrues and is distributed automatically.

- Innovation: The Syrup upgrade introduced permissionless pools.

It’s not another DeFi app; it’s DeFi’s answer to Blackstone Credit.

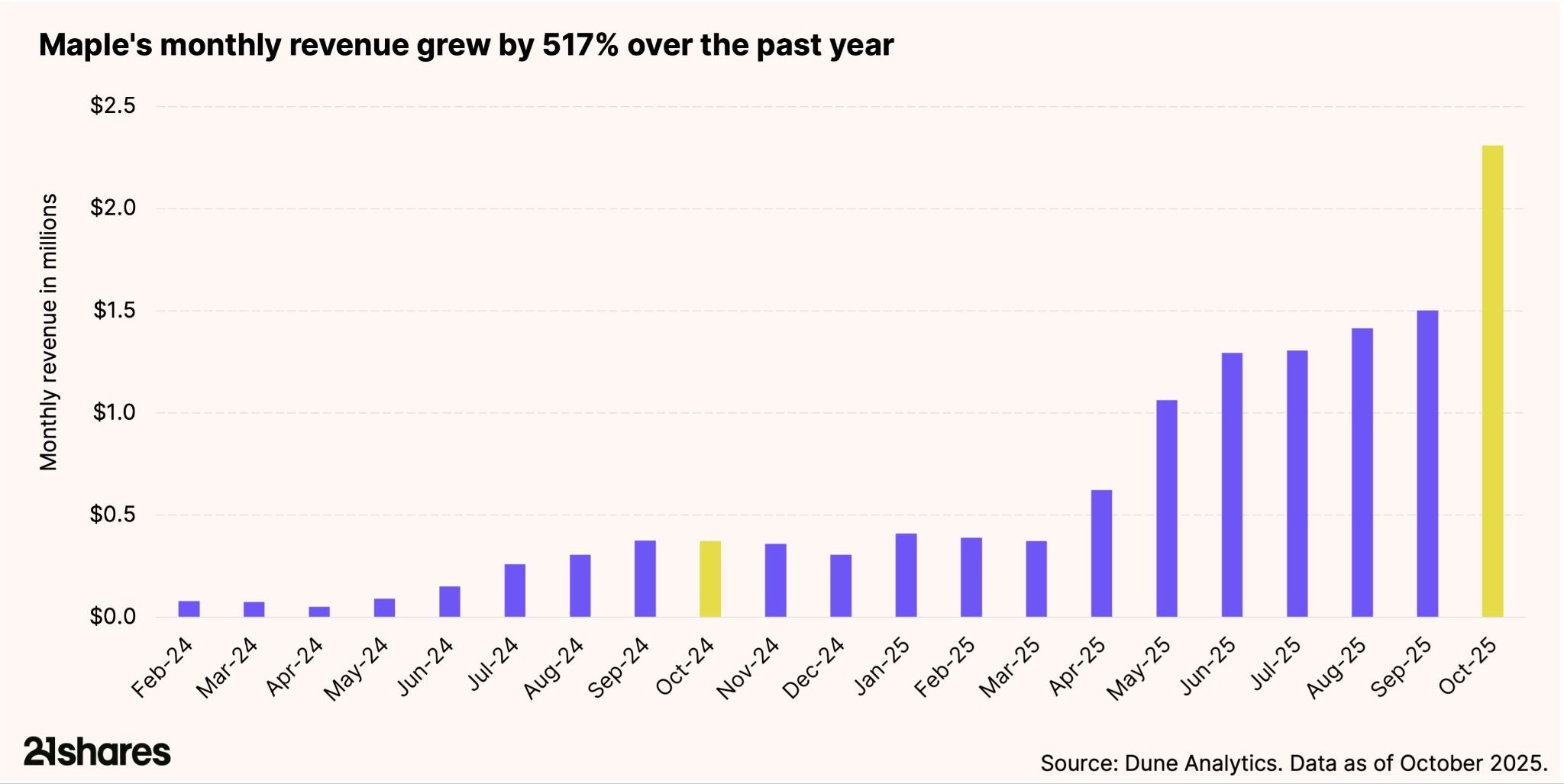

Maple’s monthly revenue also reached a record $2.3 million in October, reflecting surging demand for onchain credit and the protocol’s scaling fee income. Data from Token Terminal shows Maple leading the entire lending sector in active loan growth over the past 90 days, outpacing Aave, Morpho, and other major protocols.

Why investors should care

Maple marks DeFi’s shift from speculation to productive capital. It’s building the foundation for onchain fixed income, one of the largest frontiers for institutional adoption.

For investors, that means:

- Yield: Sustainable, real-world returns.

- Transparency: Onchain visibility into borrower performance.

- Diversification: Exposure to private credit via blockchain rails.

At the core is SYRUP, the token aligning participants and capturing protocol value. By staking SYRUP, users receive stSYRUP, which accrues rewards from protocol fees and buybacks.

Recently, governance proposals MIP-018 and MIP-019 refined this model: 25% of protocol revenue now funds buybacks and a strategic treasury, while staking rewards will gradually phase out, signaling Maple’s maturity and sustainable, revenue-backed growth that directly benefits token holders.

This report has been prepared and issued by 21Shares AG for publication globally. All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however, we do not guarantee the accuracy or completeness of this report. Crypto asset trading involves a high degree of risk. The crypto asset market is new to many and unproven and may have the potential not to grow as expected.Currently, there is relatively small use of crypto assets in the retail and commercial marketplace in comparison to relatively large use by speculators, thus contributing to price volatility that could adversely affect an investment in crypto assets. In order to participate in the trading of crypto assets, you should be capable of evaluating the merits and risks of the investment and be able to bear the economic risk of losing your entire investment.Nothing herein does or should be considered as an offer to buy or sell or solicitation to buy or invest in crypto assets or derivatives. This report is provided for information and research purposes only and should not be construed or presented as an offer or solicitation for any investment. The information provided does not constitute a prospectus or any offering and does not contain or constitute an offer to sell or solicit an offer to invest in any jurisdiction. The crypto assets or derivatives and/or any services contained or referred to herein may not be suitable for you and it is recommended that you consult an independent advisor. Nothing herein constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal recommendation. Neither 21Shares AG nor any of its affiliates accept liability for loss arising from the use of the material presented or discussed herein.Readers are cautioned that any forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors.This report may contain or refer to material that is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would subject 21Shares AG or any of its affiliates to any registration, affiliation, approval or licensing requirement within such jurisdiction.

.svg)

_logo.svg)

.svg.png)